Main Highlights:

- The banking sector reached a Pre-Tax ROE of 20.91% in the first nine months of 2025 on an annualized basis, in line with the previous two years’ profitability (20.81% in 2023 and 20.60% in 2024). This is the fifth consecutive year with Pre-Tax ROE above 20%. In the previous 20 years, only in 2004 did the banking industry profitability reach above 20% levels.

- Measured on a return on assets basis (before taxes), FirstBank and Oriental Bank showed very high profitability levels (2.09% and 1.93%, respectively), significantly above the US peers average (1.44%). These banks achieved healthy efficiency levels consistently with Cost to Income ratios below 55% in 2023, 2024 and 2025.

- Total deposits increased by $1.298B (2.1% annualized) in 2025 against 2024, with Oriental representing 31% of the increase, significantly above its deposits market share in Puerto Rico. Additionally, 56% of that increase came from private deposits, compared to the 70% public deposits share of the Banco Popular deposits increase. This underpins the success of the Cuenta Libre and Cuenta Elite in attracting new clients for Oriental Bank.

- The banking sector continued to be very well capitalized with the Tier 1 Risk Based Capital Ratio at 15.6% in the Jan-Sep 2025 period. Banks will continue returning capital to shareholders through share buy backs and dividends in 2026.

- Loan delinquency remained at historically low levels despite an increase in 2025 with the Non-Performing Loans Ratio at 1.96% compared to 1.75% in 2024.

- Loan balances grew by 4.9% in the first nine months of 2025 on an annual basis, below the 5.8% and 8.2% increases achieved in 2024 and 2023, respectively. In the past two years, Banco Popular has gained market share in the lending business with an accumulated increase of 11.1% compared to the growth of 7.1% and 7.5% achieved by FirstBank and Oriental Bank, respectively.

In the following section we will deep-dive into the lending market share changes in the past two years, considering the various lending products and other important players like the credit unions and the auto lending companies.

Market share trends in the Puerto Rico lending business (2023 to 2025)

Bank profitability is primarily driven by the spread between their core source of funds—deposits—and the loans they underwrite to their customer base. Following the significant liquidity surge during the Covid and post-Covid period, banks have increasingly focused on capturing the healthy, though limited, growth in lending demand from Puerto Rico consumers and businesses. As a result, it is critical to understand recent lending portfolio market share trends, considering not only banks but also other depository institutions (credit unions) and non-depository financial institutions that compete in the local market.

In this section, we will rely on the most recent reports from OCIF (Oficina del Comisionado de Instituciones Financieras), which—unlike FDIC data—reflect lending portfolios specific to the Puerto Rico market, excluding U.S. and U.S. Virgin Islands portfolios such as those managed by Banco Popular and FirstBank. Banesco is included in the analysis because, unlike in FDIC reporting, OCIF reports its Puerto Rico operations separately.

The most recent data available for Puerto Rico was published by OCIF in December 2025 and corresponds to Q2 2025. OCIF is currently working with V2A Consulting to develop a new reporting platform that will allow financial institutions to submit reports more efficiently and will incorporate analytical dashboards earlier in the reporting cycle, enabling institutions to generate market insights more quickly.

