About this Special Issue

More than eight months have transpired since Hurricanes Irma and Maria made landfall in Puerto Rico on September 6 and September 20 of 2017, respectively, and while some progress has been made despite myriad constraints, logistical challenges, diverse collective action problems, and a beleaguered pre-hurricane context, much remains to be done. Many local residents and organizations are still reeling from the catastrophic shock and ensuing adverse cascading effects caused by the superstorms, particularly those in more remote areas.

Shortly following the hurricanes, in November 2017, V2A published the first of a series of special post-hurricane issues providing a brief overview of the pre-disaster context, lessons learned from past disaster events, expected macro and sectoral impacts of the 2017 hurricane season, and an analysis on what Puerto Rico could expect with respect to the inflow of post-disaster relief funds.1 In this critical juncture, eight months after impact, we deem it imperative to take stock of the progress made, explore the short-, medium-, and long-term outlook for the local economy and continue to survey emerging opportunities. As a result, we bring to you the second V2A Post-2017 Hurricane Season special issue, where we provide:

» An analysis of economic activity and labor market indicators in the wake of Hurricanes Irma and Maria,

» An update on disaster relief and assistance, focusing on the expected inflow of funds from the federal government,

» Key highlights of the new fiscal plan approved by the federally appointed Financial Oversight and Management Board for Puerto Rico (FOMB)2, and

» A brief overview of the trends and challenges faced by key economic sectors, as well as emerging opportunities for investment and job creation.

Post-Hurricane Performance of Key Indicators

Economic Activity Index (EAI)

The Economic Development Bank''s Economic Activity Index (EDB-EAI)3, as depicted by Figure 1, experienced a steep decline in the months following Hurricanes Irma and Maria, decreasing on a year-over-year basis by 16%, 20%, and 16% in October, November, and December 2017, respectively, gradually returning to pre-hurricane year-over-year contractions (-7.5%, -4.2%, -2.6%, and -2.2% in January, February, March, and April 2018, respectively). When comparing the behavior of the EAI following major hurricanes impacting Puerto Rico (i.e. Hugo in 1989, Hortense in 1996, Georges in 1998, and Irma and Maria in 2017), Irma and Maria''s impact on economic activity clearly dwarfs all previous hurricanes.

Labor Market Dynamics

Puerto Rico has long suffered from a weak labor market, exhibiting a double-digit unemployment rate for decades (9.6% as of May 2018), an internationally low labor force participation hovering around 40% (40.5% as of May 2018 vs. 62.7% in the US), and, in turn, a low employment to population ratio. Labor economists have identified several key factors that help explain why the local labor market performs so poorly vis-á-vis the United States (US) mainland and other economies with more robust and efficient labor markets, pointing to weak private sector employer demand with the public-sector serving as employer of last resort, perverse disincentives to work, among others.4

Total employment, which includes agricultural workers and the self-employed5, returned to pre-hurricane levels (i.e. August 2017) in April 2018, seven months after the hurricanes (see Figure 2). Nevertheless, the May 2018 jobs report continues to register negative year-over-year numbers, posting the 22nd consecutive YoY contraction. Growth in total employment in the wake of previous hurricanes was stronger due to the markedly different economic, fiscal and demographic contexts, and the historic magnitude of the latest event.

When analyzing employment level changes across industries in the aftermath of Irma and Maria, leisure and hospitality employment suffered the steepest immediate decline (see Figure 3), followed by the trade, transportation, and utilities subsector. While growth in construction employment is expected given the billions of dollars to be invested in post-disaster reconstruction, economic and demographic challenges will generally keep employment levels subdued.

