Executive summary

This insight examines the financial challenges driving hospital acquisitions in Puerto Rico, exploring the forces behind consolidations, the benefits of acquiring distressed hospitals, and strategies to capture value post-acquisition. It provides a detailed look at why and how healthcare organizations can benefit from these acquisitions amid changing market conditions.

Puerto Rico's hospitals have struggled financially due to a declining population, reduced birth rates, and increased migration. Around 80% of hospitals reported operating at a loss in 2022, leading to service reductions, layoffs, and closures. Consolidation is seen as a survival strategy in the face of continued financial pressures. Acquiring distressed hospitals offers opportunities to expand market share, improve care quality, and enhance negotiation leverage with payers. Such acquisitions can prevent closures, maintain access to care, and create long-term value through strategic integrations that bolster efficiency and cost savings.

Successful post-acquisition integration hinges on defining clear value drivers, addressing organizational and cultural differences, and executing strategic initiatives to enhance operations, quality of care, and financial outcomes. Effective governance and synergy capture are critical for realizing the full value of acquisitions. Hospital consolidation is expected to continue. Organizations that implement well-planned integration strategies can position themselves for success, achieving financial and operational advantages.

What is driving hospital consolidations?

Hospitals in Puerto Rico have undergone significant financial hardship in the last decade. These hardships are so deep and widespread that nearly eight in ten hospitals on the island reported that they operate at a loss in 2022.12 As a result, hospitals have been forced to evaluate drastic cost cutting measures including layoffs, bankruptcy filings, closures of divisions and more. A recent study published by Galíndez LLC and Estudios Técnicos shows how Puerto Rico hospitals have been dragging losses for years, some only staying above water thanks to peripheral income sources (see Exhibit 1). The study’s findings support the likelihood of additional bankruptcies or service consolidations in the coming years.

%, PR and USA (Does not include government hospitals)

The current financial challenges impacting hospitals, along with the resulting wave of consolidations, are being driven by a range of factors. Some of these are unique to Puerto Rico or shared between Puerto Rico and the U.S., while others reflect broader global trends and shifts in the healthcare industry.

