The deep economic effects of Covid-19 are reflected in the unprecedented rise of unemployment claims around the world. In Puerto Rico, cumulative unemployment claims in the five weeks following the lockdown reached 200,419, three times the total claims during 2019. This number is in line with the US when measured in relation to the labor force. Covid-19 is also impacting the large informal economy of the Island, which is not eligible for unemployment insurance. On the other side, Puerto Rico may be seen as a safe place to do business given the successful containment of the virus so far, and as an ideal location from where to work remotely in the future.

The deep economic effects of Covid-19 are reflected in the unprecedented rise of unemployment claims around the world. In Puerto Rico, cumulative unemployment claims in the five weeks following the lockdown reached 200,419, three times the total claims during 2019. This number is in line with the US when measured in relation to the labor force. Covid-19 is also impacting the large informal economy of the Island, which is not eligible for unemployment insurance. On the other side, Puerto Rico may be seen as a safe place to do business given the successful containment of the virus so far, and as an ideal location from where to work remotely in the future.To mitigate the spread of the coronavirus, the governor of Puerto Rico issued executive order EO 2020-023, establishing a nightly curfew and a strict lockdown of non-essential businesses starting on March 15, 2020 at 6:00pm. These social distancing measures and closures, also known as nonpharmaceutical interventions (NPIs), have been extended until May 3. As to be expected, this has had a dramatic impact on labor market indicators in Puerto Rico, particularly unemployment claims. Google’ COVID-19 Mobility Report of Puerto Rico shows how travel to workplaces has decreased significantly since the lockdown is in effect (see V2A Covid-19 Mobility Dashboard: https://www.v2aconsulting.com/news-detail/128-165-mobility).

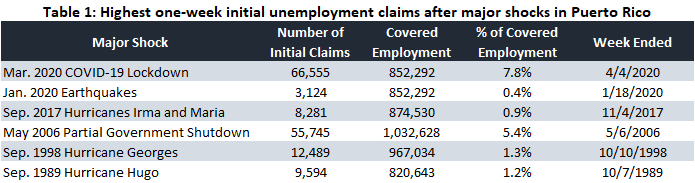

Highest one-week unemployment claims in history: 66,555 in week ending April 4, 2020

In the week ending April 4, 66,555 new unemployment claims were filed (7.8% of covered employment1 vs. 3.9% in the U.S.), marking the highest level of claims in one-week in the history of the data series, which began in January 1987 (see Table below). The previous high occurred in the week ending on May 6, 2006 (55,745; 5.4% of covered employment) following Puerto Rico’ partial public-sector shutdown. In the wake of Hurricanes Irma and Maria of September 2017, initial unemployment claims peaked at 8,281 (0.9% of covered employment).

Although the Bureau of Labor Statistics does not provide unemployment claims by sector, Estudios Técnicos, Inc. (ETI) estimated that construction, tourism and retail were the main sectors driving the unemployment claims increase2.