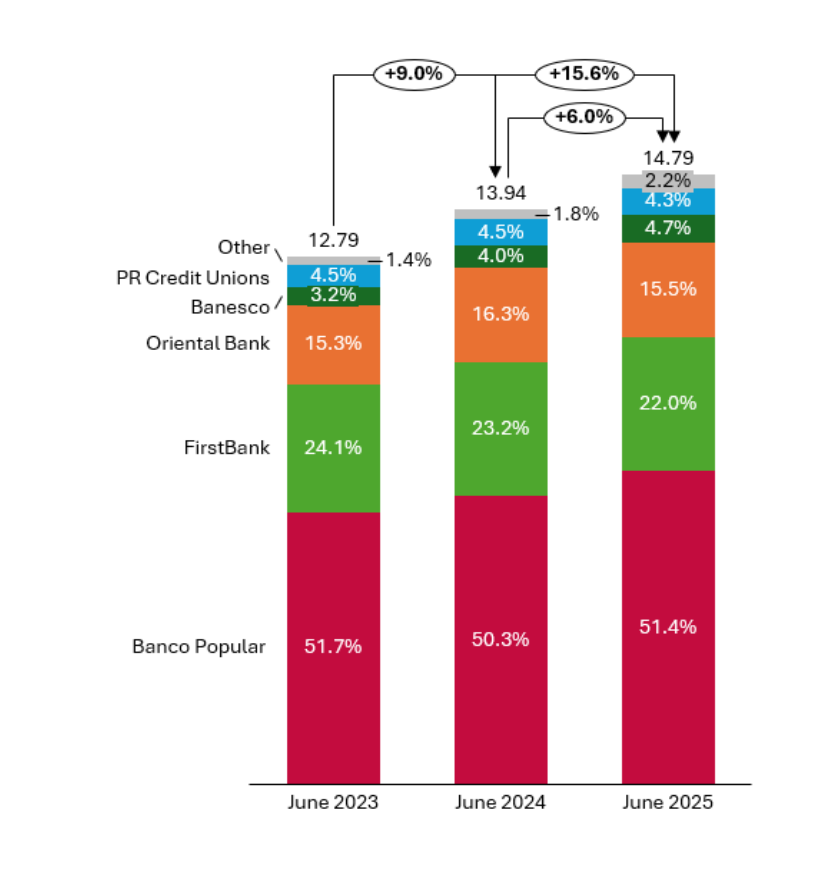

Based on OCIF data, the commercial loan portfolio is the largest segment of the Puerto Rico banking sector. As shown in Figure 1, the total commercial loan portfolio experienced double-digit growth between 2023 and 2025, driven by a dynamic business environment, as reflected in strong employment figures. Most local banks participated in this growth while largely maintaining their market shares, as seen in the cases of Banco Popular and Oriental Bank. Particularly noteworthy is Banesco’s 70% portfolio growth, driven by its focus on small and medium-sized businesses, which allowed the bank to increase its market share by nearly 50%.

Figure 1: Commercial loan portfolio (USD billions)