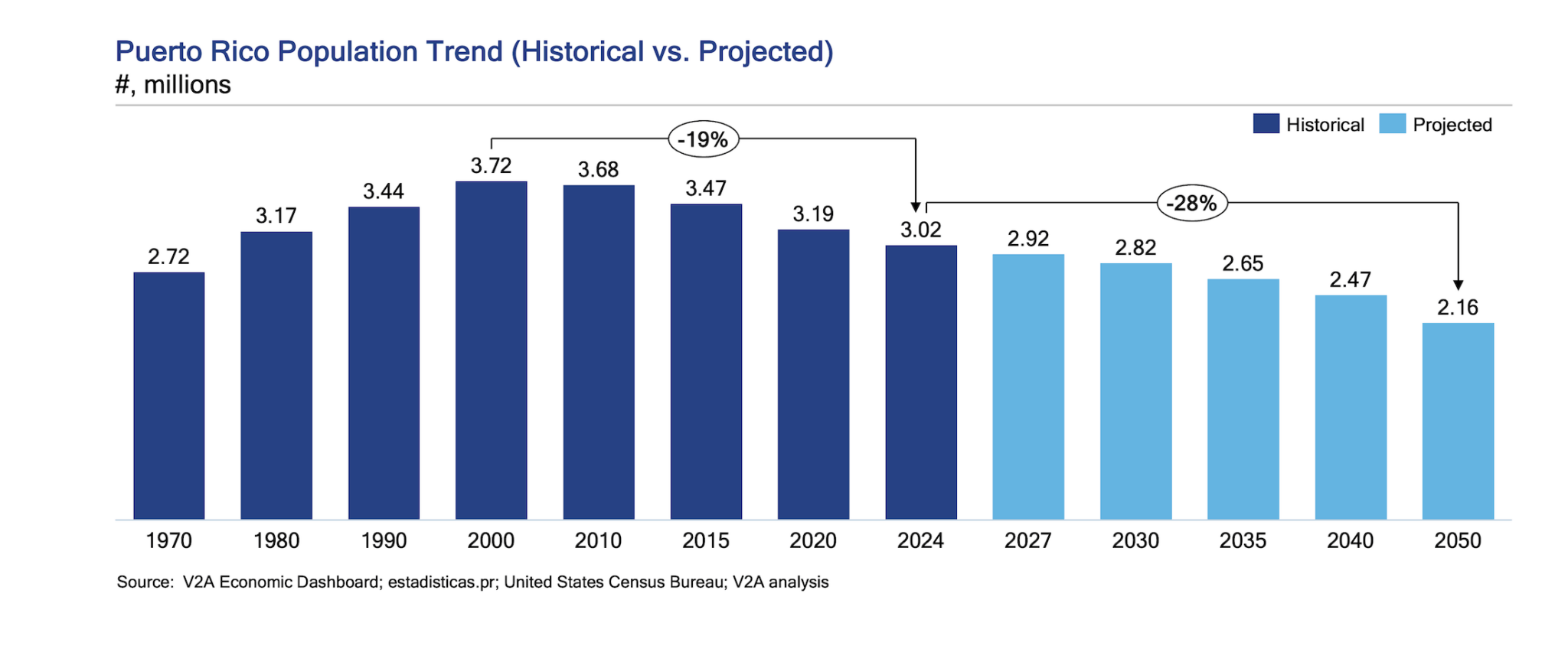

- Puerto Rico’s declining population. The total population in Puerto Rico has decreased by nineteen percent (19%) since 2000 and is expected to continue decreasing in the coming decades down to 2.16 million by 2050 per census projection. This downward trend is mainly driven by higher net migration of Puerto Ricans to the US, as well as reduced natality, where the island is experiencing for the first time more deaths than births.

- Changing demographics. Population older than 65 years of age in Puerto Rico represented 24% of total population in 2023 vs 18% in 2015 and is expected to increase to 33% by 2050. In Puerto Rico this trend is being exacerbated given that the younger population is the segment mostly migrating out of the island. Overall, this trend is not Puerto Rico specific, as global life expectancy has increased by 13% (~9 years) from 1970 to 2021. The 2024 estimated median age in the United States is 39 years while in Puerto Rico it is 46 years, for 2050 both are projected to increase to 46 years and 53 years respectively.

The trend of a declining and aging population presents significant implications for health systems. These demographic shifts are already impacting Puerto Rican hospitals, evidenced by the closure of labor and delivery rooms and the partial or full closure of specialized wings. In contrast, an aging population will drive an increased demand for care and health systems will face heightened pressure to meet the growing demand for provider services, including acute care in hospitals. The already critical shortage of home health aides and personal caregivers will further fuel demand, by aging populations seeking care in emergency room departments instead of the ideal care settings. For these reasons, global healthcare spending is expected to rise from 8.6% of GDP today to 9.4% by 2050²⁰. It will be crucial for hospitals in Puerto Rico to anticipate these changes and adapt their services accordingly to meet future demands.

- Clinical advancements have reduced acute care needs and hospitals have growing competition from outpatient/ambulatory care settings. Clinical advancements in the last three decades alone have significantly reduced hospitals lengths of stay and admissions. For example, Minimally Invasive Surgeries (MIS) have reduced hospital stays by up to 50% compared to traditional surgery thanks to the smaller incisions, reduced trauma, and quicker healing. Enhanced Recovery After Surgery (ERAS) protocols with multimodal approaches to post-surgery care, such as better pain management and faster mobilization, significantly reduce recovery times and length of stay by 30-50%. These clinical and other therapeutic advancements have enabled the shift of procedures out of hospitals in-patient setting. In 2023, over 60% of all surgeries in the U.S. were performed on an outpatient basis, often in Ambulatory Surgical Centers (ASC), which offer significant cost savings. This shift has contributed to reducing the need for hospital stays, especially for specialties like orthopedics, ophthalmology, dermatology, urology, gastroenterology, and pain management. Payors are likely to support the shift to lower-cost healthcare settings (for example in 2017, vertically integrated United Health insurer with Optum significantly expanded its own ACS business through acquisitions). This means hospitals will need to rethink their business models. Some observed responses from hospital systems in the US are acquiring ASCs to recapture a slice of the lost business or acquiring physician groups to control referral patterns.9

