On October 21st the bank holding company of FirstBank Puerto Rico, announced the acquisition of Banco Santander Puerto Rico (BSPR) for a $63M premium to BSPR’ core tangible common equity ($362M) in an all cash transaction. In this insight we will analyze the new market shares in the Puerto Rico banking sector after this acquisition and the recently announced purchase of Scotiabank operations by Oriental Bank.

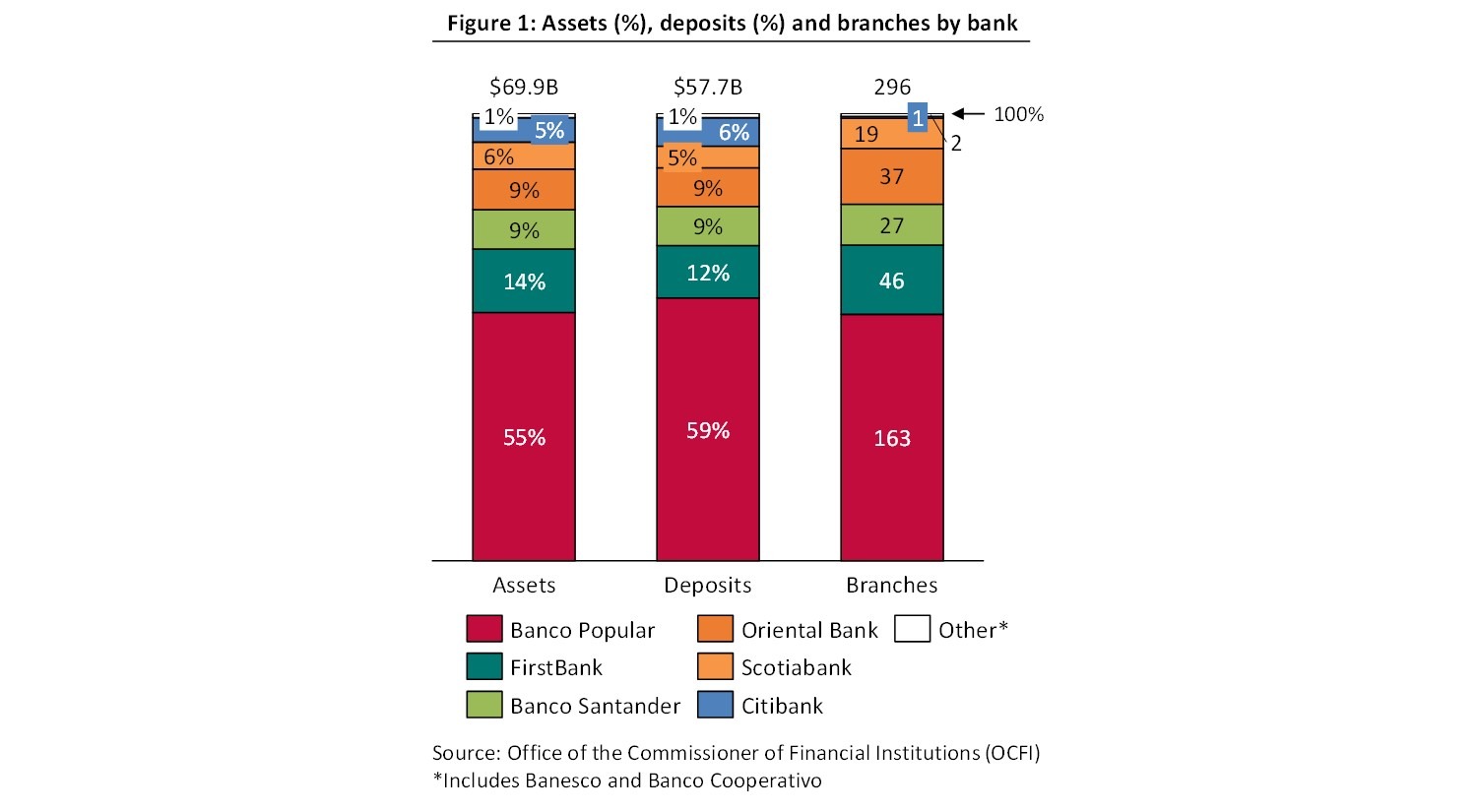

On October 21st the bank holding company of FirstBank Puerto Rico, announced the acquisition of Banco Santander Puerto Rico (BSPR) for a $63M premium to BSPR’ core tangible common equity ($362M) in an all cash transaction. In this insight we will analyze the new market shares in the Puerto Rico banking sector after this acquisition and the recently announced purchase of Scotiabank operations by Oriental Bank.The Puerto Rico banking sector has experienced a drastic consolidation process in the past ten years. Scotiabank and BSPR will be joining another five banks which operations have been absorbed by other banking entities during that period. As we have done after previous acquisitions, we are going to present how banking assets, deposits and credit portfolios will be distributed among the players still operating in the local market. Figure 1 shows assets and deposits market shares among Puerto Rico private commercial banks.

As can be observed, FirstBank will regain its second position in total assets after the acquisition of BSPR with a market share close to 23%. In terms of Deposits, FirstBank’ share could increase to 21% assuming all BSPR deposits are retained by FirstBank. With this acquisition FirstBank also strengthens its footprint in the metro area, where 16 of the 27 BSPR branches are located. Additionally, it gains a sizeable 13% deposits market share in the south region by bringing the two important BSPR branches in Ponce which together accumulate $339M deposits compared to the $211M of the two FirstBank branches in that municipality1.