Update on Disaster Relief Funding

Federal Aid & Private Insurance Disbursements

The widespread destruction inflicted upon Puerto Rico by Hurricane Maria, the third costliest hurricane in US history6, triggered considerable federal legislation and intervention to assist the US territory''s ongoing massive and highly complex recovery and reconstruction process. The Federal Emergency Management Agency (FEMA) reported that at its highest point, more than 19,000 federal employees and military service members from 80 federal agencies were mobilized to Puerto Rico.7 It should be noted that much criticism has been directed at FEMA and other federal entities for a sluggish response, and poor planning due to underestimations of potential damages and an overestimation of the disaster response and reconstruction capabilities of local entities.8

The recently approved fiscal plan assumes $62.4 billion in disaster relief funding from the federal government and private insurance disbursements to be rolled out over the next ten years (see Figure 4). Many questions remain on the actual impact these funds will have on the local economy. As per the fiscal plan, "on a weighted average basis, 12.5% of funds will directly impact the local economy" while the remaining 87.5% flows to entities off-island. Of the $62.4 billion, $35.3 billion or 56.5% will be utilized for the reconstruction of major infrastructure, roads, and schools through the Federal Emergency Management Agency (FEMA), US Department of Housing and Urban Development''s (HUD) Community Development Block Grant Disaster Recovery Program (CDBG), and the other federal agencies and programs. Furthermore, $19 billion will be destined to support the housing reconstruction and personal expenses needs of individuals impacted by the hurricanes. Private insurance disbursements, based on an analysis from the Office of the Insurance Commissioner, will amount to $8 billion, or 12.8%. Figure 4 provides the projected roll-out of the funds from FY2018 to FY2028.

To manage and oversee the historic inflow of federal funds, the Central Recovery and Reconstruction Office (CRRO) was established under the Public-Private Partnerships Authority (P3A). This new entity with ample powers with respect to the management of federal disaster funds, is required to submit by August 2018 a detailed recovery plan of the next 12 to 24 months. The government must also submit a Disaster Recovery Action Plan to the federal Department of Housing and Urban Development (HUD) for the use of the $18.5 billion from the Community Development Block Grant Disaster Recovery (CDBG-DR) program. An action plan prepared by the local housing department for the use of the apportioned $1.5 billion in CDBG-DR funds was submitted on May 10th.

Brief Overview of the New Fiscal Plan: May 2018

The new fiscal plan, approved on May 30, 2018 by the Financial Oversight and Management Board (FOMB) for Puerto Rico, consists of historic revenue-generating and expenditure-cutting measures, and structural reforms which seek to strengthen the island''s competitiveness to promote investment and job creation. The spending cuts and new revenue sources are estimated to drive roughly $12 billion in savings and new revenue by FY2023, while the structural reforms are "projected to increase GNP by 1.75% by FY2023" (Exhibit 10 of the fiscal plan). The fiscal measures include agency consolidation, reduction, and/or elimination, healthcare reform, tax reductions and tax incentives reform, pensions reform, reduction of appropriations to the University of Puerto Rico and municipalities, and instituting the Office of the Chief Financial Officer (CFO). The structural adjustment reforms include the flexibilization of local labor regulations, improving the ease of paying taxes, registering property, and the permitting process, the transformation of energy production and distribution, and prioritizing strategic, and productivity-enhancing capital improvement projects. Diverse criticisms and questionings regarding the new fiscal plan, and its embedded assumptions and forecasts, abound.9, 10, 11, 12, 13

Economic & Population Trend Analysis & Forecast

Economic Growth Forecasts

The Puerto Rican economy was already mired in a more than decade-long economic downward spiral dating back to 2006 when the fateful 2017 hurricane season struck the island.14 According to the new fiscal plan, the estimated $62.4 billion in disaster relief and insurance disbursements will boost economic growth in FY2019, after a period of hurricane-induced macroeconomic volatility. Real gross national product (GNP), assuming the full implementation of fiscal and structural reforms, is forecasted to contract by 13.3% in FY2018 (ending June 30, 2018) and bounce-back in FY2019 (+6.3%) driven by the inflow of federal funds and insurance disbursements.15, 16

Demographic Challenges

Puerto Rico has long been experiencing a shrinking population driven by low fertility rates and high emigration to the US, materially constraining aggregate demand. In 2000 the population peaked at 3.8 million, dropping to 3.3 million in 2017. The demographic challenges were further exacerbated by the superstorms and their devastating aftermath, intensifying economic and non-economic push and pull factors of migration. The new fiscal plan projects the population to further decline by roughly 12%, reaching an estimated 2.96 million in 2023, which would return Puerto Rico to population levels not seen since 1975. These troubling demographic dynamics result in a shrinking consumer and tax base, further straining cash-strapped public coffers and hindering an already struggling economy. A negative natural birth rate, in conjunction with the ongoing exodus, pose daunting challenges going forward, with no easy solutions in the short-term.