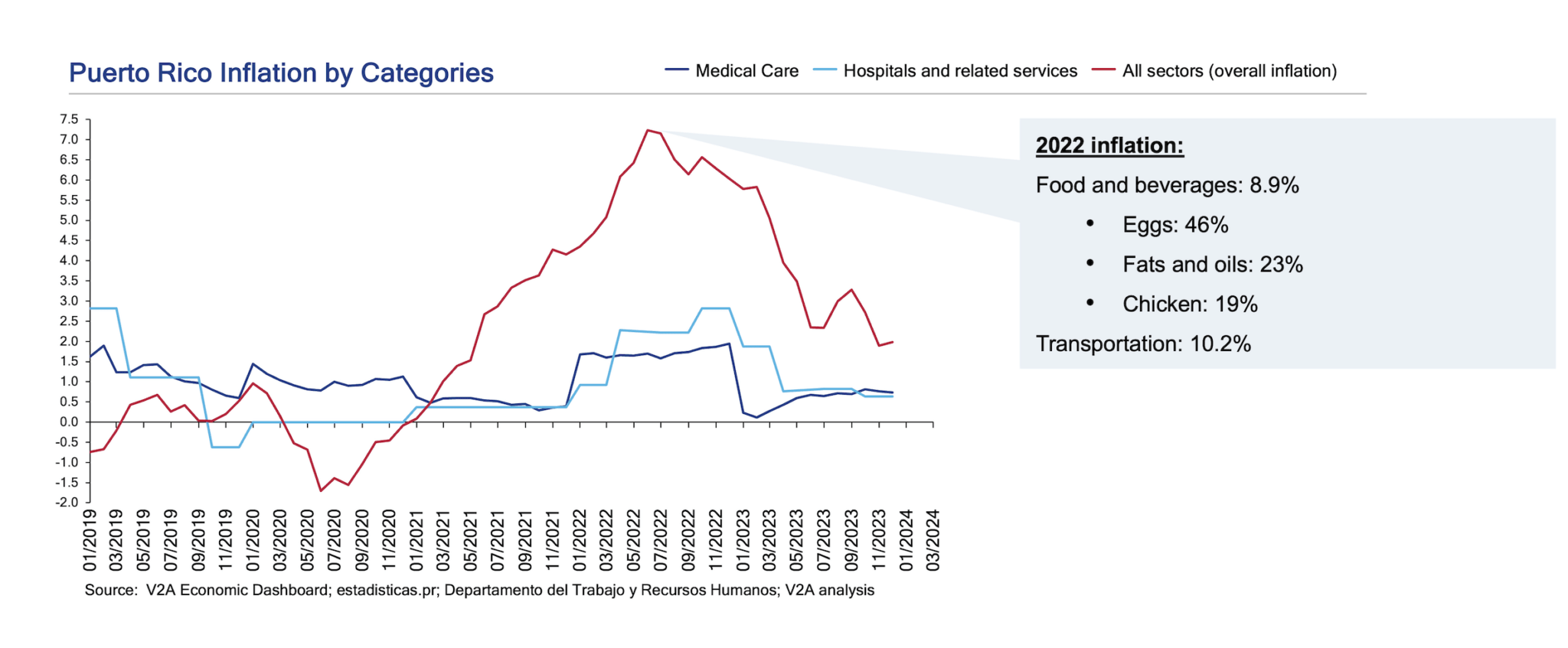

- The Funding challenge. In Puerto Rico CMS sponsored Federal programs pay for over 70% of the population’s healthcare needs (and growing) due to the demographic changes explained above. The disparity in funds provided for the island compared to the rest of the states only aggravates the financial situation of hospitals and doctors that are not being competitively compensated. Because of this, the Puerto Rico healthcare expenditure per capita is 65% lower than the US average. In Medicare alone (which represents 60% of the healthcare budget), current expenditure is 39% below the US Average, 37% below the lowest state (Hawaii) and 21% below the USVI. Moreover, overall inflation rates since 2021 (especially in pharmacy benefits for which Puerto Rico must pay the same price as everyone else) have grown significantly higher than the prices of “medical care” and “hospitals and related services”, which has contributed to the reduction of healthcare margins (see exhibit 3 below).

All in, hospitals, especially in Puerto Rico, are facing significant challenges and therefore opportunities to better position themselves to survive—and even excel—in tougher conditions. To address these challenges, hospitals should explore partnerships, mergers, and acquisitions to enhance capabilities, re-capture market shares, improve efficiency, and reduce costs through larger scale operations.

Why buy a hospital in today’s landscape?

