The crisis brought upon all of us by COVID-19 has made both citizens and lawmakers demand quick action and trustworthy solutions, as well as made us all question the benefits of globalization. While producers have logically favored moving supply chains overseas to optimize their cost base, the reality is that neglecting a reliable domestic supply of certain goods has become a national security issue. Pharmaceutical products are a clear example. This report is meant to highlight Puerto Rico’ readiness to insert itself into the COVID-19 pandemic response and the pharmaceutical repatriation effort that will likely follow.

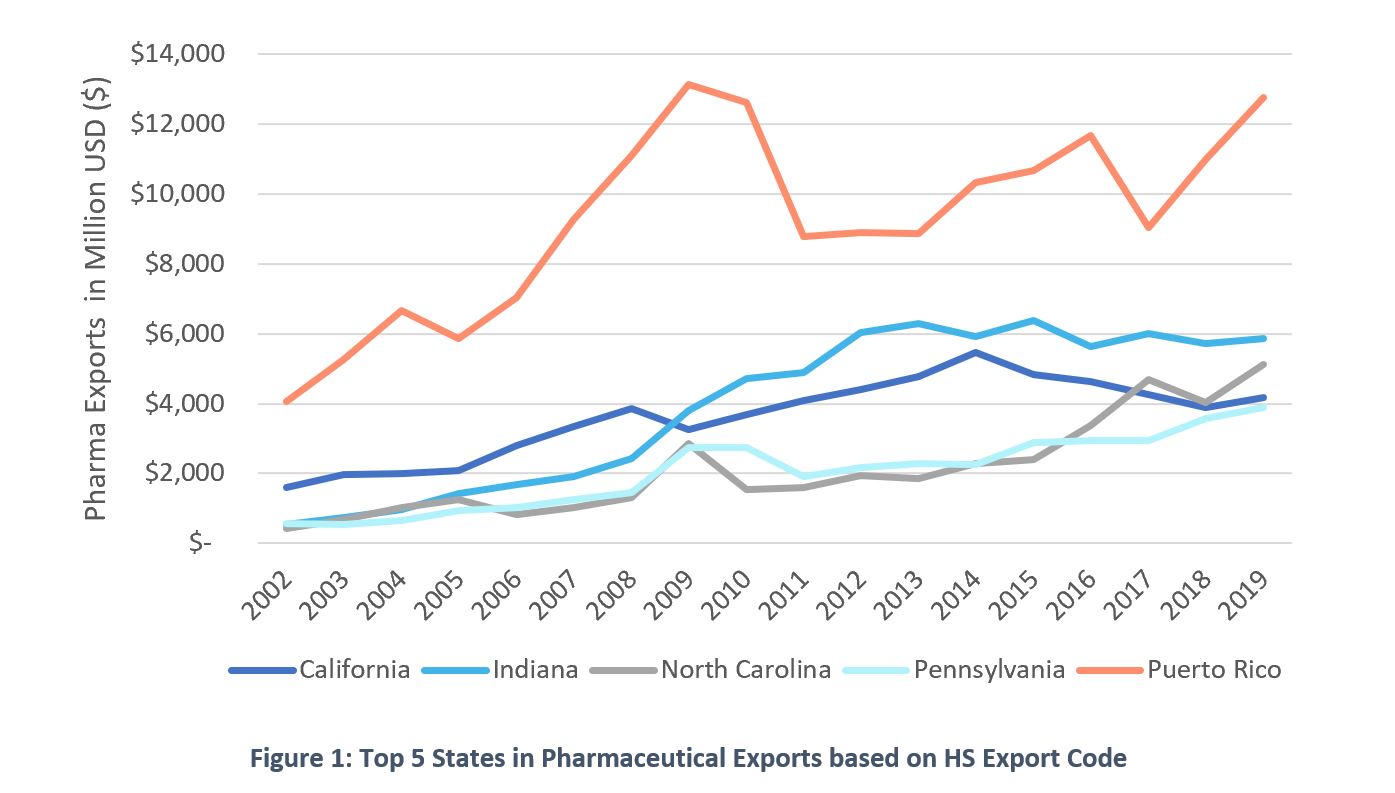

The crisis brought upon all of us by COVID-19 has made both citizens and lawmakers demand quick action and trustworthy solutions, as well as made us all question the benefits of globalization. While producers have logically favored moving supply chains overseas to optimize their cost base, the reality is that neglecting a reliable domestic supply of certain goods has become a national security issue. Pharmaceutical products are a clear example. This report is meant to highlight Puerto Rico’ readiness to insert itself into the COVID-19 pandemic response and the pharmaceutical repatriation effort that will likely follow.First some context. Puerto Rico has been a historical hub for the manufacturing of pharmaceutical goods. Through its more than 50 years of life sciences manufacturing experience it has surged to the top as a competitive destination for pharmaceuticals. In doing so, Puerto Rico has allotted quite the resume within the sector hosting 12 out of the top 20 pharmaceutical companies. Even with recent declines, 7 out of the 10 top-selling medications are currently being manufactured in Puerto Rico. In comparison, Puerto Rico leads all states in the field of pharmaceutical manufacturing since at least 2002 as seen in Figure 1.