Sector Analyses & Emerging Opportunities

Construction Sector

The construction sector17 has been one of the hardest hit since the onset of the economic downturn in 2006, experiencing a limited and short-lived boost particularly felt in 2012 thanks to federal and local countercyclical stimulus policies. Similarly, but at a greater scale, the injection of disaster relief funds will bring new dynamism to the sector, which has been contracting since FY2013. Public and private investment in construction in FY2006 reached $6.0 billion, representing 10.4% of GNP, plummeting to $2.4 billion or 3.4% of GNP in FY 2017. When analyzing construction sector jobs (household survey), the sector employed 88,000 people in FY2006, 7.0% of total employment, falling to 32,000 in FY2017, 3.2% of the total.

Cement sales, a leading indicator of construction sector activity, experienced a precipitous drop in September 2017, followed by a gradual ascent to levels not seen since 2013 (1.4 million bags in May 2018), but still well below the pre-economic downturn levels which averaged close to 3.7 million bags from FY2000 to FY2006 (44.2 million annually).18

The Puerto Rico Planning Board''s base forecast for investment in construction in FY2018 (ending June 30) is $2.2 billion, a 7% decrease with respect to FY2017 and a 20-year low. In FY2019, driven by disaster relief funds, investment in construction is projected to reach $5.6 billion, a 150% increase with respect to FY2018 and the highest level since FY2007 ($7.5 billion in the more optimistic forecast).

Parallel to this increase in construction investment slated for FY2019 is the creation of direct construction jobs as well as indirect and induced jobs given the wide range of stakeholders and linkages to other sectors (e.g. construction-related retail, engineering and design sector, supporting financial services). Using a direct employment multiplier of 12 (avg. of last five years), meaning 12 direct jobs created per $1 million in construction investment, we can expect direct jobs to reach 27,000 in FY2018 and 67,600 in FY2019. As shown in Figure 7, investment and jobs in construction could peak in FY2019 and taper off as disaster relief funds wind down.

To get a sense of where the investment in construction will be going and where opportunities lie, we can use the estimates RSMeans19 produces of the breakdown of construction investment. They find that 46% is generally spent in construction materials, both raw (i.e. cement, sand, blocks, aggregates) and retail (i.e. paint, windows, tools) construction materials, 26% for labor, 11% for professional services such as architects, engineers and/or accountants, while approximately 20% will go to the government via income taxes, corporate taxes, consumption sales tax, construction permits fees, among other taxes and fees.

Retail Sales

In the wake of Hurricane Maria, normal business and retail activity was severely disrupted due to the collapse of critical infrastructure systems including electric power, telecommunications, and logistics and transportation capabilities, clearly reflected in the behavior of retail sales. Figure 8 illustrates the dramatic drop in retail sales from $2.7 billion in August 2017 to $1.2 billion in September. During the first three months following the hurricanes (October to December), retail sales exceeded pre-hurricane levels, averaging $3.2 billion ($2.7 billion in 2017). This was mostly driven by latent demand, replacement of damaged goods, and the replenishment of stockpiles. In the first two months of 2018, retail sales reached $5.4 billion, a 7.6% increase with respect to the same period in 2017. The Retail Industry Association forecasted total retail sales of $28.5 billion in FY201820, a 9.5% annual increase.

The food industry, both supermarkets and restaurants, will likely experience a boost in sales in the second half of FY2018 partly driven by an additional $1.3 billion through the Supplemental Nutrition Assistance Program and a reduction in the consumption tax levied on processed foods. Other retail sectors, including auto, furniture stores, hardware stores, and restaurants, will likely register increased activity and sales in this post-hurricane context.

