The economic downturn, coupled with, among other factors, the overdevelopment of mid- to high-end properties, has led to a sustained decline in local residential real estate prices that continues to be a matter of major concern for Puerto Rico»s leading financial institutions.’, ‘The economic downturn, coupled with, among other factors, the overdevelopment of mid- to high-end properties, has led to a sustained decline in local residential real estate prices that continues to be a matter of major concern for Puerto Rico»s leading financial institutions.

To demonstrate capital sufficiency in light of new adequacy requirements such as Basel II»s ICAAP, financial institutions in Puerto Rico and throughout the US have had to scramble to implement portfolio stress-tests and advanced home price forecasting models. Broadly speaking, the objective of these efforts is to determine whether the lender has sufficient collateral sources to offset expected losses, and to arrive at an estimate of the bank»s capital requirements in a “worst case” scenario.

However, for Puerto Rico-based mortgage lenders and other similarly-exposed financial institutions, this has proven to be a particularly challenging exercise. US/mainland lenders have a multitude of credible and highly-detailed home price indices with which to develop their analyses, but there are no such sources for Puerto Rico»s residential real estate market. Consequently, there is arguably much room to improve the local industry»s current and forward-looking collateral valuations and resulting capital requirement estimates.

To this end, V2A developed a home price index for more than 50 segments (1) to understand the evolution of historical real estate prices in Puerto Rico and to help our clients develop more fact-based capital adequacy forecasts. We believe this index can help local lenders improve their ability to monitor portfolio risk, set capital reserves, perform collateral due diligence, perform appraisal quality control, and improve collections / loss mitigation practices.

While the index itself will soon be made available to our network of friends and clients, a key excerpt from our analyses helps illustrate how lenders could potentially benefit from more granular capital and reserve forecasting.

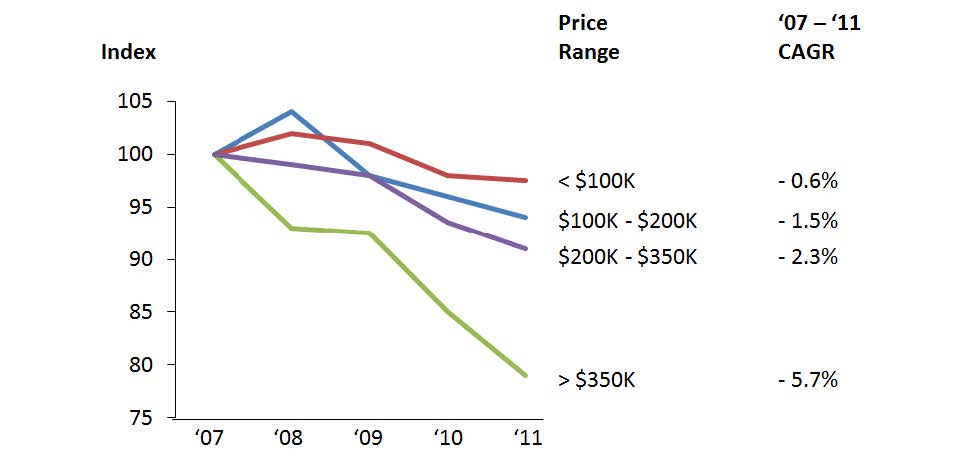

As is commonly known, overall property values for single-family detached homes have declined in recent years, with higher-end home values declining over 5% more than homes in the sub-$100K segment (see Figure A).

Figure A: Evolution of price per square foot for detached single-family homes since 2007 by price range (Index Base 2007=100)

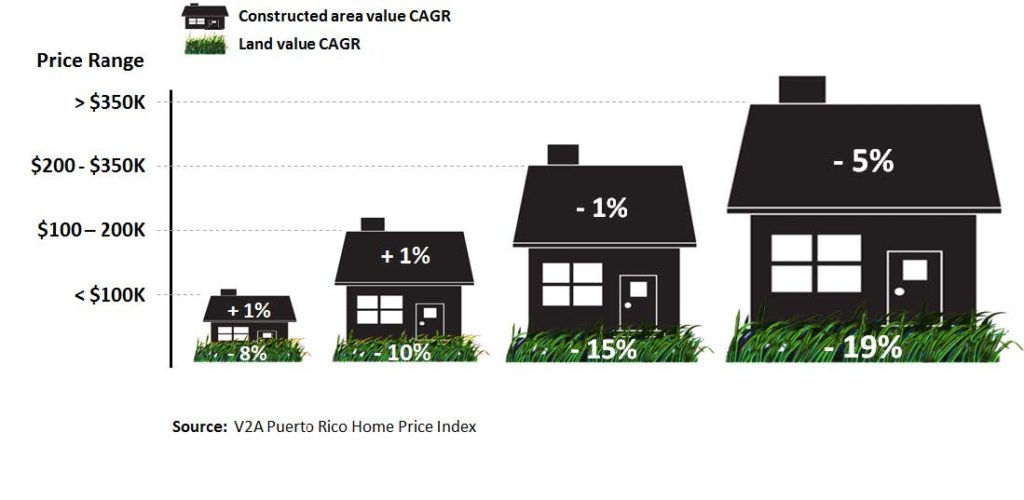

However, a closer look at the data reveals that land values have declined far more than constructed area values. Interestingly, this variance is more pronounced within the lower-end segments, where constructed area values have actually held fast and, in some cases, risen since 2007 (see Figure B).

Figure B: 2007 – 2010 CAGRs of constructed area and land values for detached single-family homes in Puerto Rico, by price segment

An aggregate-level home price index would, at best, allow a lender to develop a baseline forecast, which would then require manual and judgmental adjustments to incorporate assumed variances by segment. Conversely, a more granular fact base such as V2A’s proprietary home price index could enable segment-specific capital and reserve forecasting and, thus, segment-specific optimization strategies.

Based on the examples above, lenders with substantial single-family detached home guarantees might do well to factor in the remarkable stability of constructed area values to avoid over-estimating their capital reserve requirements. Conversely, using the relatively stable growth rate of -0.6% to forecast land values in the <$100K segment could lead a lender to underestimate their capital reserve needs, given that land values in that segment have in fact declined at a far more severe rate.

Valuing collateral accurately also enables more robust credit risk management practices. As collateral value is used in the estimation of Loss Given Default (LGD), inaccurate valuation scenarios could lead to larger-than-expected loan losses on default, which in turn would have a significant impact on the bank’s equity capital. In contrast, a more accurate valuation process could mean that a lender could reduce its LGD estimates for specific segments and, subsequently, reduce the risk margin it sets in its pricing. On a large-enough scale, a 100 basis point improvement in forecast accuracy could represent millions in additional ready-to-deploy capital.

In a market with intensifying competition for quality credits, such flexibility could potentially create a distinct competitive advantage.