Overview

The banking sector in Puerto Rico reached a Pre-Tax Return on Equity of 24.3% in 2023. This is the second highest profitability level in the past 20 years, only surpassed by the 2022 Pre-Tax ROE of 30.8%. FirstBank and Oriental bank continued to report very good results (26.7% and 24.9% Pre-Tax ROE, respectively), as they managed to integrate the operations of Banco Santander and Scotiabank. They also showed efficiency ratios below 55% and very low delinquency ratios (1.2% and 1.9%, respectively).

Banco Popular also achieved a very healthy Pre-Tax ROE (22.7%) but had an efficiency ratio north of 65% as it continued to invest in technology and digital transformation initiatives.

The banking sector loan delinquency remained at historically low levels despite a Q4 2023 increase in non-performing loans in the Puerto Rico consumer loan portfolio. Overall, the Non-Performing Loans Ratio was 2% in 2023, the lowest level since 2005.

Despite the higher interest rates, the banking loan portfolio increased by 6.6% during 2022 and by 8.2% during 2023, driven by the personal consumer, auto, and commercial lending activity. The banks’ lending activity reflects the robust performance of the local economy. The Economic Activity Index ended in 2023 at its highest level in the past ten years, and total employment reached 1,142 thousand employees, the highest since 2009 despite the reduction in population experienced in Puerto Rico (15% reduction in the past 15 years).

After the record increase in deposits experienced in 2019-21 (47% growth), total deposits decreased by 7.5% in the 2021-2023 period. The reduction was the result of three factors: 1) Lower public sector deposits after the public debt restructuring agreement of Q1 2021, 2) More attractive investment alternatives for retail and commercial customers given the interest rate increases by the Federal Reserve, and 3) The negative impact of high inflation on individuals’ disposable income. Part of the deposits’ reduction was recaptured by banks through their securities business.

Given the limited inorganic growth opportunities and their high capitalization levels, local banks continued to return capital to shareholders and to make dividend payments in 2023. Capitalization ratios remained significantly above well-capitalized levels with the Tier 1 Risk Based Capital ratio at 16.3% in December 2023.

The V2A banking report dashboard above provides additional detail on the banks’ performance in 2023 and previous years.

What has happened since the most recent banking consolidation?

On June 26, 2019, Oriental Bank announced the signing of a definitive agreement to acquire Scotiabank’s Puerto Rico operation for $550 million in cash and Scotiabank’s US Virgin Island (USVI) branch operation for a $10 million deposit premium. A few months later, on October 21st the bank holding company of FirstBank Puerto Rico, announced the acquisition of Banco Santander Puerto Rico (BSPR) for a $63M premium to BSPR’ core tangible common equity ($362M) in an all-cash transaction.

Four years (and a global pandemic) later, it is time to understand which banks and financial entities have grown their market shares in each of the typical banks’ businesses. Have the acquiring banks been able to keep their inorganic additional business? Have other players taken advantage of the ongoing banking consolidation? Are there financial entities specialized in specific products and services gaining or losing share vis a vis the remaining full service commercial banks?

To answer these questions, let’s take a look at the market share trends in the past 5 years.

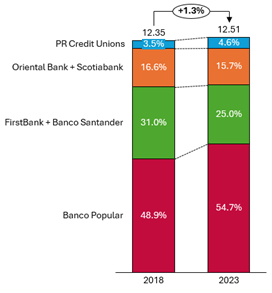

The largest loan portfolio of the banking sector in Puerto Rico is the commercial loan portfolio. As can be observed in Figure 1, the total commercial loan portfolio only increased by 1.3% between 2018 and 2023. The economic difficulties and uncertainty related to the pandemic, the higher interest rates and the liquidity obtained by companies to navigate the pandemic through federal funds explain the modest increase in the total commercial loan portfolio. Banco Popular and the credit unions sector have clearly increased their market share while FirstBank and Oriental Bank have been able to maintain part of the commercial loan business they acquired.

