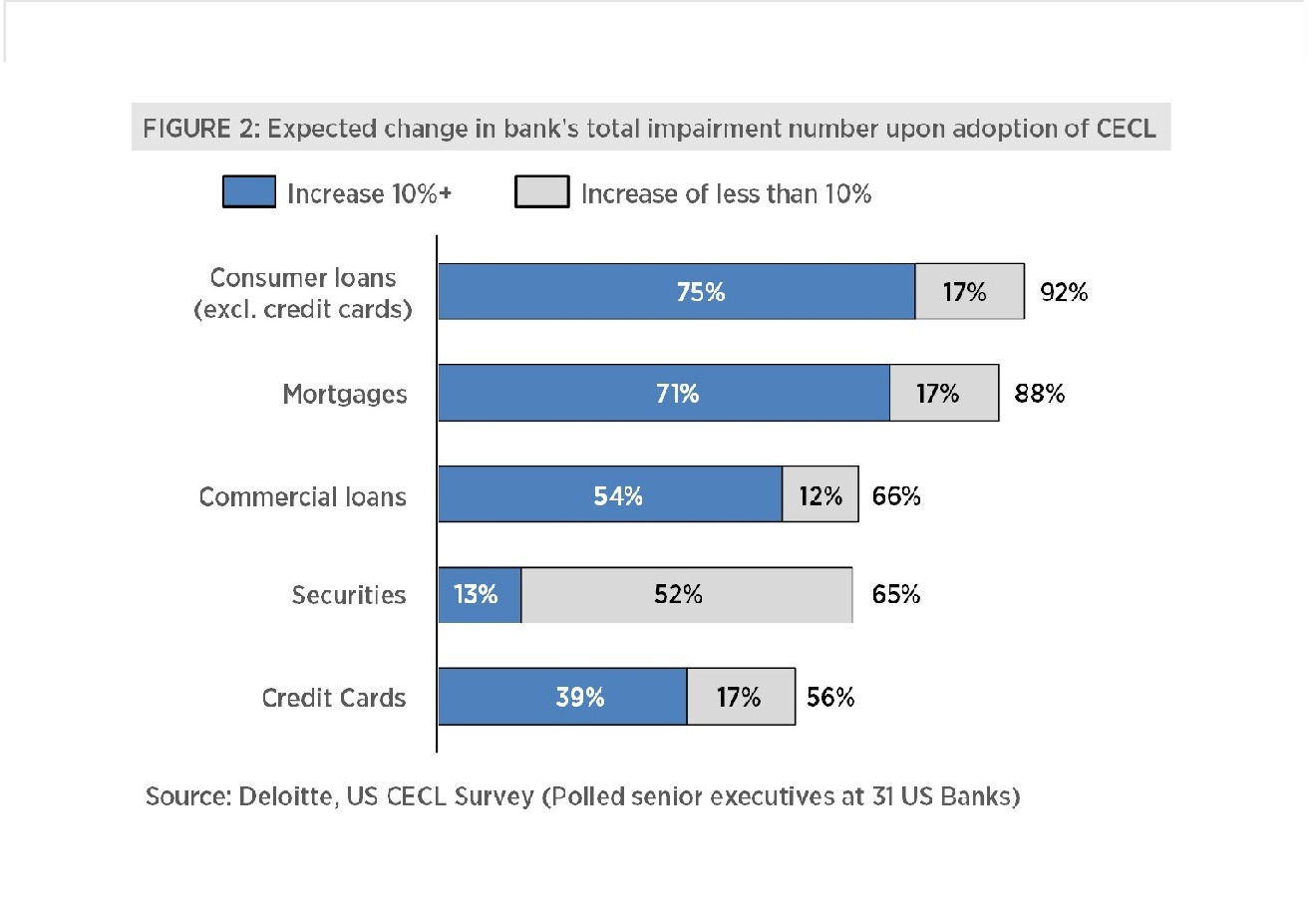

The local banking industry has gone through a profound and long-lasting consolidation process since 2010, with only three remaining banks surviving, Popular, FirstBank, and Oriental. With this consolidation came a steep decline in assets, deposits, and loans. From 2009 to 2016, total banking assets decreased by 38% or $34.9 billion, deposits by 24% or $14.4 billion, and loan portfolios by 38% or $23.5 billion. However, 2016 seems to be a turning point in the financial condition of local banks with assets increasing by 21%, deposits by 33%, and loans by 8% during the 2016-2019 period. The banks that have survived the latest wave of consolidations exhibited a strong financial performance in 2019, posting a consolidated Pre-Tax ROE of 13.7%. Their productivity, credit quality, and capital position in 2019 were solid and moving in the right direction, posting a cost-to-income ratio of 57.9%, a nonperforming loans ratio of 5.0%, and a Tier 1 Risk-Based Capital Ratio of 21.0%. Looking into the rest of 2020, the banking sector will likely benefit greatly from the imminent inflow of $8.285 billion in Community Development Block Grant Mitigation (CDBG-MIT) funds which have been made available by the Department of Housing and Urban Development (HUD), after months of delay. Additionally, new Current Expected Credit Losses (CECL) regulations will likely have material operational implications as well as financial ones.

PR Banking Industry Report Q4 2019

Alexandra Carpenter

Alexandra Carpenter Xavier Diví

Xavier Diví