The available indicators related to the Puerto Rico economy show mixed signs for the short and medium terms. There seems to be an economic deceleration despite still robust business activity in certain sectors. In this insight we evaluate the most recent economic indicators’ trends and detail the sectors driving the recent private employment increases in Puerto Rico.

The available indicators related to the Puerto Rico economy show mixed signs for the short and medium terms. There seems to be an economic deceleration despite still robust business activity in certain sectors. In this insight we evaluate the most recent economic indicators’ trends and detail the sectors driving the recent private employment increases in Puerto Rico.The Puerto Rico economy rebounded from the effects of Hurricane María quite quickly. Several factors contributed to that: i) The immediate recovery efforts and emergency funds deployed, ii) A better financial position of local firms and individuals after a very long period of belt-tightening and deleveraging, and iii) A solid performance of the U.S. economy and an environment of still-low interest rates.

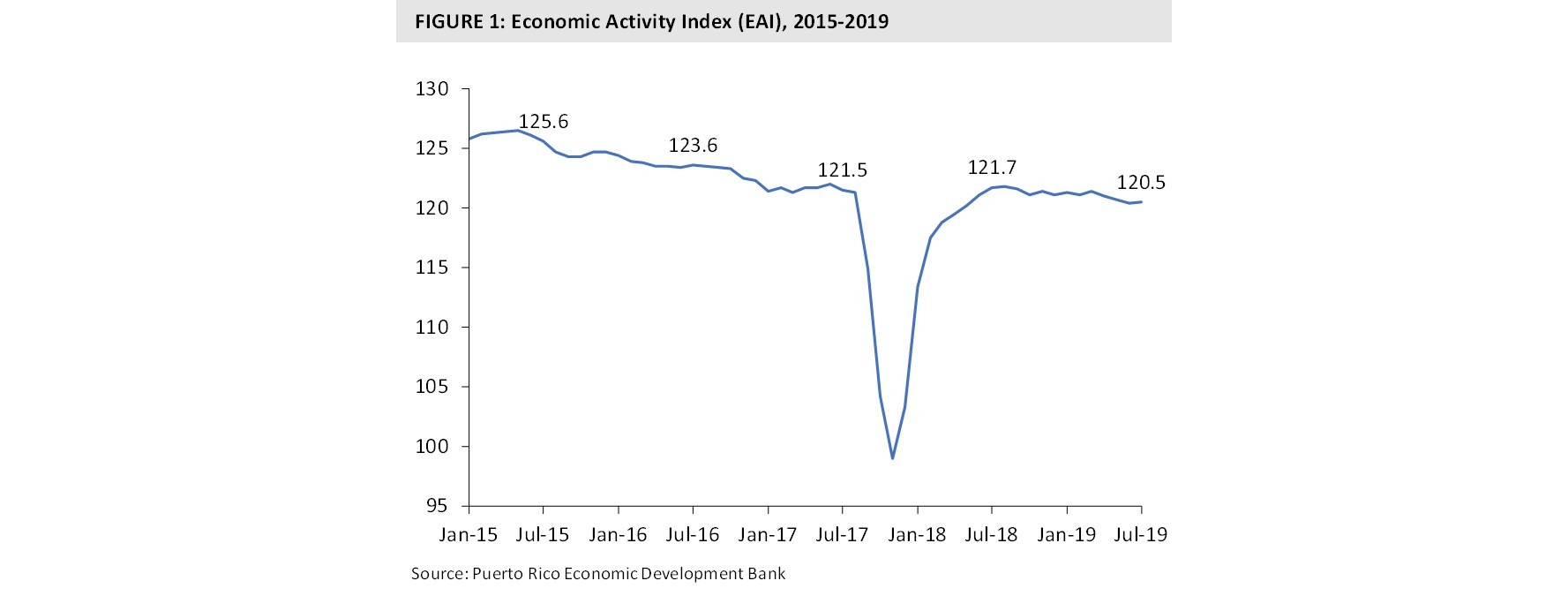

That short-term jump was soon accompanied by a flow of insurance funds, a welcomed optimism driven by the promise of ~$82 billion in disaster relief funding, and a consequent renewed appetite to spend by local families (in part driven by the need to replace goods damaged by Hurricane María). This is clearly reflected by the Economic Activity Index (EAI), which reached 121.7 in July 2018 and remained in line with pre-hurricane levels in the second half of 2018 (see Figure 1). In 2019, the local economy seems to be losing some steam but is still showing solid performance in some areas.

