On August 16th, the Federal Housing Administration (FHA) announced a 30-day foreclosure moratorium extension for certain FHA-insured mortgages secured by properties located in Presidentially-Declared Major Disaster Areas (PDMDAs) in Puerto Rico and the U.S. Virgin Islands. This extension expired on September 16th and, as the announcement indicates, »FHA does not intend to further extend the foreclosure moratoriums after this date».

On August 16th, the Federal Housing Administration (FHA) announced a 30-day foreclosure moratorium extension for certain FHA-insured mortgages secured by properties located in Presidentially-Declared Major Disaster Areas (PDMDAs) in Puerto Rico and the U.S. Virgin Islands. This extension expired on September 16th and, as the announcement indicates, »FHA does not intend to further extend the foreclosure moratoriums after this date».

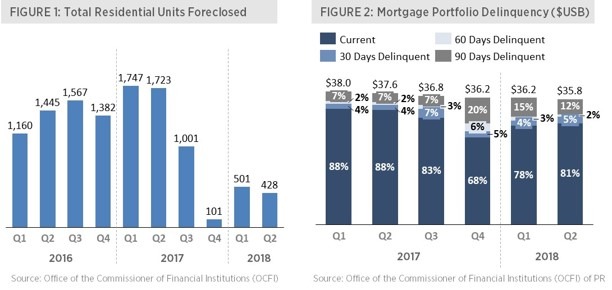

This yearlong moratorium is having consequences on the banking and real estate sectors of Puerto Rico. As can be observed in Figure 1, foreclosures reduced dramatically in Puerto Rico from 1,747 and 1,723 in Q1 2017 and Q2 2017, to 1,001 in Q3 2017 and only 101 in Q4 2017. Foreclosures increased in the first half of 2018 but remained at a much lower level than before Hurricane Maria (501 in Q1 2018 and 428 in Q2 2018). The reduction in the number of foreclosures is also reflected in an increase in the 90+ days delinquent portfolio of the local banking sector. This portfolio represented only 7% of the mortgage portfolio in Q3 2017, but increased to 20% after the hurricane and, while decreasing in the following two quarters, remained above pre hurricane levels (12% in Q2 2018, see Figure 2).

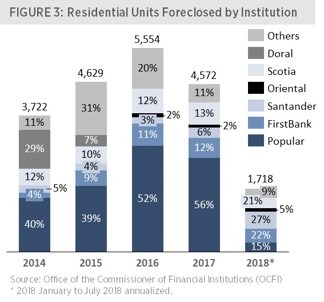

The reduction in the number of foreclosures is particularly large for Banco Popular because it is the main servicer of FHA-insured mortgage loans (from 56% of total foreclosures in 2017 to 15% in the first seven months of 2018, see Figure 3). On the opposite side, banks like Santander seemed to increase their foreclosure efforts after Hurricane María, with 273 foreclosures in the first months of 2018 compared to 289 for the full year 2017.

We estimate that if no foreclosure moratorium had been approved, a minimum of 4,300 additional properties would have been foreclosed in the September 2017 to June 2018 period. In other words, there is currently a large backlog of properties waiting to be added to the REO inventory of banks and Government-Sponsored Enterprises (GSEs) once the moratorium expires. When this happens, the supply of available for sale properties will increase, which will impact the real estate market and put downward pressure on real estate prices. It is difficult to estimate the magnitude of the impact because we do not have an accurate estimate of the current supply of residential properties for sale in Puerto Rico. However, considering that the total number of mortgage loan originations in 2017 was 13,732 (including refinancing), even a portion of the potential 4,300 additional foreclosed properties would have an impact on the real estate market.

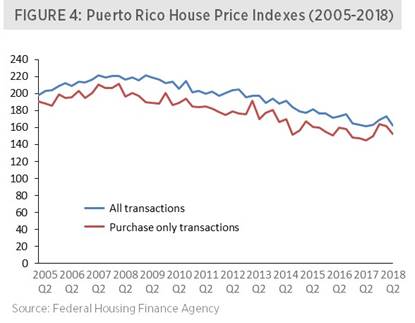

The Federal Housing Finance Agency (FHFA) prepares two House Price Indexes for Puerto Rico, one for purchases and refinancing transactions and the other one for purchase transactions only. As we can see in Figure 4, both indexes have been on a downward trend since the beginning of 2008 until Q2 2017. After Q2 2017, the index has somewhat stabilized. The economic impact of federal recovery funds and insurance payments may help the real estate market to recover and push prices up again, but we should not undermine the impact of the expected increase in foreclosed properties on future housing prices.

The backlog of non-foreclosed residential properties poses also other questions aside from the impact on real estate prices. For example, how are banks and GSEs going to deal with home owners that have benefitted from this moratorium? Are they going to implement foreclosure efforts right away after the moratorium expiration? What will be the impact for banks that have provided foreclosure relief to their own mortgage loan portfolio in terms of delinquency levels and ultimately charge offs? Have servicing costs increased as a consequence of the moratorium and, more importantly, have GSEs compensated their servicers for that? Are banks and GSEs prepared for a sudden increase of their REO inventory? If not, are they prepared to cope with the continuous devaluation of properties as they remain unsold? Are realtors expecting the increase in foreclosed properties inventories? How are they going to manage it given the soft mortgage origination market?

Some of these questions will be answered in the coming months. But one thing is certain, sooner or later the number of foreclosed properties in Puerto Rico will increase again.

Sources

Office of the Commissioner of Financial Institutions (OCFI) of Puerto Rico, Federal Housing Finance Agency (FHFA), analysis by «Financial Institutions Practice» V2A.

Disclaimer

Accuracy and Currency of Information: Information throughout this «Insight» is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.