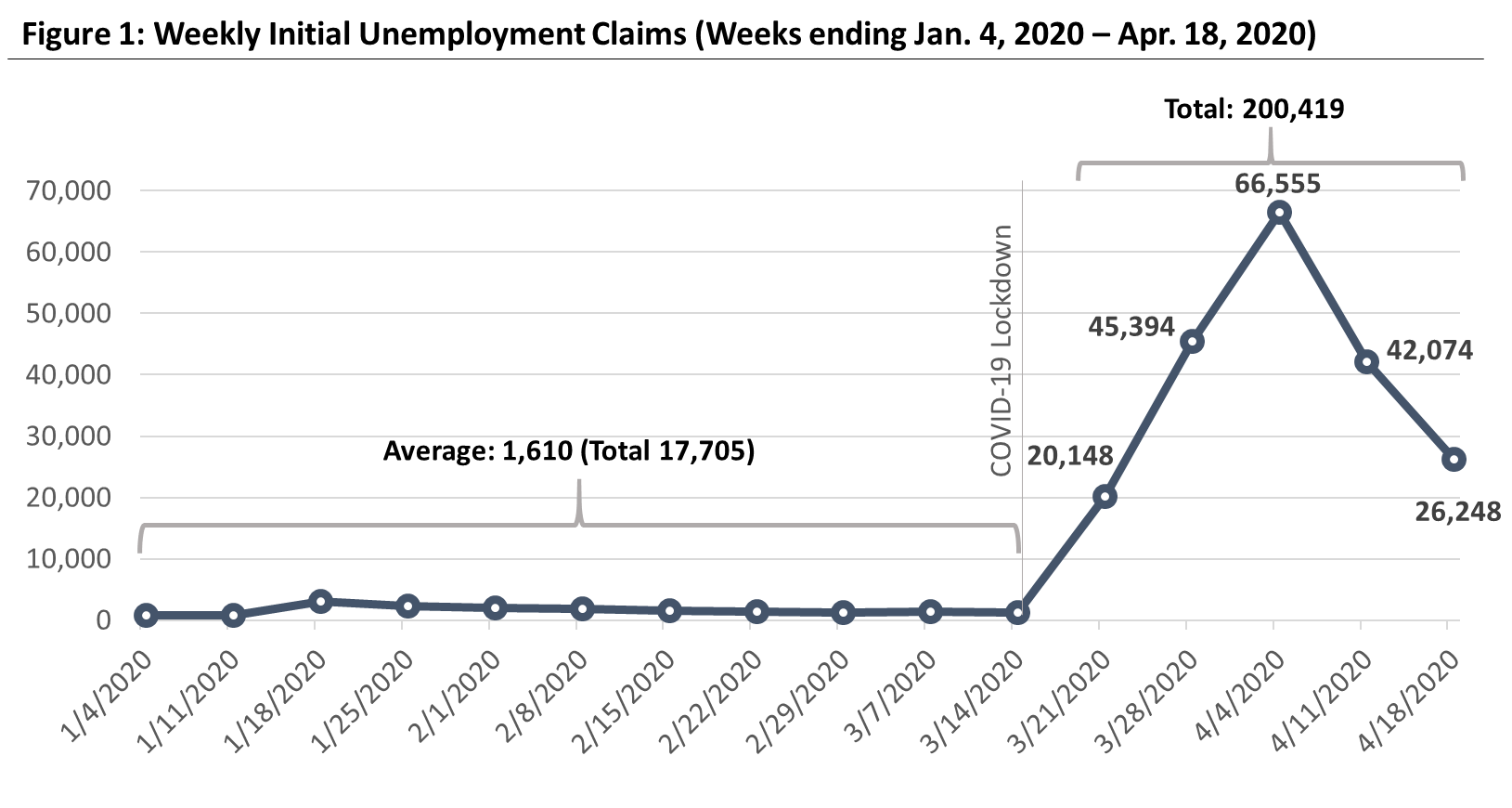

Cumulative Initial Unemployment Claims in the five weeks following COVID-19 Lockdown reached 200,419, representing 19% of the labor force

When combining the five weeks following the lockdown (from March 16 to April 18), cumulative unemployment claims amounted to 200,419 (see Figure below). This represents approximately 19% of Puerto Rico’ civilian labor force3. To put this number in perspective, cumulative unemployment claims in 2019 (52 weeks) reached 66,514. In other words, in the five weeks following the establishment of the coronavirus social distancing measures, unemployment claims reached three times (300%) the number of unemployment claims filed during the entirety of 2019.