Puerto Rico’ role in addressing the opportunities arising from the current pandemic may be divided in two phases. A more limited opportunity, the first phase, arises from the need for mass-producing pharmaceutical products quickly as soon as specific therapies are proven effective. A broader and more likely opportunity, the second phase, arises from the medium to long term movement to insource key drugs that are currently produced outside the US which may be deemed critical to hypothetical future events.

SHORT-TERM OPPORTUNITY

A rapid ramp-up of hundreds of millions of units will likely be needed in the short term, which will require three key elements — readily available facilities, a quickly scalable skilled workforce, and rapid access to key materials. Puerto Rico is uniquely positioned in all three elements. First, the recent decline in manufacturing volume on the Island has left idle or seriously underutilized large-scale, state-of-the-art facilities. While there are currently over 40 biopharmaceutical sites on the Island, there are at least three large-scale API (active product ingredient sites/chemical) sites mostly idle and available to accommodate high volume production. Similarly, on the finished product side, there are also a handful of largely underutilized drug product sites (available to produce capsules, tablets, etc), as well as the excess capacity of many other manufacturing sites that typically operate with a 25-40% capacity cushion.

Similarly, although close to 30,000 people are currently employed by the industry in one form or another, this number is less than 50% of the peak employment experienced just over a decade ago. There is a large, high-skilled and already trained, workforce available at a moment’ notice, including both technical (engineers, pharmacists, etc.) and non-technical (operators, mechanics, etc.). Finally, Puerto Rico’ pharmaceutical manufacturing scale results in a sophisticated “ecosystem", with widespread availability of typical raw materials and manufacturing equipment, through already established robust supply chains.

So why is this short-term opportunity limited? Although it seems clear that Puerto Rico is uniquely positioned to tackle this rapid demand, unfortunately drug transfers and regulatory approvals take a long time and may be out of synch with the timing needed to address the emergency. Whereas a typical transfer may take at least a year (and typically much more), the need is immediate. Nevertheless, there are two mitigating factors that may enable this scenario. First, if any of the identified compounds has been manufactured in an existing facility in the past, ramp-up could be accomplished relatively quickly. Second, that the gravity of the crisis makes it such that regulators push to bypass many of the established approval steps, which would be likely controversial and potentially dangerous; a plausible but not probable scenario.

MEDIUM/LONG-TERM OPPORTUNITY

The same needs described, facilities, workforce and materials also apply to the expected pharmaceutical manufacturing repatriation that will likely follow.

We examined the pharmaceutical goods imported to the US against what is currently being manufactured and internationally exported from Puerto Rico1. This comparison provides an accurate heatmap of the areas in which Puerto Rico is already a player and potentially able to increase production if the US enacts regulation or emits strict guidance to repatriate a percentage of the foreign production of pharmaceutical goods.

