The PR banking sector footprint has reduced significantly in the past years. Despite having fewer branches, banks have managed to increase deposits by 28% since 2016. As we will explain in this insight there is opportunity for footprint expansion is some areas as well as further consolidation in others. In the short term the footprint reduction is likely to continue driven by the Scotiabank acquisition by Oriental.

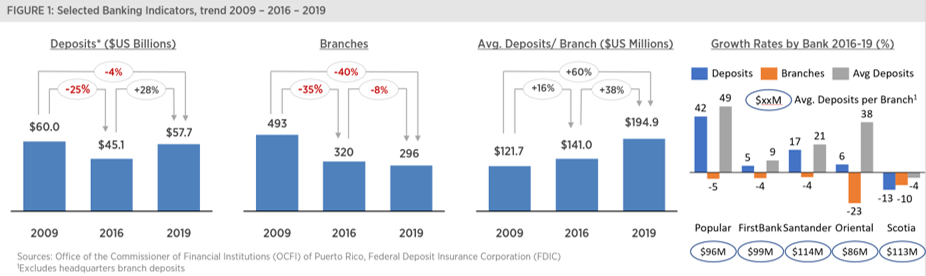

The PR banking sector footprint has reduced significantly in the past years. Despite having fewer branches, banks have managed to increase deposits by 28% since 2016. As we will explain in this insight there is opportunity for footprint expansion is some areas as well as further consolidation in others. In the short term the footprint reduction is likely to continue driven by the Scotiabank acquisition by Oriental.As we mentioned in a previous insight, the banking sector has consistently reduced its brick and mortar footprint on the island. Since December 2009 — before the Federal Deposit Insurance Corp. (FDIC)-assisted transactions involving Westernbank, Eurobank and R-G Premier Bank— the number of bank branches in Puerto Rico was reduced from 493 to 296 (a 40 percent reduction; see Figure 1). Furthermore, after 2016, the reduction in banking branches has coincided with a 28 percent increase in total deposits. As a result, the average deposits per branch has grown by 38 percent. Banco Popular and Oriental Bank have experienced the largest increases in their branches’ average deposits (49 percent and 38 percent, respectively). In the case of Banco Popular, the main driver has been an increase in its total deposits base, while the large reduction in the number of branches has been the main driver of Oriental’ increase in average deposits per branch.

The footprint reduction is likely to continue after Oriental Bank announced it acquired Scotiabank because there are three Scotiabank branches less than 200 meters from an Oriental branch (Los Colobos, San Patricio and Plaza del Sol) and three more are less than 400 meters from an Oriental branch (Plaza Las Américas, Plaza del Caribe in Ponce and Caguas). Bank consolidation is not the only driver behind the reduced physical presence; banks are also increasingly relying on digital channels to increase their business and service their customers.

But banks are still highly dependent on customer segments that rely on or look forward to branch interaction. One-third of Puerto Rico adults are more than 60 years old and cash is still an important transaction method used by local businesses and individuals, particularly outside the metro areas. As a result, footprint optimization will continue to play an important role for banks to gain market share and improve efficiency levels.

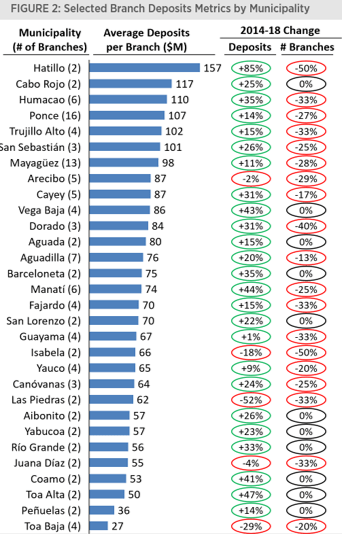

In Figure 2 we can see the deposits change between 2014 and 2018, the reduction in number of branches and the estimated deposits per branch1 for Non-Metro municipalities with more than one bank branch2. All municipalities either maintained their number of branches or experienced a reduction during the 2014-18 period. With the exception of Arecibo, Juana Díaz, Isabela, Toa Baja and, particularly, Las Piedras, municipalities saw a rise in deposits. As a result, eight municipalities have seen average deposits per branch surpass the $100,000 threshold. For example, San Sebastián’ average deposits per branch increased from about $60,000 in 2014 to about $101,000 in 2018. If the deposits trend continues going forward, there may be opportunities for some banks to open new branches for the first time in many years and “steal" market share in specific areas of the island. On the other hand, the fact that some municipalities (e.g., Toa Baja and Juana Díaz), with average deposits below $60,000 per branch, have experienced a reduction in total deposits, indicates there may be further consolidation or branch-elimination opportunities in other parts of Puerto Rico.