Auto Sales

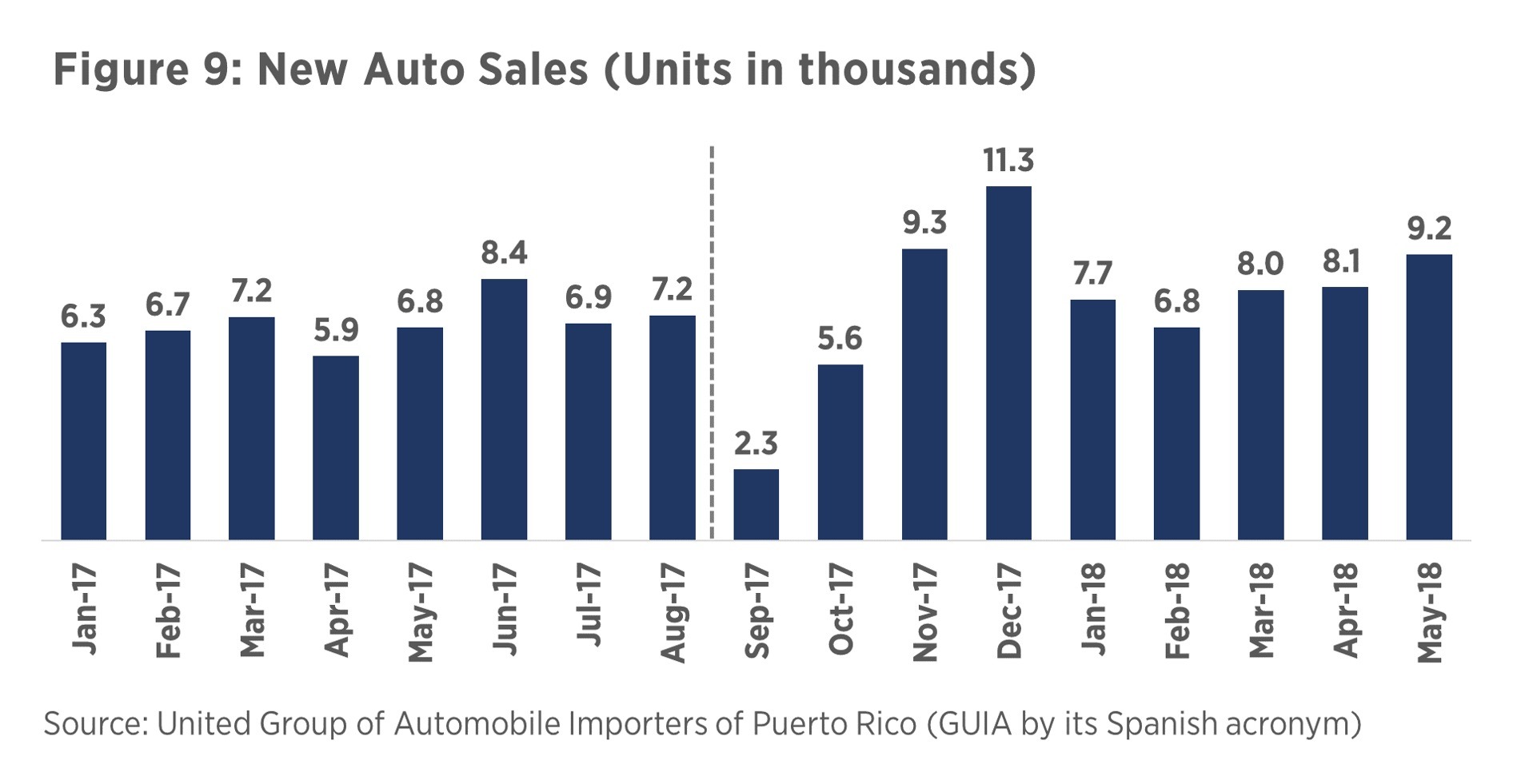

New auto sales, after experiencing a hurricane-induced dip in September and October, took a sharp upturn in December, with 11,336 new cars sold (see Figure 9). This increase in sales is due to the replacement of hurricane-damaged cars and the demand not served in the months of September and October due to post-disaster disruptions to normal business activity. The United Automobile Importers Group (GUIA by its Spanish acronym) estimates 2018 auto sales to reach between 84,000 and 86,000 units, following sales of 84,080 in 2017 and 86,053 in 2016. These auto sales levels are low when compared to a peak reached in 2005 of more than 140,000, or when compared to 2012 and 2013 levels when roughly 100,00 autos were sold. Commercial banks and non-depository institutions are poised to continue benefitting from auto sales activity by originating and servicing auto loans. The government will also continue to benefit from auto sales activity through the receipt of auto excise tax revenues. So far in FY2018, the government has collected $307 million, 4.2% of the $7.27 billion in General Fund Net Revenues from July 2017 to April 2018, according to the Treasury Department.