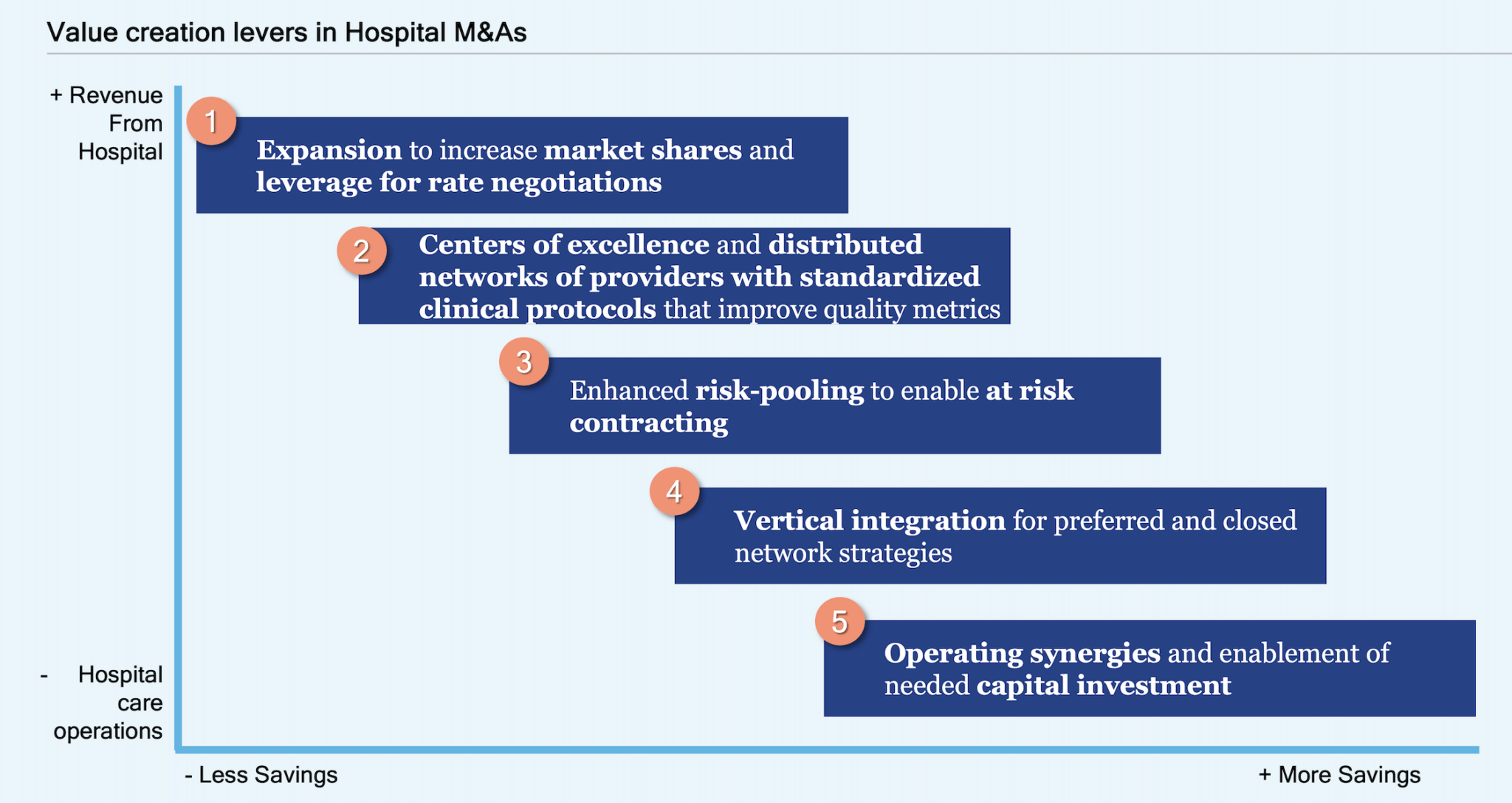

Given the current financial situation of hospitals in Puerto Rico, highly discounted acquisitions are currently functioning as the principal tool for our health systems to keep financially struggling hospitals open, many forced to sell during bankruptcy proceedings, avoiding a closure and geographical loss of access to care. However, when done well, integrations can generate substantial value for the entire health system by affecting patient traffic, increasing negotiation leverage, lowering total system costs, providing better quality of care, and integrating care delivery. Exhibit 4 below illustrates the five key value creation levers that can be at play as part of today’s strategy of acquiring a hospital.

- Expansion to increase market shares and leverage for rate negotiations.

Historically, prototypical consolidation involved similar-sized hospital systems merging or a larger hospital system acquiring a smaller one, with both organizations located in the same geographic area. However, over the last decade a new type of hospital system merger has become increasingly popular: a merger between hospitals located in geographically separate areas (called “cross-market mergers”).

This may be partially because hospital markets are geographically very concentrated (think of Sistema de Salud Menonita Health Plan’s market concentration in the central-east sections of the island), so opportunities to scale require hospital systems to look farther. The cross-market merger can be exemplified by the recent acquisition of HIMA San Pablo hospital located in Bayamón by Auxilio Mutuo who leads the San Juan – Cupey region. Furthermore, increased market share provides leverage in rate negotiations with payors, further increasing revenues by expanding geographic coverage within a market to offer sufficient breadth of access to potential insurer or employer partners.

- Centers of excellence and distributed networks of providers with standardized clinical protocols that improve quality metrics.