Figure 1: Commercial loan portfolio (USD billions)

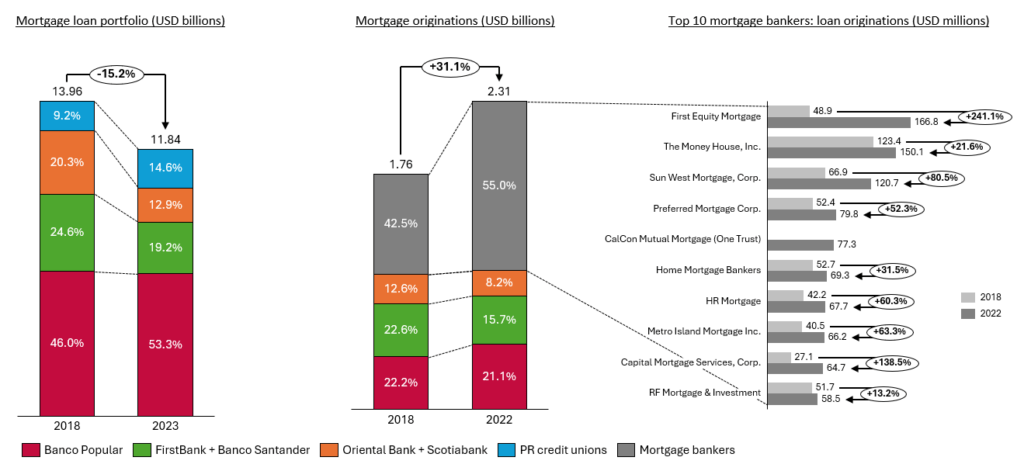

When we look at the second largest portfolio, the mortgage loan portfolio, we see the same exact pattern. Banco Popular and the local credit unions sector have gained market share while Oriental Bank and FirstBank have experienced a reduction. In the case of FirstBank the total mortgage loan balances have reduced. This is the result of a conscious decision to limit originations to loan products that are pooled and sold to other investors instead of keeping them in the bank’s books.

Regarding mortgage loan originations, mortgage bankers captured most of the increase in the origination activity from 2018 to 2022 (last available data point), growing their market share from 42.5% in 2018 to 55% in 2022. Only Banco Popular, among commercial banks, was able to increase the mortgage origination amount translating into a smaller reduction in market share compared to the other banks. The biggest winners among mortgage bankers were First Equity Mortgage (+241.1%), Capital Mortgage Services (+138.5%), and Sun West (+80.5%).

Figures 2, 3 and 4:

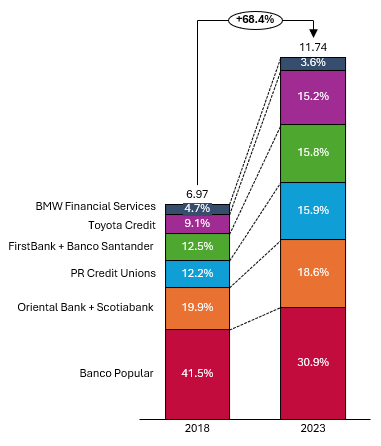

The third largest portfolio is the auto loan portfolio. As can be observed in Figure 5, the Puerto Rico auto loan portfolio has seen an unprecedented increase during the 2018-2023 period (+68.4%). This is the result of the record auto sales experienced in 2021, 2022 and 2023 when they reached more 120k units in each of the three years. All banks and auto financing institutions experienced auto loan portfolio increases. But the institutions that managed to gain market share were Toyota Credit, the local credit unions as a whole, and FirstBank, in this order.

Figure 5: Auto loans portfolio

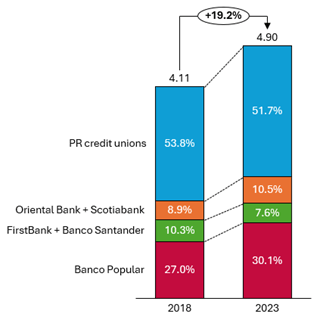

The personal loans portfolio also increased during the 2018-2023 period (+19.2%), driven by the additional borrowing capacity of Puerto Rico residents thanks to the federal funds’ inflows received during and after the Covid 19 pandemic. Banco Popular and Oriental Bank were able to gain some market share at the expense of the local credit unions sector which still holds more than 50% of the market.