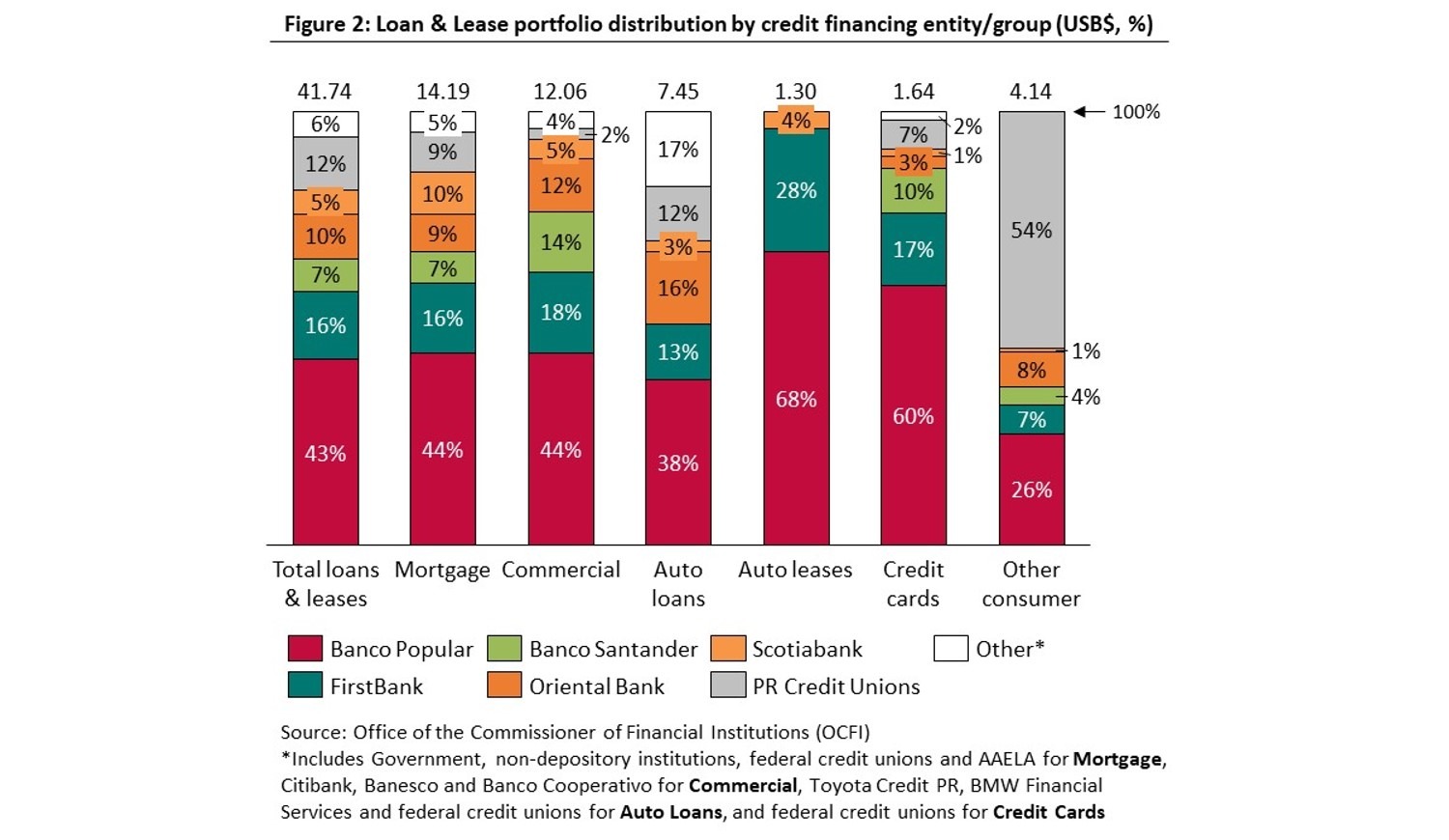

Figure 2 shows the distribution of the various credit financing businesses among market players in Puerto Rico. As can be observed, local credit unions and other players have a non-negligible participation, particularly in the Auto Loans and Other Consumer Loans (mainly personal loans) segments. Their participation is welcomed, as they provide competition to the banking sector, whose consolidation is raising concerns to retail and commercial customers because they will have less options to choose from and because oligopolistic dynamics are more likely to take place.

The acquisition of BSPR provides FirstBank with a very strong commercial lending portfolio particularly in the small business and investment banking segments, and, to a lower extent, a sizeable credit cards business. FirstBank’ market share could increase from 18% to 32% in the commercial lending business and from 17% to 27% in the credit cards business2. Regarding the credit cards business, FirstBank will also be able to leverage BSPR’ relationship with American Express which brings a unique set of credit card products targeted to the affluent consumer. American Express also brings its strong merchant relations from its acquiring business, which FirstBank should leverage to offer distinctive offers to its credit card base.