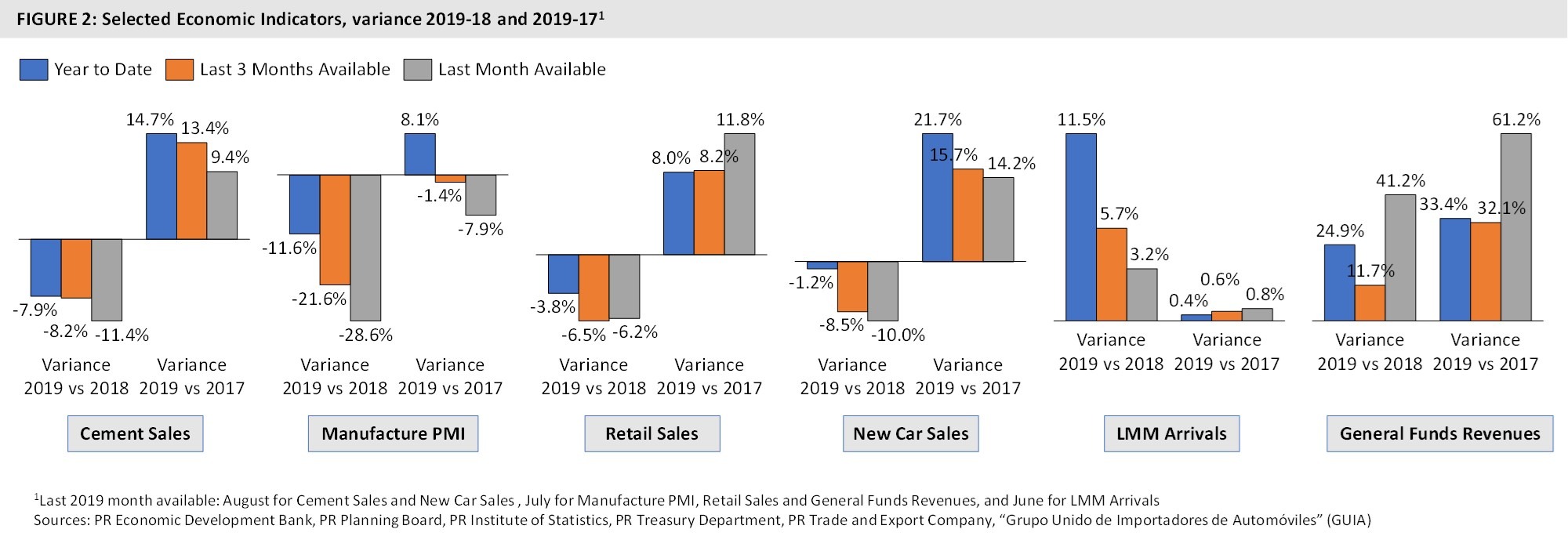

As can be observed in Figure 2, the construction sector still shows greater activity compared with 2017, with cement sales rising by 14.7 percent in the January to August 2019 period compared with the same period in 2017. However, growth rates have reduced in recent months (13.4 percent for the June to August period and 9.4 percent for August), and the drop against 2018 increases every month. Similarly, the Purchasing Managers’ Index, which tracks manufacturing activity, has shown continued deterioration against 2018 and 2017.

Families continue to spend at a much faster pace than in 2017 (8 percent growth in retail sales for the January to July period, 8.2 percent for the May to July period, and 11.8 percent for July). Something similar can be observed regarding new car sales trends. Both retail and car sales indicators are down against 2018 levels, but that was expected considering the «artificial" jump in spending after Hurricane María, which was driven by a need to replace goods and insurance claim payments.

The tourism sector continues to show very solid performance despite the catastrophic effects of Hurricane María on the lodging sector, which are still felt today. Luis Muñoz Marín International Airport arrivals are above 2017 pre-hurricane levels and significantly above 2018. As we mentioned in a previous V2A Insight, the tourism sector’ dynamism has been driven by two main factors: i) Growing cruise ship activity (cruise ship passenger numbers in the first seven months of 2019 were 18.7 percent above 2017 levels), and ii) An expansion of the short-term rental activity with the total number of room nights booked1 jumping from ~17,000 in 2015 to ~149,000 in 2018. (Visit go.cb.pr/V2Alodging)

Finally, we need to mention the dramatic increase in General Fund revenues reported by the Puerto Rico Treasury Department (25 percent above 2018 and 33 percent above 2017 in the first seven months of the year). The increase is driven by income tax receipts from individuals but, especially, by income tax receipts from corporations. Aside from successful collection and tax evasion efforts by the local authorities and some large business transactions, this increase also shows an important dynamism of the business sector.