Figure 6: Personal loans portfolio (USD billions)

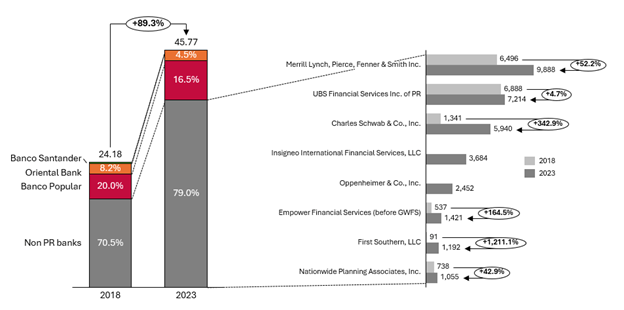

Finally, the brokerage and securities business in Puerto Rico experienced an important increase in activity that was captured mainly by new players and existing brokerage houses outside the local banking sector. As can be observed in Figure 7, total assets under management increased by 89.3% from 2018 to 2023. This large increase confirms the vast amount of direct federal funds received by individuals (as well as businesses) to mitigate the impact of the Covid 19 pandemic in Puerto Rico. We estimate that total pandemic related transfers received in Puerto Rico represent 49% of the total annual production of the local economy measured in GNP terms.

The other factor driving the assets under management growth is the interest rate increases. Banks have continued to pay low interest rates on their interest-bearing deposits, and individuals (and businesses) have moved part of their increasing liquidity to investment vehicles with higher yields like certificates of deposit and fixed and variable income investments.

The expansion of asset management needs has been captured by both local banks and brokerage institutions. But the latter have clearly captured a much bigger portion, increasing their already high market share vis a vis commercial banks. The winners in terms of dollar increase in assets under management were Charles Schwab & Co., Inc. (+USD 4.60 billion), Insigneo International Financial Services, LLC (+USD 3.68 billion), Merrill Lynch, Pierce, Fenner & Smith Inc. (+USD 3.39 billion), Oppenheimer & Co., Inc. (+USD 2.45 billion), and First Southern, LLC (+USD 1.10 billion).

Figure 7: Assets under management (USD billions)

In summary, the last round of banking consolidation in Puerto Rico and other industry factors have translated into changes in the market share of some banking portfolios in the past five years. The acquiring banks, FirstBank and Oriental Bank, have been able to further improve their profitability confirming their ability to leverage scale and integrate the acquired banking operations. They have been able to keep part of the acquired businesses and relationships but have also lost some market share in some lending businesses when we look at the acquirer + acquired operations combined.

Banco Popular has gained share in the commercial, mortgage and personal loan portfolios. The local credit unions sector has continued to expand its activity outside the traditional consumer lending and has captured market share in the commercial, mortgage and auto lending businesses. But the biggest winners have been business specific players in various lending products and banking services. In the auto loan business, which has expanded substantially in recent years, Toyota Credit grew its loan portfolio from USD 632 million in 2018 to USD 1,781 million in 2023, an increase of 182%. In the mortgage loan origination business, mortgage bankers increased their share from 42.5% in 2018 to 55.0% in 2022. In the brokerage business, some brokerage institutions like Merrill Lynch, Charles Schwab, Insigneo and Oppenheimer grew their assets under management by more than 2 billion each between 2018 and 2023, capturing the largest portion of the Puerto Rico residents additional liquidity.

Finally, the year 2023 also brought a new player in the banking sector of Puerto Rico, Nave Bank, which joins Banco Popular, FirstBank, Oriental Bank, Citibank, Banesco USA, and Banco Cooperativo as the only private commercial banks with local operations. Based on December 2023 FDIC reported data, Nave Bank holds approximately USD 109 million in total assets, and is focusing its lending activity on the commercial business. Nave Bank is a digital bank and the first to obtain an FDIC banking license in Puerto Rico in over 20 years.

As shown by the entrance of Nave Bank, banks face the progressive elimination of one of the biggest entry barriers of the sector, the brick-and-mortar branch infrastructure. As more and more customers rely on digital channels to perform their banking operations, new and existing digital banks will continue to look into Puerto Rico to introduce their products and services.

Disclaimer

Accuracy and Currency of Information: Information throughout this “Insight” is obtained from sources that we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.

ONLY ENGLISH VERSION