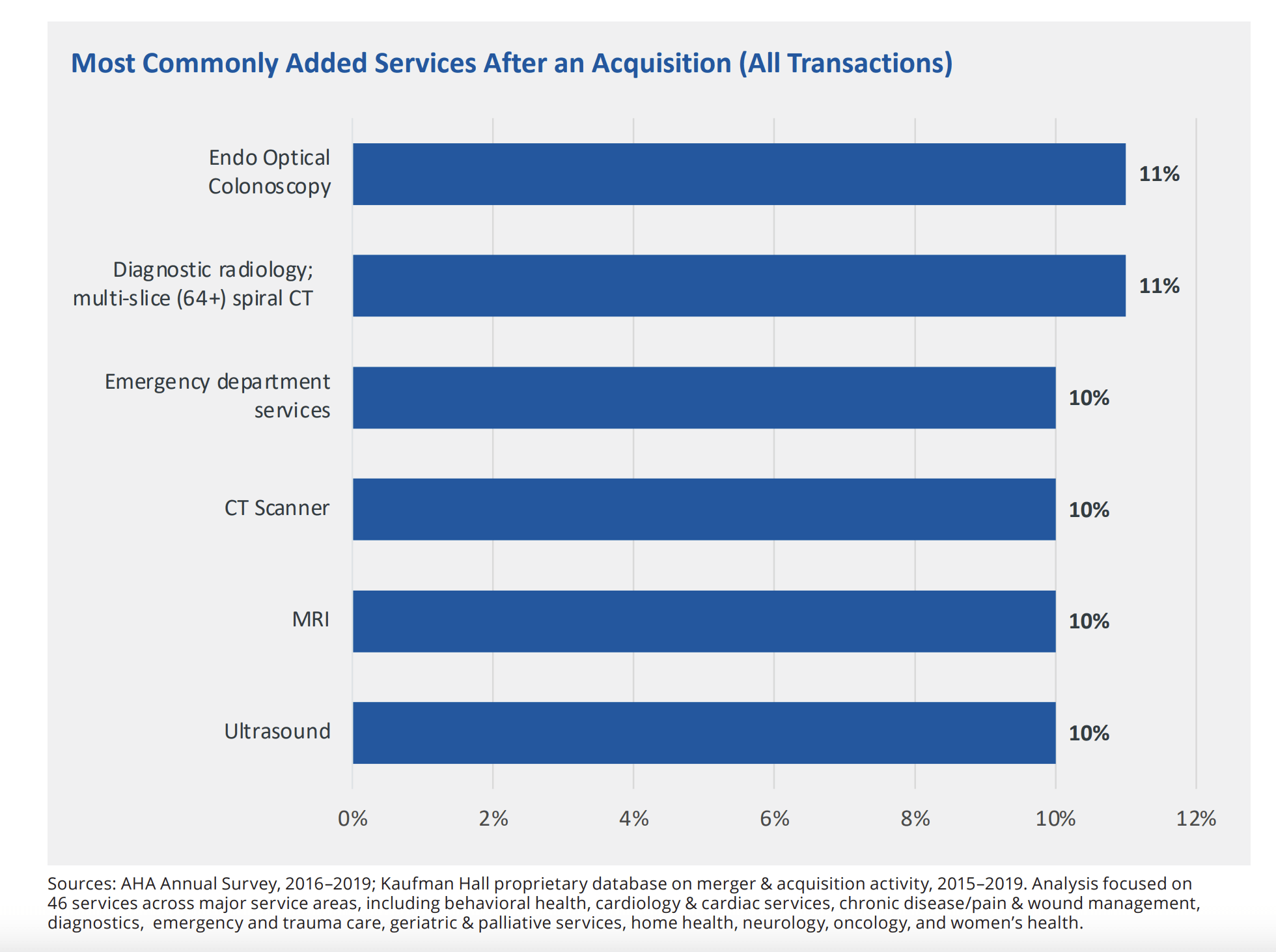

Integration allows institutions to benefit from economies of scale and can be a way to expand a hospital’s clinical offerings. A report published by Kaufman Hall that analyzed data on 463 hospital transactions between 2015 and 2019 showed that almost 4 in 10 (38%) of acquired hospitals added one or more services post-acquisition. Almost half of the hospitals acquired by an academic medical center (46%) added one or more services and patients at hospitals acquired by academic medical centers or large health systems also gain improved access to tertiary and quaternary services. Locally, a prime example of this is Metro Pavía’s Hospital System acquisition of HIMA Caguas hospital, where the new owners announced an expansion of the existing specialized services such as neurosurgery, radiotherapy, oncology, bone marrow transplant, epilepsy, and the Advanced Neuroscience Center.