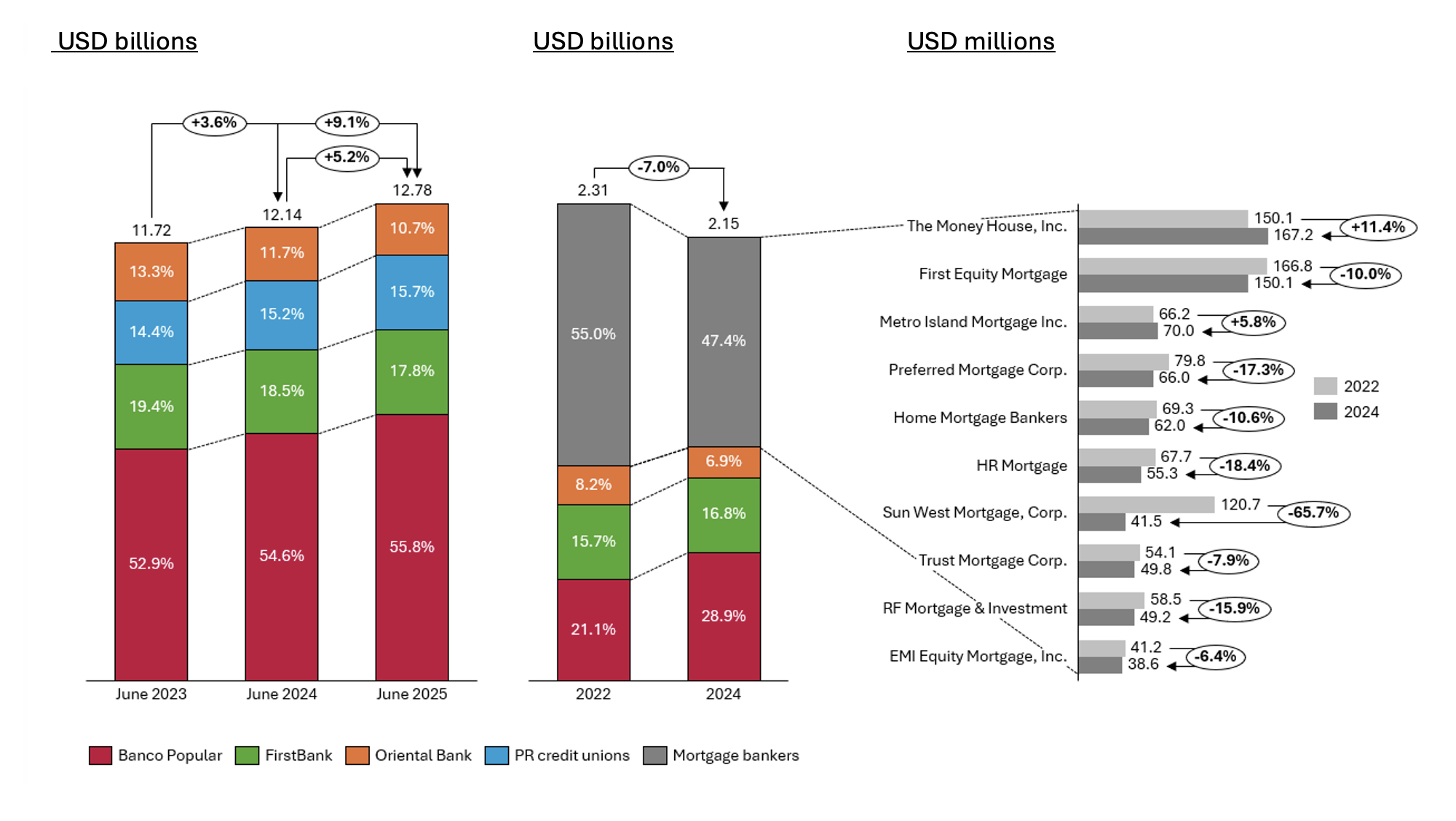

The second-largest portfolio is the mortgage loan portfolio, which increased by 9.1% between 2023 and 2025 (see Figure 2), despite subdued mortgage origination activity in the context of higher interest rates (see Figure 3). Mortgage originations declined by 7% between 2022 and 2024, and while 2025 OCIF data is not yet available, a further reduction is expected. The increase in outstanding mortgage balances was driven primarily by Banco Popular’s strategy of retaining FHA-insured mortgage loans rather than selling them in the secondary market. This approach enabled the bank to capture interest income in addition to servicing fees, as noted in its financial disclosures. Credit unions also gained market share by deepening relationships with their large member bases and positioning themselves as trusted mortgage lending alternatives.

With respect to mortgage loan originations, there was been a notable shift in the mix between banks and mortgage companies. Mortgage companies saw their market share decline by eight percentage points between 2022 and 2024 (from 55.0% to 47.4%), partially reversing the gains achieved during the 2018–2022 period, when their share increased from 42.5% to 55.0% (see V2A’s Q4 2023 Banking Industry Report). FirstBank—and particularly Banco Popular—gained mortgage origination market share during the 2022–2024 period.

Among mortgage companies, The Money House and First Equity Mortgage remained the market leaders, together accounting for 32% of total originations. However, their performance diverged significantly between 2022 and 2024: while The Money House increased originations by 11.4%, First Equity Mortgage experienced a 10.0% decline (see Figure 4).