Tourism Activity

Tourism has proven to be a resilient sector throughout the deep economic slump affecting Puerto Rico, representing 6% of GNP and servicing 5.2 million visitors in FY2017, highest level of visitors since FY2008. As experienced in New Orleans immediately following Hurricane Katrina, the local leisure and hospitality sector has suffered significant initial negative effects but is rebounding gradually.

As to be expected, cruise ship passenger traffic was adversely impacted, decreasing from 114,00 in Aug. 2017 to roughly 17,000 passengers in Sep. 2017. Just two and a half weeks after Hurricane Maria devastated Puerto Rico cruise ship traffic begin to flow again. It remained subdued in Oct. and Nov., rebounding in Dec., reaching 150,000 passengers. Air passenger traffic flows behaved similarly, plummeting in Sep. and gradually recovering to normal levels by Dec. The cruise industry, according to the Tourism Company, will reach record numbers in the 2018-2019 season with 14 total cruises arriving at the port of San Juan, 4 more than last season. Total passengers are forecast to be 1.7 million in 2018, with an economic impact of $250 million.

Currently there are 12,458 hotel rooms available in Puerto Rico, number set to increase to 15,128 once the renovations in the Wyndham Grand Río Mar Puerto Rico Golf & Beach Resort, Ritz-Carlton Reserve and El San Juan Hotel are finalized. Additionally, there are over 3,000 hotel rooms in different phases of development which will be eventually introduced to the market (e.g. W Marriott, Aloft San Juan Convention Center, Aloft Ponce, and Four Seasons Cayo Largo). These hotel projects represent an estimated $1.9 billion in new construction investments, as well as 3,831 direct jobs in the operational phase. Furthermore, high hopes are resting on the newly created Corporation for the Promotion of Puerto Rico as a Destination, Inc., a destination marketing organization (DMO) created pursuant to Act 17 of 2017, looking to provide consistency to Puerto Rico''s destination branding strategy and execution plan, and achieve the full potential of the local "vistor economy."

Banking and Other Financial Services

The local banking sector has undergone deep structural changes since the economic downturn began in 2006 and the 2007-2009 Great Recession. Several waves of consolidation have reduced the number of commercial banks from 11 commercial banks in 2005 managing over $100 billion in assets to 6 in Q1 2018, with $58.8 billion. Puerto Rico now has a highly concentrated banking sector, with Popular and FirstBank controlling three-fourths of the local banking business. Furthermore, current strong capital positions and healthier balance sheets will help local banks face potential future deterioration of economic conditions and asset quality.

As seen in Figure 10, the hurricanes took a toll on banks’ consolidated return on equity (ROE) in Q3 and Q4 of 2017, after a strong first half of the year, quickly rebounding to a ROE above 8% in Q1 2018. Industry-wide deposits have been consistently increasing since Q4 2015, reaching $52.1 billion at the end of Q1 2018. The inflow of federal and insurance funds will provide numerous opportunities for local banks for deposit and loan growth, particularly in the long-stagnant construction segment, consumer lending (incl. autos) and other sectors. Furthermore, local banks should be watchful of the August 2018 publication of the island-wide recovery plan and CDBG action plans to effectively integrate them into their respective long-term strategic planning processes.

Concluding Remarks

While in the short- and medium-term the economy of Puerto Rico will be bolstered by the billions of dollars flowing into the island, pressing questions remain about what will be the economic drivers for growth beyond FY2023. Many experts have pointed to the need of developing and implementing an agreed upon vision of what the Puerto Rican economy aspires to be in the long-term. Furthermore, the fiscal and structural reforms contained in the recently approved fiscal plan, as well as the recovery and reconstruction process which should follow the Build Back Better principles21, are fraught with implementation risks and challenges. Uncertainties regarding the island''s export-oriented industrial sector also abound. The latest threat to the sector is the federal law known as The Tax Cuts and Jobs Act enacted on December 2017 which established a 12.5% tax on income generated from intangibles (i.e. patents and licenses) in foreign jurisdictions, including Puerto Rico.