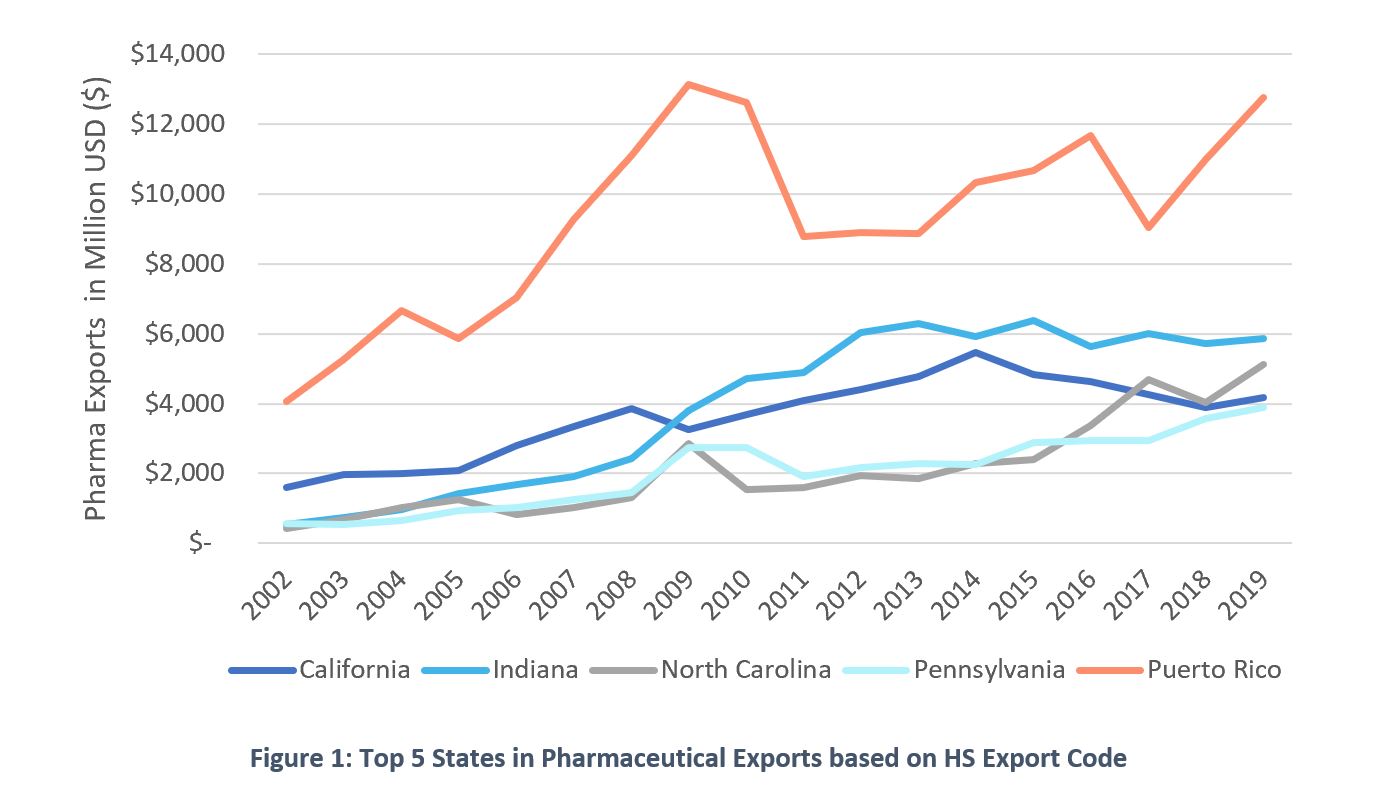

By evaluating the portfolio of existing lines of production, it can be safely assumed that Puerto Rico can make quick gains in substituting a considerable amount of the production lines currently hosted internationally. To quantify the viability of this transition, we identified all pharmaceutical goods imported by the US and those exported out of the Port of San Juan, PR using the Harmonized System (HS)2 10-digit commodity codes. In 2019 Puerto Rico exports included 42 out the 102 pharmaceutical product classifications3 imported by the US. In terms of total volume, these 42 product classifications represent 73% of the pharmaceutical imports. Moreover, in terms of gross dollar value of imports, these 42 product classifications amount to 88% of the US pharmaceutical imports, as seen Figure 2. It is important to note that this analysis does not include pharmaceutical products manufactured in Puerto Rico that stay in the US, therefore the production of imported products is potentially higher than the abovementioned.