Figure 2: Mortgage portfolio

Figures 3 and 4: Mortgage originations and top 10 mortgage bankers

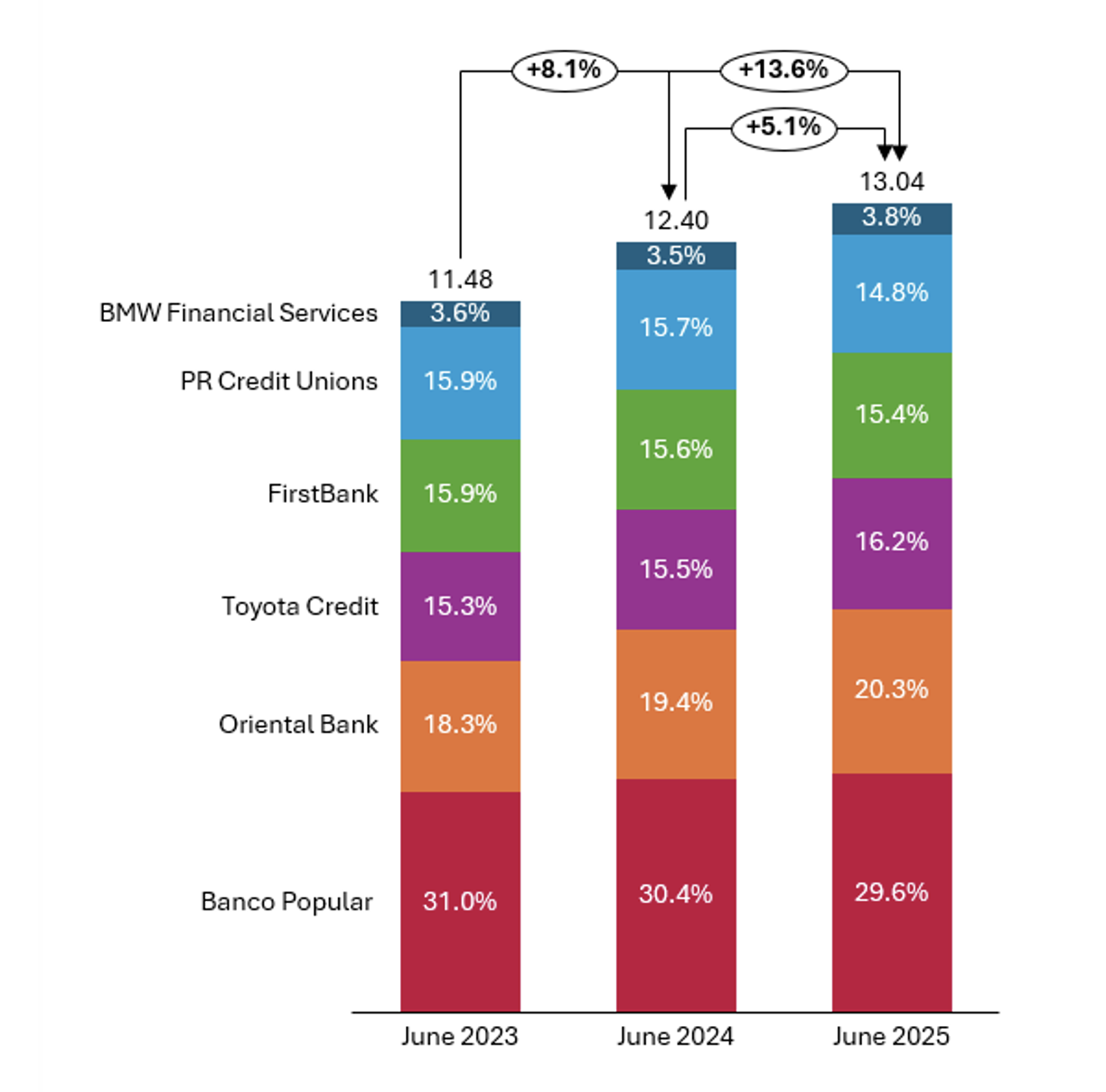

Figure 5: Auto loans portfolio (USD billions)