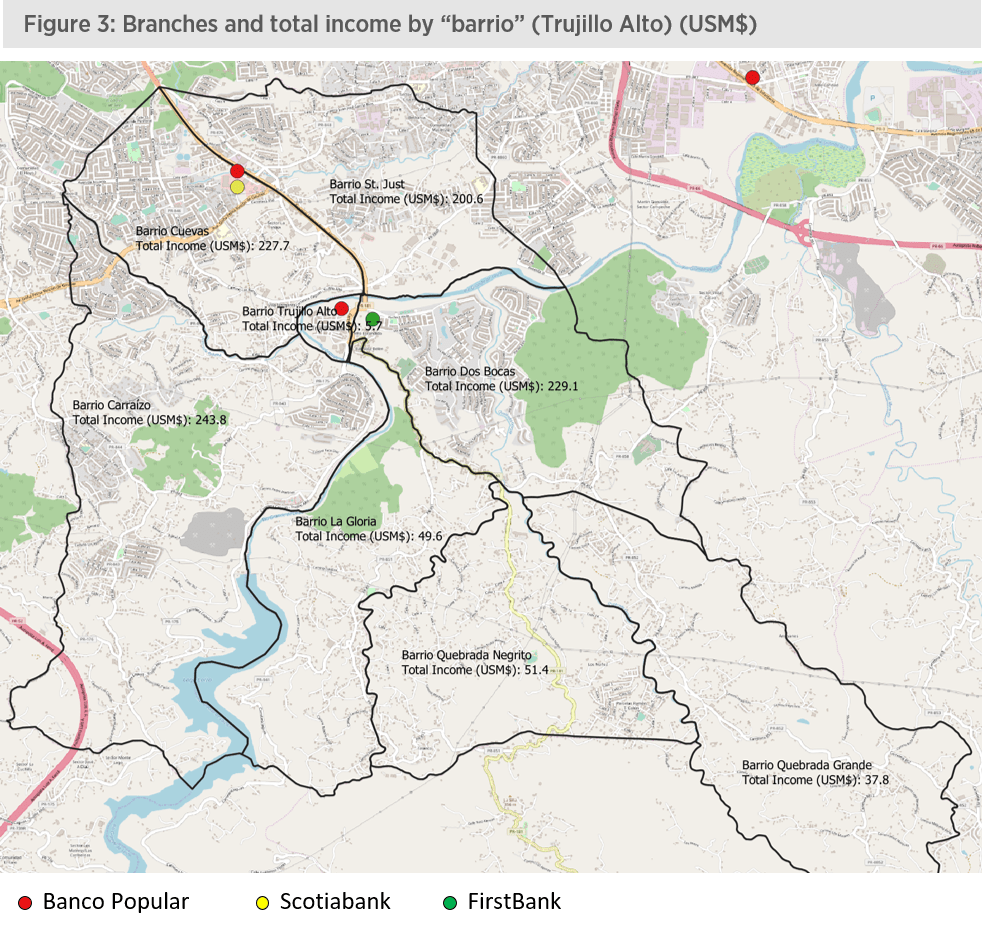

Finally, as an example, we can look at a specific municipality where there may be potential for market share competition. Trujillo Alto experienced a 15 percent increase in total deposits between 2014 and 2018, and currently has four bank branches (see Figure 3). Two of the branches are near PR-181 — Popular with total deposits of $164,000 and Scotiabank with total deposits of about $102,000 as of June 2018. This is not only an area with heavy traffic and commercial activity but is also located between two high-income barrios in Trujillo Alto — and St. Just, with $228 million and $201 million total income3, respectively. An attractive area from which to “steal" deposit share could be along PR-199, closer to Barrio Carraízo (with the highest total income in Trujillo Alto) and the Cupey area (west of Trujillo Alto).

In summary, the local banking footprint has reduced significantly in the past 10 years. Given recent deposits trends, it is important for banks to identify opportunities to increase coverage as well as areas where further consolidation is required. Deposit trends, together with available census and geographical data, can help banks further optimize Puerto Rico’ bank branch coverage.

Notes

1Deposits by branch data is provided by the FDIC. The last data available is for June 2018. June 2019 data is expected to be available in September 2019.

2We have excluded San Juan, Bayamón, Guaynabo, Caguas and Carolina given their size and the fact that they contain multiple micro markets, as well as the smaller municipalities that only have one branch, generally from Banco Popular.

3Calculated by multiplying the mean income per household and the number of households, as reported by the U.S. Census Bureau

Sources

Federal Deposit Insurance Corporation (FDIC); Office of the Commissioner of Financial Institutions (OCFI); QGIS (geographic information system application)

Disclaimer

Accuracy and Currency of Information: Information throughout this “Insight” is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.