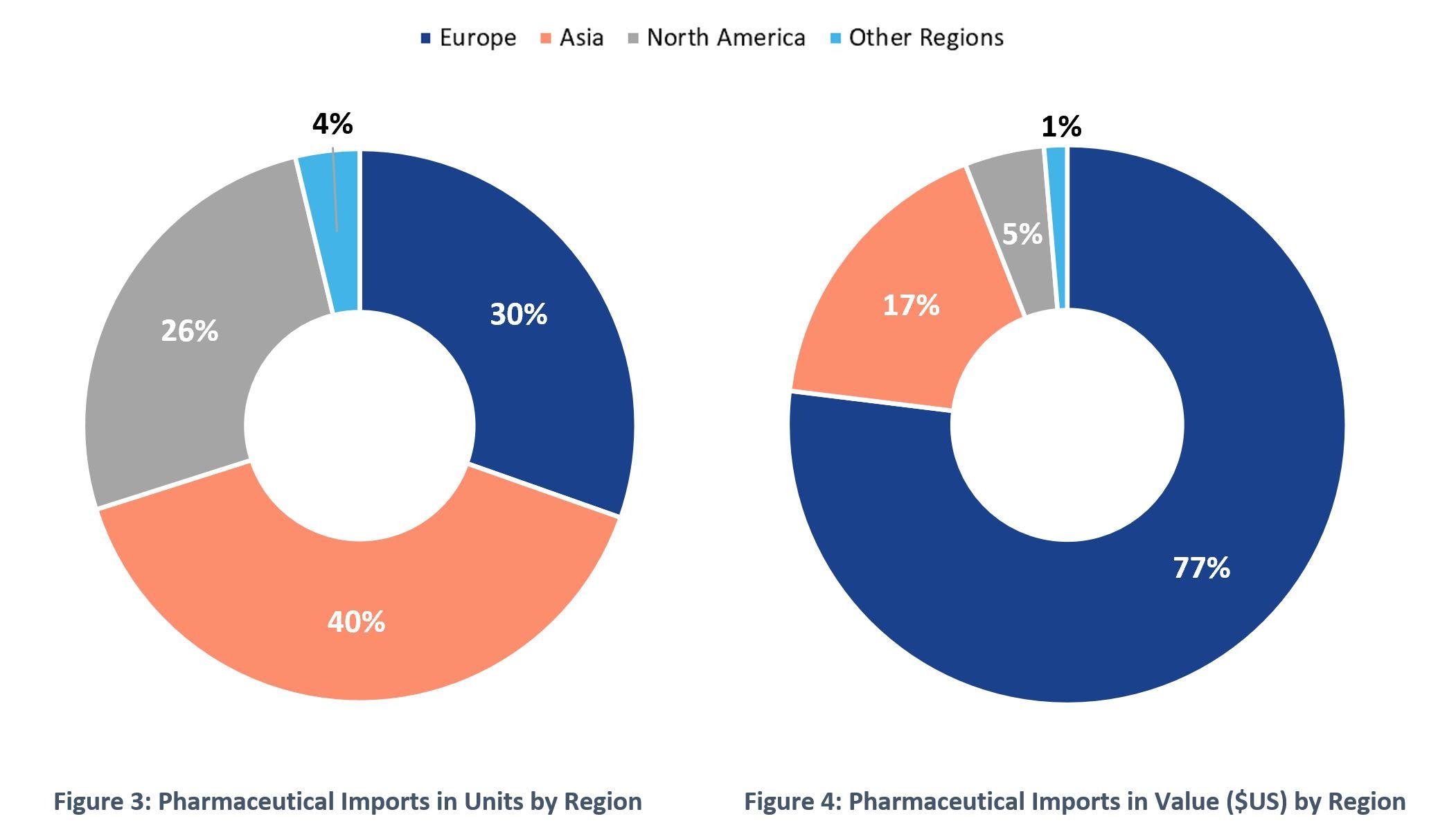

When we look at the regions from where the US is importing pharmaceutical products, we see that Europe is the biggest player in value ($US). As seen in Figure 3 and 4, Europe accounts for 77% of the pharmaceutical imports of the US in value ($US), however Asian countries lead in terms of volume with 40% of the total volume imported. Products from Asian countries will probably be prioritized in the repatriation effort due to the logistic challenges they pose which could impact the supply of pharmaceutical goods in the US in case of a global emergency. They account for 17% of the US imports amounting to $21.8 billion, representing a real growth opportunity for Puerto Rico’ pharmaceutical industry.

Obviously beyond HS commodity codes, a more detailed analysis is needed to assess the implications of Puerto Rico’ experience manufacturing high-value/low-volume products versus the repatriation needs of low-value/high-volume products sourced from Asia which may likely be identified as imported national security critical products. Still, our analysis directionally points to a fairly good correlation with Puerto Rico’ product portfolio characteristics and the US pharmaceutical needs backed up by the fact that in terms of total units these 42 product classifications represent 73% of all pharmaceutical US imports in terms of volume.

CONCLUSION

Puerto Rico has a unique combination of existing infrastructure, highly-skilled, readily available workforce, and established pharmaceutical manufacturing ecosystem, which positions the Island as an ideal location. We see Puerto Rico as a potential player in the immediate response to the COVID-19 crisis, and expect the Island to play an important role in the inevitable repatriation wave of pharmaceutical manufacturing back to US shores that will likely follow.

Notes

1Data from pharmaceutical products manufactured in Puerto Rico and exported to the US is not available, since they are not considered an export by the US Census Bureau

2 The Harmonized System (HS) of tariff nomenclature is an internationally standardized system of names and numbers to classify traded products

3 US Census Bureau only reports up to 102 pharmaceutical HS product classification in their data

Sources

USA Trade and Exports Data from the US Census Bureau (https://usatrade.census.gov/)

Puerto Rico Industrial Development Corporation (www.PRIDCO.com)

Disclaimer

Accuracy and Currency of Information: Information throughout this “Insight” is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.