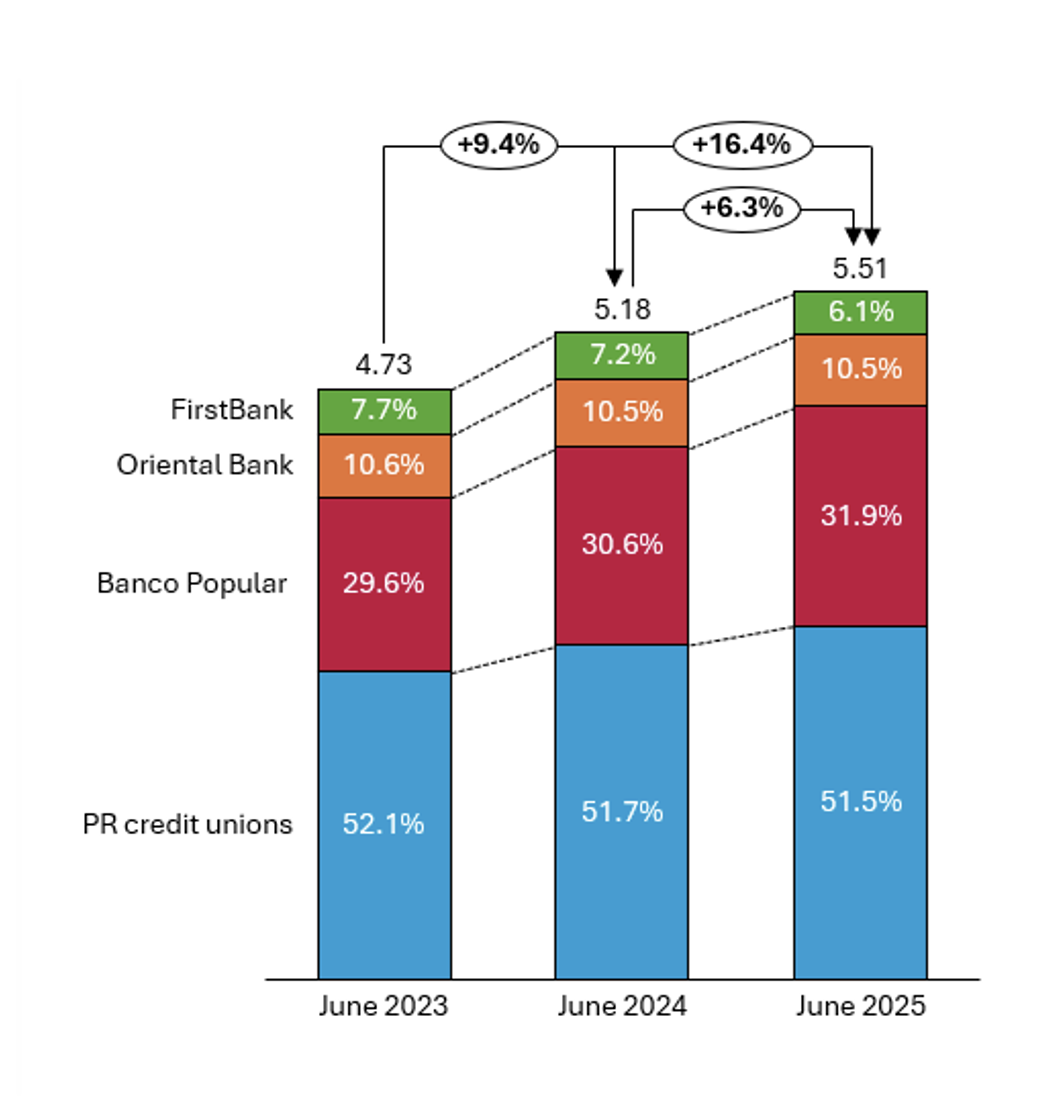

The personal loan portfolio recorded the largest increase among major lending categories during the 2023–2025 period (+16.4%), supported by the enhanced borrowing capacity of Puerto Rico residents following substantial federal fund inflows during and after the Covid-19 pandemic. Although the credit union sector experienced a slight decline in market share, it continued to hold more than half of the market. Banco Popular was the only bank to gain share, increasing its position from 29.6% in 2023 to 31.9% in 2025.

Figure 6: Personal loans portfolio (USD billions)