BSPR’ personal loan portfolio is also an important addition for FirstBank. The personal loan business is the only one where Banco Popular has a market share below 30%. With the local credit unions share of 54%, the personal loans business represents one of the few opportunities for inorganic growth for the local banks. The Auto Loan business is another competed segment in Puerto Rico even after Popular’ acquisition of Reliable, since not only local credit unions but also federal credit unions and company financing divisions like Toyota Credit and BMW Financial Services provide financing at competitive prices. These players accumulate 29% of the auto loan business (see Figure 2).

The commercial credit business is probably the sector most impacted by the consolidation process. The share of local credit unions in this sector is small and Citibank customers are mostly concentrated in the large company segment. For the small and medium sectors, the banking consolidation process is translating into an important reduction in the available choices to apply for credit. Finally, it is curious how just two players (Banco Popular and FirstBank) dominate the auto lease financing in Puerto Rico, considering the high profitability of this business in the Island.

Notes

1 As of June 2019

2 These credit card balances and shares exclude balances from credit cards issued in the US (e.g. American Express proprietary credit cards like the Green, Gold, Platinum and Black cards)

Sources

Office of the Commissioner of Financial Institutions (OCFI), Federal Deposit Insurance Corporation (FDIC)

Disclaimer

Accuracy and Currency of Information: Information throughout this «Insight» is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.