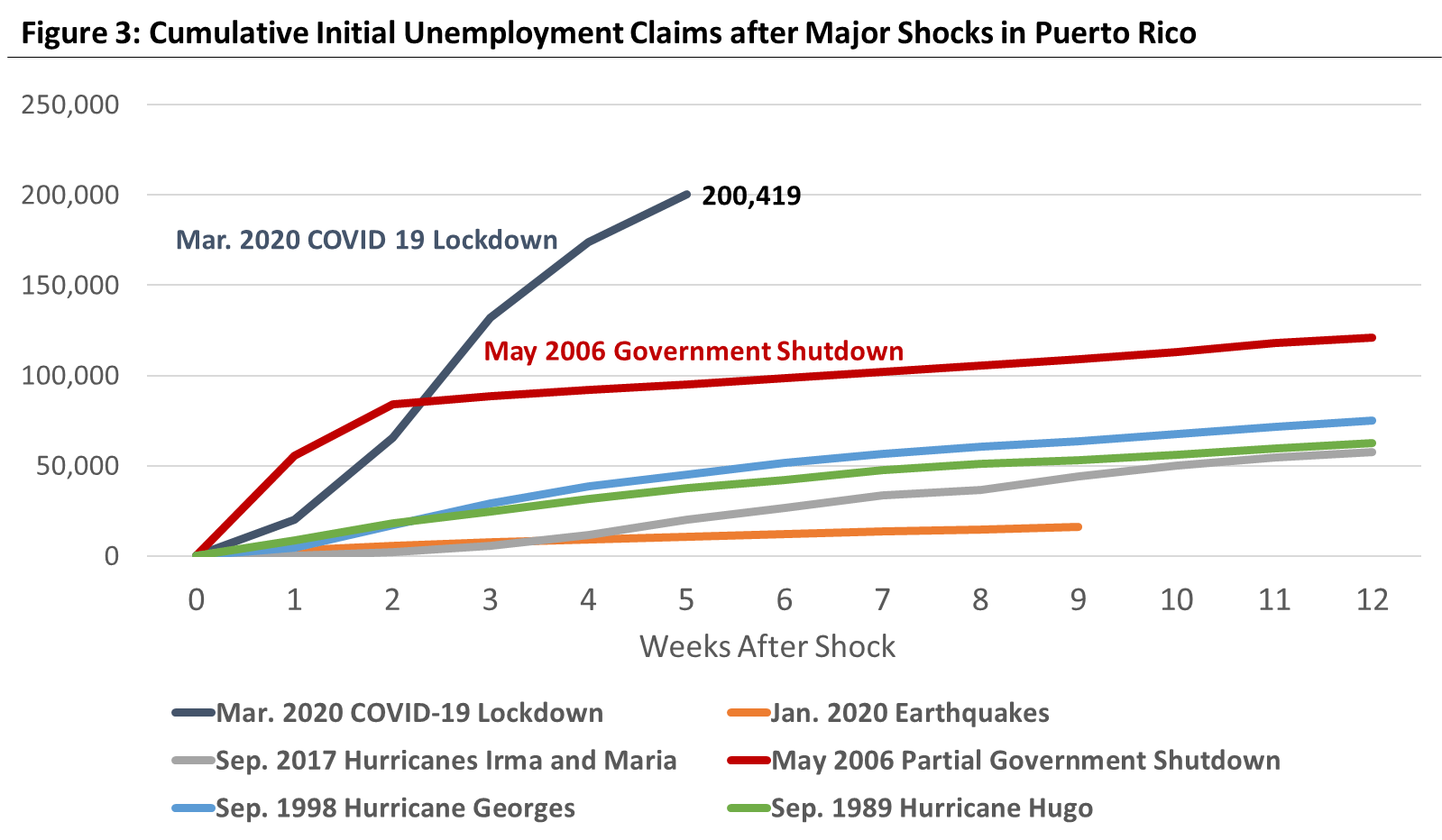

To compare the level of unemployment claims in Puerto Rico following the COVID-19 lockdown and other major events which disrupted economic activity and employment numbers, Figure 3 graphs cumulative initial unemployment claims following a selection of key events. It is clear from this figure that the spike in unemployment claims is unprecedented. The partial government shutdown of May 2006, Puerto Rico’ first, also caused unemployment claims to rise steeply but is still greatly surpassed by what is occurring in the COVID-19 context4. The ~200k cumulative unemployment claims during the Covid-19 period represent 29% of the private employment as of February 2020. While this is a very large number, it is encouraging to see that, under these terrible circumstances, the private sector is still being able to retain ~70% of its workforce.