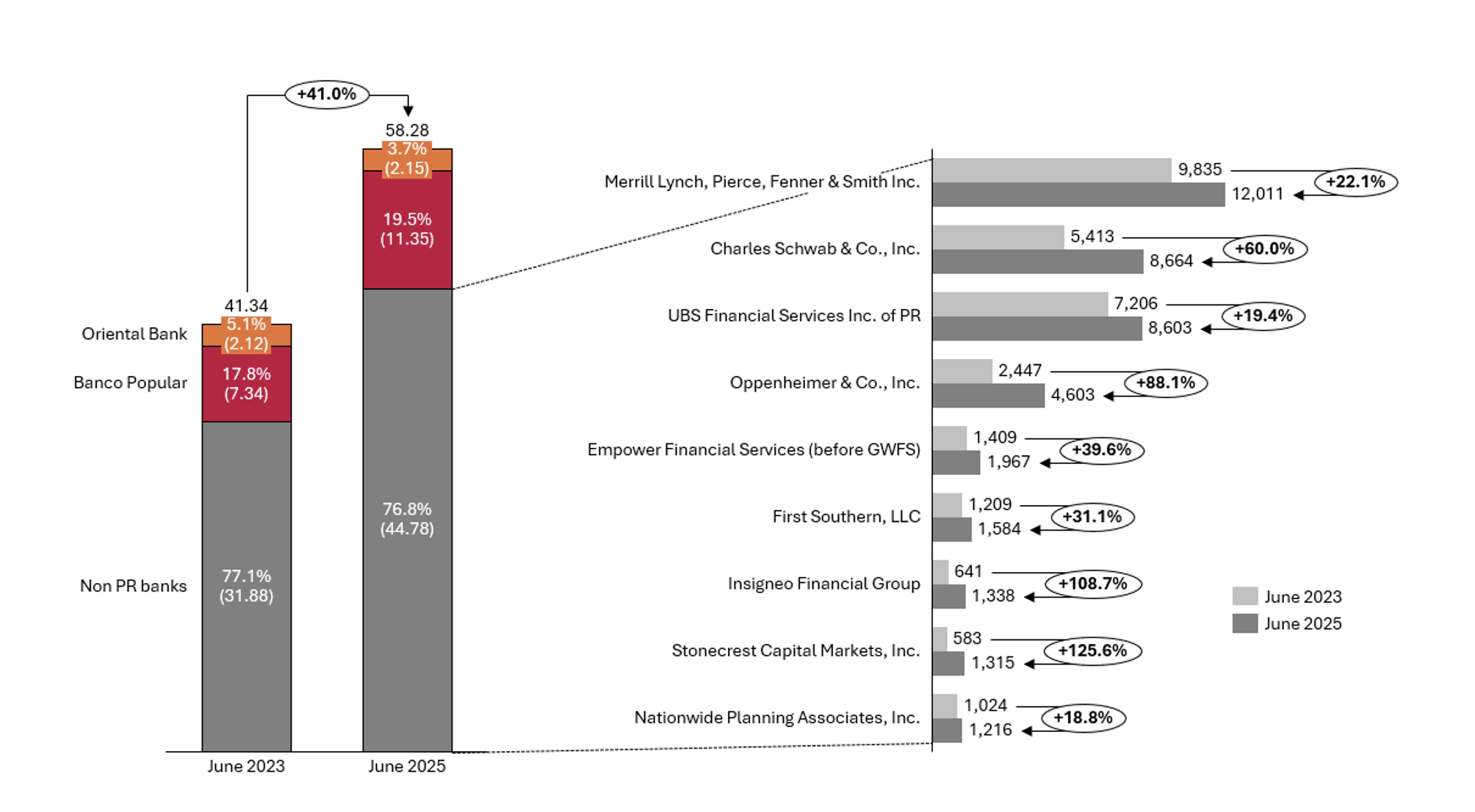

Finally, the brokerage and securities business in Puerto Rico experienced a significant increase in activity between 2023 and 2025, as individuals and businesses shifted liquidity from deposit accounts to higher-yielding assets. As shown in Figure 7, total assets under management grew by 41% over the period. This growth was driven primarily by rising interest rates and strong equity market performance. Banks continued to offer relatively low yields on interest-bearing deposits, prompting customers to reallocate liquidity toward higher-return investment vehicles, including certificates of deposit and fixed- and variable-income securities.

Banco Popular captured 24% of the total growth in assets under management, increasing its market share from 17.8% in 2023 to 19.5% in 2025. Outside of local banks, four brokerage institutions—Merrill Lynch, Charles Schwab, UBS Financial Services, and Oppenheimer & Co.—dominated the market, collectively accounting for 76% of total assets under management. The growth of Charles Schwab is particularly notable, given that it managed only $1.3 billion in assets in Puerto Rico in 2018.

Figure 7: Total assets under management (USD billion)

Closing Summary

The 2023–2025 period has been marked by intensified competition across the Puerto Rico lending market, as banks, credit unions, and non-bank financial institutions sought to capture the island’s healthy—though selective—credit growth following the post-pandemic liquidity surge. Market share outcomes have varied notably by product, reflecting distinct competitive dynamics in commercial, mortgage, auto, and personal lending. Despite already commanding a dominant position, Banco Popular has demonstrated a remarkable ability to continue gaining share across multiple portfolios, leveraging scale, balance-sheet strategy, and deep customer relationships. At the same time, newer or more specialized players such as Banesco—particularly in commercial lending—and Toyota Credit in auto loans, have sustained strong growth trajectories, while credit unions remain formidable competitors, especially in mortgage and personal lending, supported by their extensive member bases and trust-driven models.

Looking forward, the competitive landscape is likely to become more complex as digital banks and technology-enabled financial platforms expand their presence on the depository side. The potential fragmentation of banking relationships—where deposits, payments, investments, and lending may increasingly be held with different providers—will be a critical factor to monitor, given its implications for funding costs, cross-selling economics, and long-term customer loyalty. How incumbent banks respond to these trends, while defending and growing lending market share in an environment of evolving customer behavior and technological disruption, will be a key determinant of profitability and strategic positioning in Puerto Rico’s banking industry over the coming years.

Xavier Diví

Xavier Diví