Hospitals in financial distress are likely to cut down on standard of care and patient centricity and patient experience, which in turn further reduces the number of visitors/patients and therefore revenue. Once an integration happens, focus on branding, improved quality, processes and patient experience is essential to drive higher patient volumes and therefore growth.

Studies of mergers and acquisitions of independent rural hospitals with larger systems found reductions in mortality for several common conditions among patients at rural hospitals that had merged or been acquired. For non-rural hospitals, evidence on quality improvement is poor. Nevertheless, improving hospital quality outcomes can directly impact their Profit and Loss (P&L) by improving patient satisfaction, increasing reimbursements, reducing costs and penalties related to poor performance in quality-based payment programs. Some key quality outcomes that can improve a hospital's P&L include:

- Reduction in hospital readmissions: avoidable 30-day readmissions help hospitals avoid not being reimbursed by plans after providing care (most plans in Puerto Rico have clauses in their contracts with hospital providers to not pay for these) and penalties from Medicare and Medicaid (under the Hospital Readmissions Reduction Program).

- Improvement of wait times, clinical outcomes and mortality rates: all these improve the hospital’s brand reputation and therefore patient volumes. In turn, these attract better talent and lead to better contractual negotiations with payers.

- Reduced length of stay (LOS): in a risk-sharing or at-risk contractual arrangement which will be talked more about in the section below, improved quality treatments and outcomes is essential for profitability. Decreased in Hospital-Acquired Infections (HAIs) and Complications as well as efficient patient flow (reducing bottlenecks in admissions, transfers, and discharges) can shorten lengths of stay and resource utilization, allowing hospitals to treat more patients and manage staffing costs effectively.

- Enhanced risk-pooling to enable at-risk contracting.

At the crossroads of healthcare’s transition to Value-Based Payment Models, integration is a survival strategy. The shift towards value-based care incentivizes providers to deliver better outcomes rather than simply more services. Value payment programs are designed to drive down the total cost of care and push-down utilization risk to providers. This poses a challenge for hospitals given that this assumption of risk requires a patient population large enough to diversify risk and absorb the impact of high-cost, high-need patients. Most hospitals in Puerto Rico contract primarily through Per Diem rates with only very few larger institutions engaging in Diagnostic Related Group (DRG) reimbursements and/or capitation compensation agreements.In the US, Medicare’s DRG-based prospective payment systems are more common, however, most of those systems eliminate some of the risk associated with unusually high-cost patients through specified additional “outlier” payments clauses. Integrations are a way to enable hospitals to build systems that effectively manage patient care across the entire continuum, by achieving the scale needed for significant investments in expanding non-acute services and enhancing data and IT infrastructure to support population health management. Without this scalability, hospitals cannot take on the financial risks associated with value-based payment models.

- Vertical integration for preferred and closed network strategies.

Vertically integrated healthcare systems that manage both the Managed Care Organization (MCO)/insurer responsibilities as well as the provision of care by owning hospitals, clinics, medical groups and other healthcare providers can pose many benefits. In a closed or preferred network strategy, where an insurer/MCO limits patient access to a specific set of providers (often those they own or have exclusive contracts with), acquiring a hospital brings 3 key value drivers:

- Participate in the of 30-40% of the healthcare budget that is spent in hospital service providers: Insurers that choose to vertically integrate with service providers and settings (such as clinics and hospitals) tap into the bigger portion of where the healthcare utilization cost is directed. Instead of paying others to provide the service and keep margin, under these integrations they pay themselves for the services rendered to their membership lives.

- Cost Containment and Efficiency: With a closed network, the MCO can direct patients exclusively to its own hospital and affiliated providers, ensuring better control over service pricing, reducing administrative overhead, and eliminating the need to negotiate with external hospitals. This leads to more predictable healthcare costs and improves financial performance for the insurer.

- Enhanced Care Coordination: A closed network allows the MCO to maintain tighter control over patient care. By owning the hospital, the MCO can ensure that its care protocols, care teams, and technology platforms are integrated, promoting higher levels of care coordination and reducing duplication of services or unnecessary treatments and well as rapid transition of care out of the hospital and to lower care setting or the patient’s home.