While risks and challenges remain, many opportunities are and will continue to surface. Beyond the aforementioned emerging opportunities, the Puerto Rico Disaster Recovery Action Plan delineates several economic recovery programs including $50 million for small business loans, $10 million for small business incubators, and $25 million for commercial redevelopment, programs which will help spur growth and the entrepreneurial spirit.22

Since the occurrence of future hurricane events is highly probable, build-back-better and hazard mitigation investments are urgent and critical when rebuilding to avoid or mitigate future disaster damage, and to create more resilient communities. The 2018 Atlantic hurricane season is already upon us. Forecasters in the National Oceanic and Atmospheric Administration (NOAA) are predicting a near normal or above normal Atlantic hurricane season in 2018 with a 70% probability of 5 to 9 hurricanes, and 1 to 4 major ones (Cat. 3 to 5).23

Download the PDF version of this article here.

Endnotes and References

1. V2A''s first special post-hurricane issue titled Puerto Rico Post-2017 Hurricane Season: Initial Insights and Outlook is available at http://www.v2aconsulting.com.

2. The Financial Oversight and Management Board for Puerto Rico (2018, May 30). New Fiscal Plan for Puerto Rico: Restoring Growth and Prosperity. Retrieved from https://oversightboard.pr.gov/documents/.

3. The Economic Activity Index, a coincident index composed of nonfarm payroll, cement sales, gasoline consumption and electric power generation, is currently being published by the Economic Development Bank for Puerto Rico since April 2018 as a result of the Government Development Bank’s closure, and forthcoming liquidation and debt restructuring under Title VI of PROMESA.

4. Burtless and Sotomayor (2006), in the book The Economy of Puerto Rico: Restoring Growth, point to the four factors identified by labor economists which explain the difference in employment levels between Puerto Rico and the mainland U.S. These are ''''differences in work opportunities, or employer demand; differences in worker skill endowments, which in turn produce disparities in gross wages; differences in the structure of taxes and social welfare benefits, which can affect the net return to work; and differences in preferences.''''

5. Total employment, published through a Federal (BLS) and State/Territory (PR Department of Labor and Human Resources) collaborative effort, which includes agricultural workers and the self-employed, estimates employment using the Current Population Survey, known as the household survey.

6. The National Oceanic and Atmospheric Administration''s (NOAA) estimate of damage in Puerto Rico and the U.S. Virgin Islands due to Maria is $90 billion dollars, with a 90% confidence range of +/-$25.0 billion, or $65.0-$115.0 billion, which makes Maria the third costliest hurricane in U.S. history, behind Katrina (2005) and Harvey (2017). The report is available at https://www.nhc.noaa.gov/data/tcr/AL152017_Maria.pdf.

7. Federal Emergency Management Agency (2018, March 16) Six Months After Maria: Progress Made, Work Continues. Retrieved from https://www.fema.gov/news-release/2018/03/16/six-months-after-maria-progress-made-work-continues.

8. The Economist. (2018, April 14). After the hurricane America has let down its Puerto Rican citizens. Retrieved from https://www.economist.com/news/briefing/21740394-islanders-must-look-themselves-salvage-their-fortunes-america-has-let-down-its-puerto.

9. Criticisms and controversies abound concerning the approved fiscal plan. Many point to the unrealistic assumptions embedded in the plan, the lack of consideration of the social costs of the historic austerity measures, and too much hope placed on tried-and-failed macroeconomic adjustment policies.

10. Gluzmann, P., Guzman, M., & Stiglitz, J. (2018). An analysis of Puerto Rico''s debt relief needs to restore debt sustainability. Retrieved from https://www8.gsb.columbia.edu/faculty/jstiglitz/sites/jstiglitz/files/An%20Analysis%20of%20Puerto%20Rico%27s%20Debt.pdf.

11. Villamil, J. (2018). PROMESA, la Junta y nuestro futuro. Perspectivas. Retrieved from https://www.estudiostecnicos.com/pdf/perspectivas/2018/abril2018.pdf.

