Overview

The banking sector in Puerto Rico had a great 2022. The Pre-Tax Return on Equity reached 30.8%, the highest in the past 20 years. The sector's profitability was partly the result of good efficiency levels. The cost-to-income ratio (or efficiency ratio) reached 56.8% in 2022. Since 2006, when the Puerto Rico economic troubles started, only in 2018 had the banking sector shown a better efficiency level than in 2022.

The banking loan portfolio increased by 6.6% during 2022, fueled by commercial, auto and consumer loans, reflecting a robust performance of the local economy. The higher interest rates had a negative effect on the mortgage loan origination (34% down vs. 2021), but the reduction was more than offset by the other lending activity. The quality of the loan portfolio also improved. The non-performing loans ratio decreased from 3.7% in 2021 to 2.7% in 2022, the lowest since 2006.

After the record increase in deposits experienced in 2019-21 (47% growth), total deposits reduced by 9.3% in 2022. The decrease was the result of three factors: 1) A reduction in public deposits after the public debt restructuring agreement of Q1 2021, 2) More attractive investment alternatives for retail and commercial customers given the recent interest rate increases by the Federal Reserve, and 3) The negative impact of high inflation on individuals' disposable income.

Given the limited inorganic growth opportunities and their high capitalization levels, local banks continued to return capital to shareholders and to increase dividend payments in 2022. However, capitalization ratios remained significantly above well-capitalized levels (16.4% in 2022). The high capitalization levels of Puerto Rico banks put them in a good position to face the current banking uncertainty after the collapse of Silicon Valley Bank. Local banks also have 8.2% of their assets in cash and equivalents, and they hold large amounts of short-term treasury securities to face potential deposit decreases. On the other hand, they are exposed to unrealized losses from mortgage-backed securities and longer-term treasury securities that could negatively impact their bottom line if they have to sell them in the near term.

The V2A banking report dashboard above provides additional detail on the banks’ performance in 2022 and previous years.

Despite the banking consolidation, competitive pressure is likely to increase

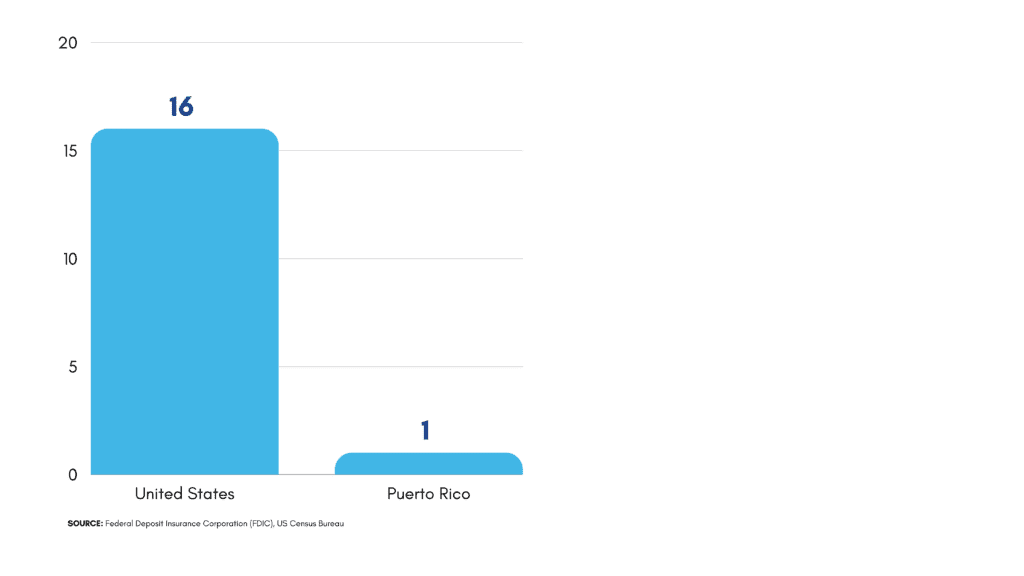

The banking sector has experienced significant consolidation in the past years. The total number of Puerto Rico FDIC-insured banks has decreased from 10 in 2009 to just 3 in 2022. As a result, there is currently only 1 bank per million population (18-year-old or more) in Puerto Rico, compared to 15 in the United States (see figure 1). Every State in the US has more FDIC-insured banks per million population (18-year-old or more) than Puerto Rico.

Figure 1: Number of FDIC Insured Banks per Million of 18-Year-Old or More Population

The remaining three banks in Puerto Rico accumulate ~88% of total individual and commercial deposits (excluding government deposits). Unsurprisingly, they have maintained lower interest rates on interest-bearing deposits compared to their US peers (see figure 2) contributing to their higher profitability levels.

Figure 2: Trend of Fed Funds Target Rate and US-PR Banks Interest Expense to Interest Bearing Deposits

However, this does not mean that Puerto Rico banking institutions are not exposed to competitive pressures in the local market. Local credit unions have managed to take advantage of the banking consolidation to increase their lending business vis a vis local bank. As shown in figure 3, the number of credit union members increased by 15% between 2015 and 2022 while the total population in Puerto Rico continued to decrease.