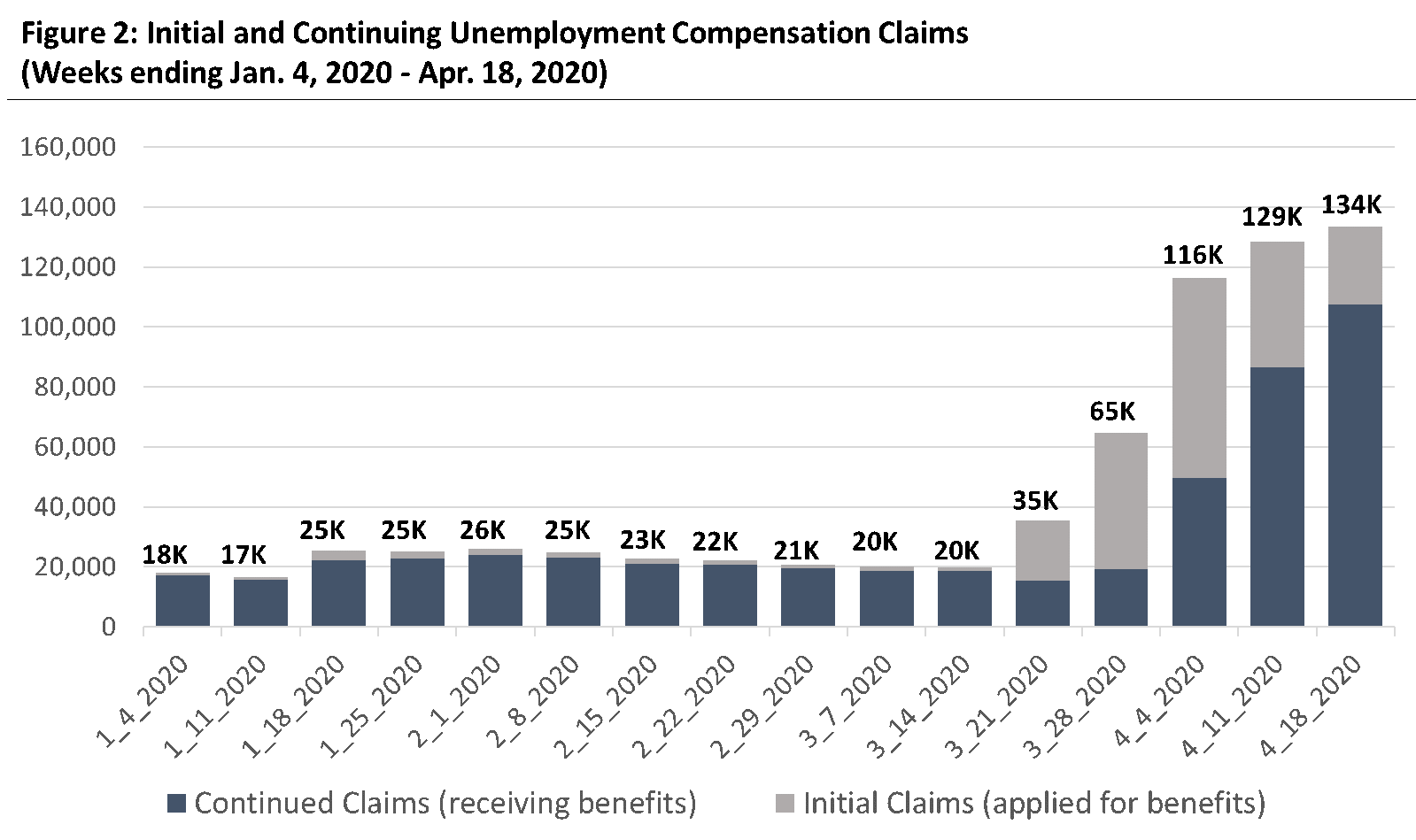

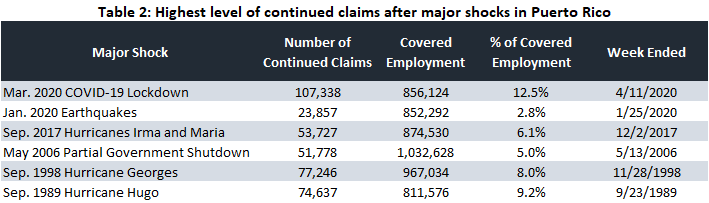

Continued Claims and Insured Unemployment Rate also reached historic highs: 107,338 continued claims; 12.5% insured unemployment rate

While initial claims measures the number of people filing for unemployment for the first time (emerging unemployment), continued claims measures the number of people actually receiving unemployment benefits. For the week ending April 11 (last available data point), there were 107,338 continued claims, for an insured unemployment rate of 12.5% (continued claims as a percent of jobs that are eligible for unemployment benefits). This is the highest figure in the history of the data series (see Table 2).

US National Trends and Comparison to States

Labor markets across the United States have also been hit hard since mid-March when the lockdowns came into effect, with some states suffering more than others.

At the national level, approximately 26.5 million people5 have filed for unemployment benefits in the five weeks following strict measures to curb the coronavirus. Since the Great Recession of 2007-2009, 21.5 million jobs have been added to the US job market. In other words, the job gains that took a decade to occur were eliminated over a five-week span6.