12. Marxuach, S. (2018). The Social Cost of the Fiscal Plan. Center for a New Economy. Retrieved from http://grupocne.org/2018/04/29/el-costo-social-del-plan-fiscal/.

13. Merling, L. & Johnston, J. (2018) Puerto Rico''s New Fiscal Plan: Certain Pain, Uncertain Gain. Center for Economic and Policy Research. Retrieved from http://cepr.net/images/stories/reports/puerto-rico-fiscal-plan-2018-06.pdf.

14. Economists usually point to the mid-1970''s as the starting point of Puerto Rico''s competitiveness erosion and loss of its capacity to grow at high rates as it had done from the late 1940''s to early 1970''s.

15. The Economy of Puerto Rico: Restoring Growth of the Center for a New Economy and Brookings Institution (2006) and the United Nations Economic Commission for Latin America and the Caribbean book titled Globalización y Desarrollo: Desafíos de Puerto Rico Frente al Siglo XXI provide an extensive discussion on the gap between the gross national product and the gross domestic product in the case of Puerto Rico.

16. Available real GNP growth estimates for FY2018 and FY2019 generated by the Planning Board differ from those contained in the approved fiscal plan, with the former estimating a less pronounced contraction in FY2018 (-5.6%) and weaker growth in FY2019 (3.5%) (see Figure 5).

17. Construction can be divided into 10 sub-sectors: (1) Residential construction, (2) nonresidential construction, (3) utility system construction, (4) land subdivision, (5) highway, street, and bridge construction, (6) other heavy and civil engineering, (7) foundation, structure, and building, (8) building equipment contractors, (9) building finishing contractors, and (1o) other specialized contractors.

18. If we assume roughly 4,500 94lb bags of cement per $1 million in construction investment (avg. FY2013-FY2017) and use the Planning Board''s forecasts of investment in construction, we can expect cement sales to reach 10 million in FY2018 and close to 25 million in FY2019 (34 million in the more optimistic scenario).

19. RSMeans is a leading supplier of construction cost information in North America estimating the 2018 Construction Cost Breakdown: https://www.rsmeans.com/.

20. El Nuevo Día (2018, March 8). Las ventas en el comercio se disparan en el año fiscal 2018. Retrieved from http://www.elnuevodia.com/negocios/.

21. The government of Puerto Rico published a Build Back Better Report presented in Congress, which requested $94.4 billion in disaster funds through supplemental appropriations, available at http://www.documentcloud.org/documents/4198852-Build-Back-Better-Puerto-Rico.html.

22. Manufacturing contributes more than $50 billion to Puerto Rico''s GDP, roughly 50% of total economic output. However, in terms of employment, it supports 70,000 or 8.2% of total nonfarm employment. As has been well-documented, income shifting, and transfer pricing practices explain the inflated GDP numbers. The sector has been in decline for some time due to the erosion of its global competitiveness as trade liberalization expanded, wages have gradually increased, and the costs and ease of doing business have become a source of competitive disadvantage. A report by the Federal Reserve Bank of New York on Puerto Rico''s competitiveness states that ''''going forward, there appears to be only a limited prospect for the sector to be a driver of growth.''''

23. National Oceanic and Atmospheric Administration. (2018, May 24). Forecasters predict a near- or above-normal 2018 Atlantic hurricane season. Retrieved from http://www.noaa.gov/media-release/forecasters-predict-near-or-above-normal-2018-atlantic-hurricane-season.

The "Puerto Rico Post-2017 Hurricane Season: Update & Revised Outlook" is the second of a series of special V2A publications given the extraordinary exogenous shock impacting Puerto Rico''s economy.

V2A''s first special post-hurricane issue, the "Puerto Rico Post-2017 Hurricane Season: Initial Insights & Outlook", is available here.

V2A''s quarterly publication, the "PUERTO RICO BANKING INDUSTRY REPORT", is available here.

V2A contributors to this special V2A publication:

Olivier Perrinjaquet, Hector Rivera and John Bozek

Disclaimer

Accuracy and Currency of Information: Information throughout this report is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.

Alexandra Carpenter

Alexandra Carpenter