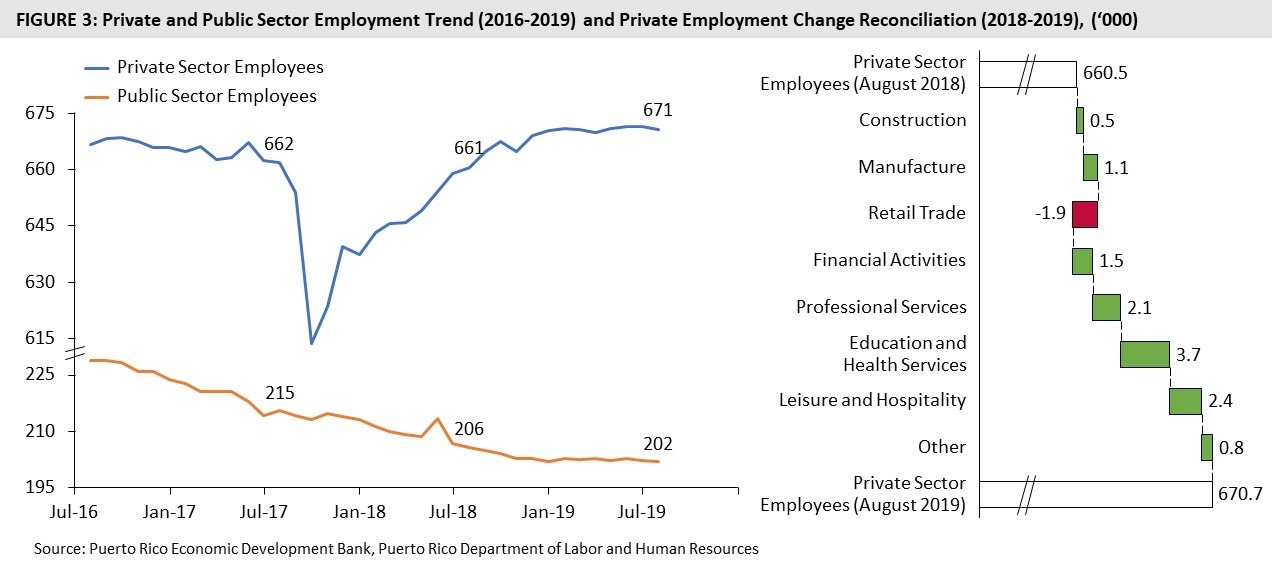

That dynamism is backed by the private employment figures, which show a steady increase since Hurricane María, reaching approximately 671,000 employees in August 2019 (see Figure 3, excludes self-employed). That private sector increase has coincided with a significant reduction in public sector employment, driven by the implemented austerity measures. When we look at the approximately 10,200 more private sector employees between August 2018 and August 2019, we see how the increase has been shared across several economic sectors (see Figure 3). The Education and Health Services, Leisure and Hospitality, and Professional Services sectors have shown the largest employment increases with 3,700, 2,400 and 2,100 more employees, respectively.

In summary, the available economic indicators show mixed signs for the short and medium terms. There seems to be a clear economic deceleration despite still robust business activity, particularly in certain sectors. Looking at the long-term economic potential, needed structural reforms are far from being implemented. For a developed economy in an innovation-driven stage like Puerto Rico’ (as per the World Economic Forum), there are two critical factors to compete in the global economy: i) Human capital with critical thinking and ability to create (i.e. education, particularly pre-school and primary), and ii) A favorable business environment (i.e. infrastructure and ease of doing business). Regarding infrastructure, Puerto Rico has an excellent opportunity to leverage the promised recovery funds whenever they arrive. Regarding education, public discussion should continue to revolve around the best alternative education models for a reduced number of children who will live in a very different business environment than today’, as opposed to a pure exercise of reducing costs.

Notes

1Room nights booked in short term rental properties are calculated multiplying the number of bookings and the number of rooms by property

Sources

Puerto Rico Economic Development Bank, Puerto Rico Planning Board, Puerto Rico Institute of Statistics, Puerto Rico Treasury Department, Puerto Rico Trade and Export Company, «Grupo Unido de Importadores de Automóviles" (GUIA), World Economic Forum (WEF Global Competitiveness Report 2014-15), V2A Economic Indicators Database

Disclaimer

Accuracy and Currency of Information: Information throughout this «Insight» is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.