In Puerto Rico, the two largest hospital systems (by number of beds) are vertically integrated with health insurers. A prime example of this value creation opportunity can be found in the recent acquisition of HIMA Caguas by the Metro Pavía hospital system that is vertically integrated with First Medical health plan. First Medical provides health insurance for the Medicaid and commercial segments in Puerto Rico and most of its commercial plan offerings include preferred provider network (PPN) benefits with $0 out of pocket cost for members that use their own hospitals and clinics. Despite being the biggest health system on the island, Pavía did not have any hospital assets in the south-east region where the Mennonite Hospital system and Health plan dominate (no other competing hospitals in the region), which likely created leakage from the PPN strategy in the region. Securing the acquisition of the HIMA-Caguas asset during bankruptcy proceedings (which was rumored to be also bid by the Mennonite system) helped First Medical complete its PPN network access strategy in the region

- Operating synergies and enablement of needed capital investment.

Hospital leaders interviewed in a study conducted by Charles River Associates (CRA) for the American Hospital Association (AHA) noted that mergers allow their systems to recognize savings in fixed costs associated with supply chain (group purchasing), IT, back-office overhead (e.g., administration, billing, revenue cycle), pharmacy and laboratory operations, and physical plant management. An updated analysis in 2021 of the same hospital systems’ financials reported to CMS after integrations confirmed hospital executives’ responses, which reveals a statistically significant 3.3% decrease in annual operating expenses at hospitals that have been acquired. A separate 2017 study in the Journal of Health Economics found an even more significant average cost savings of 4%–7% of the operating costs and about 50% of total overhead costs of the acquired hospital in the years following an acquisition.

The most noted savings lever is related to supply chain. While most hospitals use group purchasing organizations (GPOs) to access discounts, smaller hospitals, often acquisition targets, cannot achieve the same savings due to smaller purchase volumes. Larger systems, through direct negotiations with suppliers, often overseas, can secure better deals. Additionally, centralizing warehousing and distribution for hospitals within the same system reduces costs. Standardizing purchases, such as limiting the variety of implants for joint replacements, further enhances savings by increasing bulk discounts and lowering inventory management costs, making supply chain optimization a key advantage of hospital consolidation.

Acquired hospitals can also benefit from better access to capital to better serve their communities. Many of the hospitals saved from bankruptcy in the US have seen significant post-acquisition enhancements such as restauration of facilities, CAPEX expenditures in high-demand surgical equipment, digital infrastructure that reduces administrative burden and improves revenue cycle, as well as transformation of facilities to higher demand - lower level of care inpatient settings.

How to realize value creation after closing the deal?

At V2A Consulting we have extensive experience aiding organizations in their post-merger integrations to define high value creation strategies to materialize deal ROI targets. Our merger integration approach encompasses 5 pillars with ten critical success factors that ensure maximization of value creation and realization of full value capture. Below an introduction to each:

Define Vision and Integration Approach based on the value creation lever/s that apply (acquisition rationale)

By defining the vision for the merger, including timeline, revenues, and operational performance you can direct efforts in line with those goals. For example, the vision can include aspirations regarding an immediate improvement in customer experience starting day one after transaction closing, which will result in an increase in market share in the first year of operation of the acquired hospital. The merger vision is also enabled by a carefully crafted integration approach, which helps make decisions around magnitude and speed of organizational changes, and level of involvement from the acquired management team. This vision can change as integration begins its execution, hence, we suggest creating an integration task force or an Integration Management Office (IMO) that is continuously making important decisions as they arise.

Address Culture and Organization

Once you have identified goals for integration it is key to address cultural differences. For example, Hospital A’s culture can promote administrative personnel to focus on clinical outcomes, whereas Hospital B focuses on Patient Experience and ease of doing transactions. When acquisitions are within the same region/community, the acquired hospital’s local board is usually disbanded but is represented on the hospital system’s board to encourage a common culture. But with more distant acquisitions, local boards should be maintained or represented to ensure that the local communities have a voice in their local hospital’s governance. In CRA’s study, most hospital leaders interviewed spoke about the critical importance of adopting a “common culture” referring to a commitment by all hospital system members (and their clinical staff) to the same vision of how to move toward a delivery model that rewards value-based rather than volume-based care. This implies substantial economic and clinical integration to eliminate the incentive to make decisions based on a unilateral view of their benefits and costs rather than a system-wide perspective.

Organizational changes typically require hard and uncomfortable decisions involving leadership. Ideally, acquirors can develop a good understanding of which leaders should remain in their roles in the future, merged organization. In those cases, our experience says that providing confidence and empowerment to them will help the overall merger integration process. On the other hand, if leaders that are not culturally aligned, or are not good performers are making integration decisions, typically their decisions are then reverted later on in the process which creates waste in time, budget and energy. Having the wrong people making strategic decisions as integration occurs can be costly in the long run.