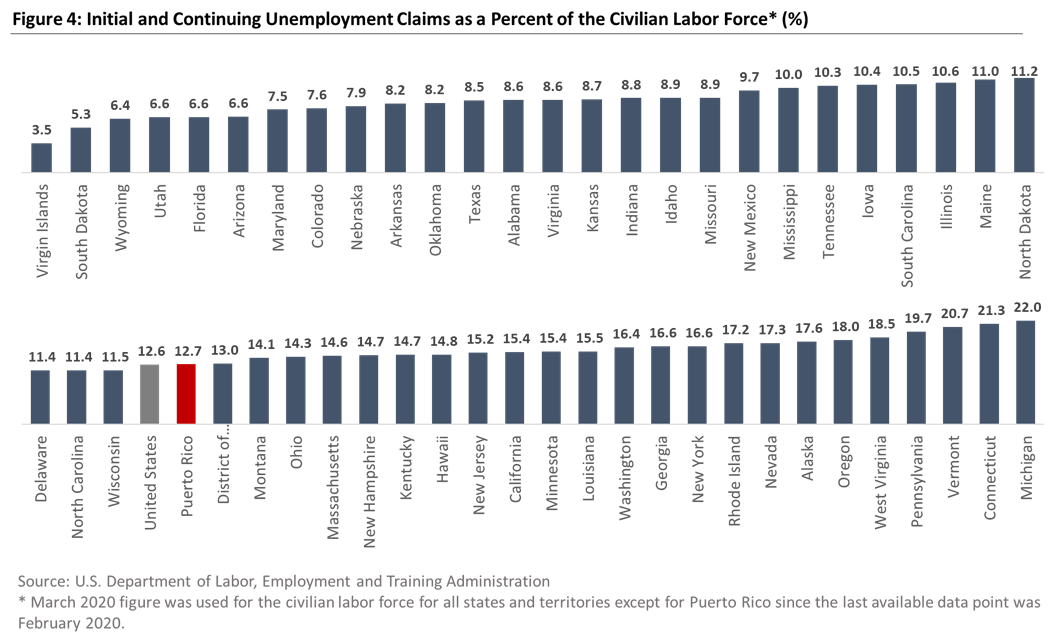

When analyzing the unemployment claims levels by state, it is clear that the severity of the problem varies widely from state to state. Initial unemployment claims (those applying for benefits) and continuing unemployment claims (those receiving benefits) as a percentage of the civilian labor force for the U.S. (including Puerto Rico, D.C., and USVI) was 12.6% for the week ending on April 18. This metric fluctuated from a high of 22% for Michigan to a low of 3.5% for the USVI, and for 16 states it exceeded 15%. Puerto Rico registered a ratio of 12.7%, very close to the US level. Florida, which has relatively more lax lockdown measures, has one of the lowest ratios at 6.6%.

In the case of Puerto Rico, it should be noted that there is a large informal economy that is not reflected in the official labor statistics. This partly explains why Puerto Rico’ labor force participation rate stood at 39.5% in January 2020 (not seasonally adjusted) vs. 63.4% in the U.S. (seasonally adjusted). The informal economy has been estimated to be about 28% of the island’ Gross National Product (GNP)7. It is likely that a significant portion of the informal workforce is unable to work but is ineligible to receive unemployment benefits. The lack of a safety net in the form of unemployment benefits for the local informal economy makes the COVID-19 crisis more difficult to overcome for Puerto Rico.

«Every cloud has a silver lining.»

While the economic effects of COVID-19 will be very painful for many individuals and families, it is safe to say that Puerto Rico’ strict lockdown measures have effectively contained the spread of the coronavirus. By acting early and decisively, containment measures have kept contagion numbers and deaths at lower levels than in places with more lax social distancing measures.

This will be favorable for Puerto Rico as the economy gradually opens back up since it will likely be perceived as a relatively safer location and will be associated with lower probabilities of contagion. This is particularly important for the tourism sector which has been decimated by this pandemic. Furthermore, it is likely that in the post-COVID 19 workplace, remote working will be more commonplace. Living and working from Puerto Rico is a more enticing choice than many other uninspiring locations.

Notes

1 Covered employment: everyone eligible to receive unemployment benefits

2 https://www.elnuevodia.com/negocios/economia/nota/sintasadedesempleoparapuertoricodebidoalacuarentena-2562282/

3 February 2020 civilian labor force data point is used since the March 2020 figure is still not available

4https://www.nytimes.com/2006/05/02/us/02puerto.html

5 Seasonally adjusted

6 https://www.politico.com/news/2020/04/16/coronavirus-unemployment-claims-numbers-190026

7 https://knowledge.wharton.upenn.edu/article/puerto-ricos-debt-crisis-why-theres-no-quick-fix/

Sources

US Department of Labor, Employment and Training Administration

Bureau of Labor Statistics

Disclaimer

Accuracy and Currency of Information: Information throughout this «Insight» is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.