Figure 3: Number of Members of Puerto Rico Credit Unions

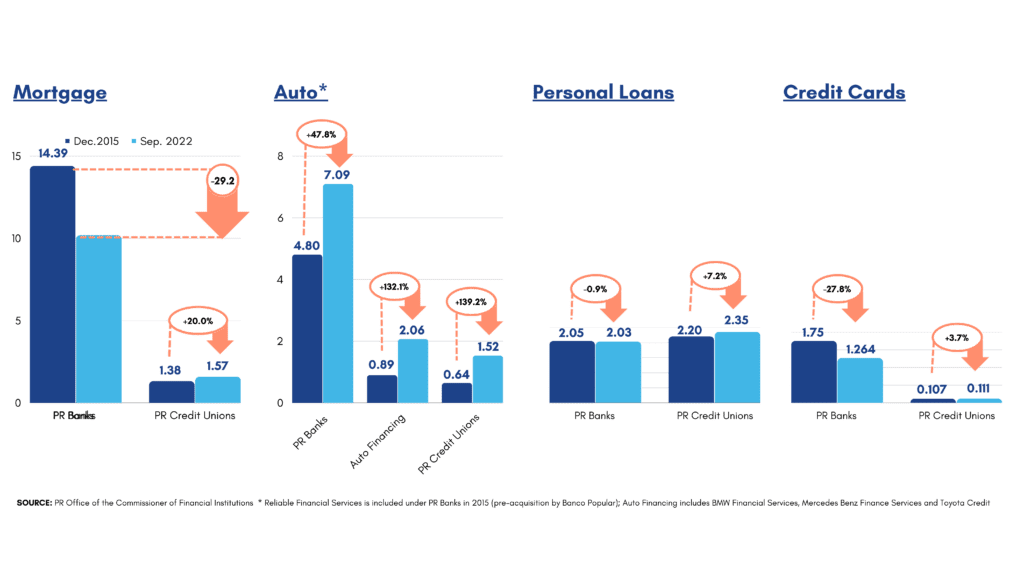

Local credit unions grew all their core loan portfolios between December 2015 and September 2022 (see figure 4). Their mortgage loan balances increased by 20%, compared to a reduction of 29% in the Puerto Rico banking system.

The auto lending activity experienced a significant increase in the past years. The auto financing institutions (e.g., BMW Financial Services, Mercedes Benz Finance Services, and Toyota Credit) and local credit unions achieved the largest increases, more than doubling their auto loan balances between 2015 and 2022. Regarding the personal loans portfolio, where credit unions hold a dominant position, they were able to further increase their share since 2015. Finally, Puerto Rico credit unions modestly grew their credit card portfolio despite the increasing competition from US banks.

Figure 4: Individual Loan Portfolios 2015-2022 (USB$)

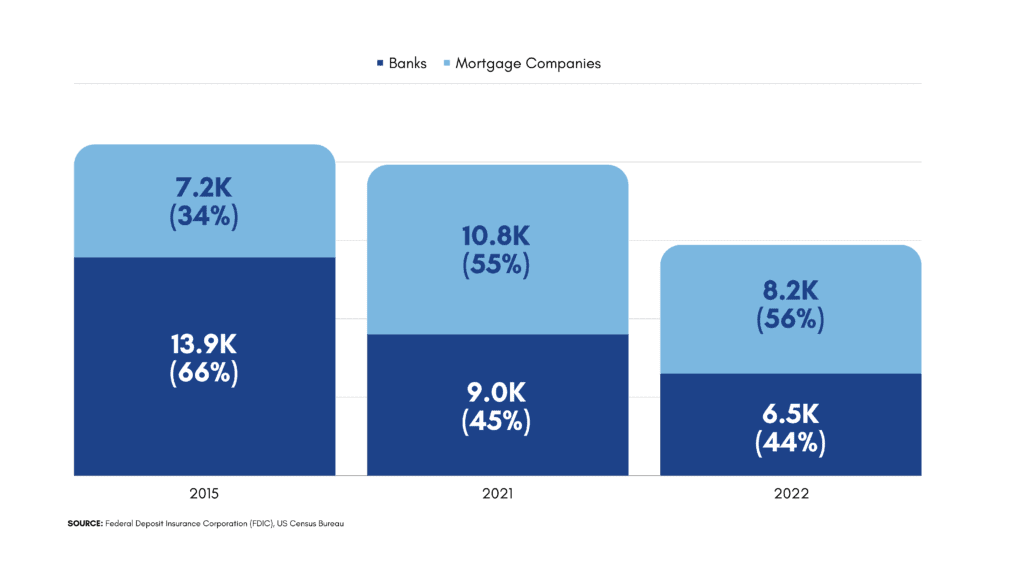

Figure 5: Distribution of Mortgage Loan Originations between Mortgage Companies and Banks

In summary, the three remaining banks in Puerto Rico continue to be the main suppliers of banking services in Puerto Rico. And they have been operating with very healthy profitability levels in the past years. However, there are geographies and customer segments where other players can provide a closer, more personalized service. Some of these players, like the local credit unions, have taken advantage of their close relationship with their members, their preferential tax treatment, and the fact that they are less regulated than banks, particularly at the federal level.

Additionally, banks face the progressive elimination of one of the biggest entry barriers of the sector, the brick-and-mortar branch infrastructure. As more and more customers rely on digital channels to perform their banking operations, new and existing digital banks will look into Puerto Rico to offer their products and services. So far, there are at least two potential new players that intend to enter the local market through digital banking solutions, Dinio and Nave Bank. And others may come.

Disclaimer

Accuracy and Currency of Information: Information throughout this “Insight” is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.

ONLY ENGLISH VERSION

Elvis Torres Delgado

Elvis Torres Delgado Xavier Diví

Xavier Diví