Identify Value Drivers

Based on the vision for the acquired hospital, and the acquisition rationale, leaders must identify value drivers, and clearly define initiatives that will create value on a short- and long-term basis for the integrated organization. This could include short-term goals like renegotiating smaller contracts with vendors based on economies of scale (i.e. engage or renegotiate terms with GPOs for pharmaceuticals, medical supplies and equipment since contractual clauses usually contain provisions for renegotiations if significant changes in volume are triggered) to longer term plans like the implementation of a uniform billing platform or an integrated EHR software. Once you have decided on which value drivers you would like to focus on, you can design their corresponding project implementation timeline and governance accordingly.

Planning Flawless Execution

Finally, to facilitate successful execution, acquiring Hospitals should stand up an Integration Management Office (IMO), where stakeholders are clear about their roles and responsibilities to promote accountability and clarity in the process. Critical hospital roles that need to be represented and actively participated in (in addition to the CEO and COO) are Chief Administrative Officer, Chief Medical Officer, Chief Financial Officer and Chief Human Resources Director. This IMO (which can consist of internal and/or external as wells as full-time and/or part-time resources) should collaborate with any existing project management office, and its activities and reporting mechanisms will progressively transform into part of the hospital’s business-as-usual operation.

Conclusion

The landscape of hospitals in Puerto Rico is surely expected to change as the community’s needs evolve. Most likely, healthcare business leaders will continue to receive opportunities to acquire hospitals that are in distress, both in their same geography and/or across the island. Once a smart decision is made about an Acquisition, focusing all efforts on capturing value through merger integration will help secure that the financial and operational objectives of the transaction are met. A structured approach that includes Setting the Vision, Identifying Value Drivers, Addressing Organization and Culture, and Executing flawlessly, can make the difference between celebrating a huge success, or becoming another case study for value destruction in M&A.

If your organization is navigating the complexities of an M&A integration, V2A Consulting is here to support you at every stage. Our expertise in Analytics and Market Intelligence enables us to deliver expedited commercial due diligence and comprehensive financial modeling, empowering our clients to make informed decisions quickly. With a track record of success in post-merger integrations, we can help your organization achieve sustainable growth and operational excellence. Contact us today to learn how we can turn your challenges into opportunities for long-term success.

References

- Galíndez LLC and Estudios Técnicos Puerto Rico Hospital Industry and financial situation study published in February 2024

- Ocho de cada 10 hospitales en el país operan con pérdidas - El Nuevo Día (elnuevodia.com)

- World Bank Database

- Median age Comparison - The World Factbook (cia.gov)

- International Database (IDB) (census.gov)

- https:/mis.wustl.edu/patient-care/laparoscopic-cholecystectomy/

- Ljungqvist, O., Hubner, M. Enhanced recovery after surgery—ERAS—principles, practice and feasibility in the elderly. Aging Clin Exp Res 30, 249–252 (2018). https://doi.org/10.1007/s40520-018-0905-1

- Ambulatory-Surgical-Centers-Market-Size-2022-2028-to-Reach-USD-58-85-Billion-at-a-CAGR-of-6-9.

- https://www.bain.com/insights/ambulatory-surgery-center-growth-accelerates-is-medtech-ready/

- Navathe AS, Connolly JE. Hospital Consolidation: The Rise of Geographically Distant Mergers. JAMA. 2023;329(18):1547–1548. doi:10.1001/jama.2023.5391

- https://www.aha.org/system/files/media/file/2021/10/KH-AHA-Benefits-of-Hospital-Mergers-Acquisitions-2021-10-08.pdf

- HIMA Caguas se convierte en el Hospital Pavía de Caguas – Metro Puerto Rico

- https://jamanetwork.com/journals/jamanetworkopen/fullarticle/2784342

- V2A Industry SMEs interviews during recent market research engagements

- Coulam RF, Gaumer GL. Medicare's prospective payment system: A critical appraisal. Health Care Finance Rev. 1992 Mar;1991(Suppl):45-77. PMID: 25372306; PMCID: PMC4195137

- Hospital-Merger-Full-Report-FINAL-1.pdf (aha.org)

- Adjudican subasta del hospital HIMA de Caguas a Metro Pavía Health System - El Nuevo Día (elnuevodia.com)

- Do hospital mergers reduce costs? - PubMed (nih.gov)

- https://www.aha.org/system/files/2018-04/Hospital-Merger-Full-Report-FINAL-1.pdf

- McKinsey Health Institute: Living longer in better health: Six shifts needed for healthy aging.

Coral Frederique Guzmán

Coral Frederique Guzmán Luis Ortiz Sánchez

Luis Ortiz Sánchez Andrea Puig Márquez

Andrea Puig Márquez