First Thoughts

In the aftermath of a catastrophic natural disaster like the one experienced in Puerto Rico during September 2017, an acute sense of uncertainty often takes hold of the affected people and organizations. Households, business firms, nonprofit entities, and the public sector need timely, objective, accurate and reliable information and insights to better inform their strategic planning and other decision-making processes. This special V2A issue, the first of a series of issues, seeks to narrow this information gap by providing a preliminary assessment and outlook under this new Post-Hurricane María reality. It also serves as a succinct, yet comprehensive one-stop read containing up-to-date and relevant information from a variety of sources.

While the challenges ahead for Puerto Rico cannot be overstated and the post-disaster recovery and reconstruction process will likely be measured in years, opportunities for renewed growth do arise and must be acted upon with long-term vision and resolve. Effective and efficient collaborative partnerships between the public, private and third sectors will be paramount to capitalize on these opportunities by essentially minimizing pernicious collective action problems.

Historic 2017 Hurricane Season

The magnitude and impact of the 2017 Atlantic Hurricane Season are historic.

The 2017 hurricane season has wreaked havoc in the already beleaguered Island of Puerto Rico, leading to numerous fatalities, widespread property destruction, and a tragic humanitarian crisis. The utter disruption of critical infrastructure systems including electric power, telecommunications, transportation, water supply, and banking and finance, has severely hampered economic activity, triggering countless other cascading and spillover effects. On September 20, Hurricane María, preceded by Hurricane Irma, made landfall as the strongest storm in Puerto Rican history. This superstorm had an average wind speed over land of 123 miles per hour, making it the worst Atlantic storm in recorded history and the 6th strongest cyclone event of 13,000 since the mid-twentieth century.(1) The category 4/5 hurricane, which has been characterized as a 50- to 60-mile-wide tornado, bisected Puerto Rico from the southeast to the northwest, inflicting immeasurable loss and pain to the Greater and Lesser Antilles of the Caribbean.

Pre-Disaster Context

Superstorms Irma and Maria compound Puerto Rico’s daunting fiscal and economic troubles.

These adverse effects come at a time when Puerto Rico is mired in a protracted economic and fiscal crisis which has fueled an exodus to the mainland United States. Real Gross National Product (GNP), the more appropriate measure of real economic output in the case of Puerto Rico, has contracted by more than 16% since 2006.(2) Labor market indicators have also experienced a marked deterioration. Total employment has decreased by 23% from the peak reached in April 2006 to August 2017, representing a loss of roughly 300,000 private and public-sector jobs, the unemployment rate has remained in double-digits for decades, and the labor force participation rate is below 40%.(3) A largely obsolete economic model, an underperforming public sector with weak public institutions, loss of competitiveness in an increasingly globalized marketplace, burdensome costs of doing business, and poor regulatory quality that hamper growth and productivity, are some of the main factors that explain Puerto Rico’s economic stagnation.(4)

Further intensifying Puerto Rico’s economic and humanitarian woes is the government’s poor fiscal health and liquidity risks, which limit the implementation of traditional countercyclical fiscal measures. Overburdened by an over $70 billion debt load and an additional $50 billion in unfunded pension liabilities, Puerto Rico filed for bankruptcy protection on May 1, 2017 under Title III of the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) enacted on June 30, 2016. This law established a federally-appointed fiscal oversight and management board (FOMB), an orderly and predictable bankruptcy framework, and a fast-track process for endorsing critical infrastructure projects. This piece of legislation also defined a multi-step procedure for the development, review, and approval of a long-term fiscal plan to achieve fiscal responsibility and regain access to the US municipal bond market, ultimately approved on March 13, 2017, albeit with several amendments. Given the new post-Hurricane María reality, the FOMB has requested the Government of Puerto Rico to submit a revised fiscal plan by December 22, 2017, aiming to certify it in the beginning of 2018. Furthermore, in the FOMB’s 10th public meeting, the first after Maria, it was revealed that the liquidity problem has been heightened due to a reduction of $1.1 billion in revenues from the provision of electric and water services, a net cash flow drop of $1.7 billion due to reduced revenue, and an estimated net cash outflow of $3.2 billion for disaster relief spending, among other unanticipated outlays.(5)

Historical perspective: Learning from Past Hurricanes

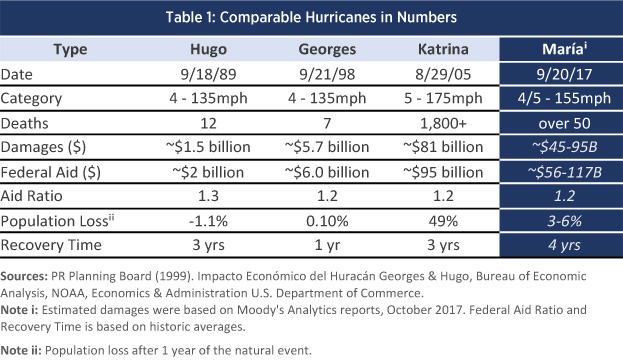

Studying the effects of Hurricanes Hugo and Georges on Puerto Rico, and of Hurricane Katrina on the U.S. Gulf Coast States (Texas, Louisiana, Mississippi, Alabama and Florida), gives us an idea of what the way forward may look like for the Island.

HURRICANE HUGO (1989) AND HURRICANE GEORGES (1998)

On September 18, 1989 Hurricane Hugo made landfall on the eastern part of Puerto Rico as a Category 3/4 hurricane.(6) Beyond the tragic loss of life, it left more than $1.5 billion in damages in its wake and 30,000 people homeless.(7) According to the Planning Board, roughly $2 billion were received in federal aid.

Hurricane Georges struck Puerto Rico on September 21, 1998 as a Category 3 hurricane bisecting the Island from east to west, the first to cross the entire Island since the 1932 San Ciprian Hurricane.(8) According to FEMA(9), Georges caused in Puerto Rico an estimated $5.7 billion(10) in infrastructure damages and lost economic output, $4.7 billion or 84% of which was attributed to damages in housing and other structures. The utility infrastructure on the Island suffered considerable damages, with 96% of the Island’s electricity customers losing power and 75% losing water service.(11) Furthermore, the agricultural sector was decimated, losing 75% of coffee crops, 95% of plantain and banana crops, and 65% of live poultry. The Planning Board found that Puerto Rico received upwards of $6 billion from the Federal Emergency Management Agency (38%), other federal government sources (26%), private insurers (30%), the central government (4%), and the Red Cross (2%) in hurricane relief aid.(12)

HURRICANE KATRINA (2005)

One of the most deadly and destructive storms in recent U.S. history was Hurricane Katrina, which entered the Gulf of Mexico on August 26, 2005. The figures of loss of life, displacement of people, property and infrastructure damage, and economic losses were staggering. More than 1,800 people perished due to the storm, 1.2 million people evacuated the New Orleans Metro Area, 300,000 homes were destroyed, and more than $80 billion in damages was estimated.(13) Due to numerous breaches to the city’s flood control protection, over 80% of New Orleans and neighboring communities flooded, and remained underwater for weeks. Around 49% of the population in the area migrated due to the devastation.

Macro-impacts of the 2017 Hurricane Season

Immediate economic losses are expected after a category 4/5 hurricane.

Short-term economic disruptions adversely impacting output, income and employment are to be expected following catastrophic natural disasters. A local consulting firm estimated that real GNP growth could decrease by at least 8% in FY 2018 with a pessimistic estimate of -15%, contingent upon the re-establishment of critical infrastructure systems.(14) Moody’s Analytics estimated that economic losses, i.e. physical damages and cumulative economic output loss, could amount from $45 to $95 billion dollars.

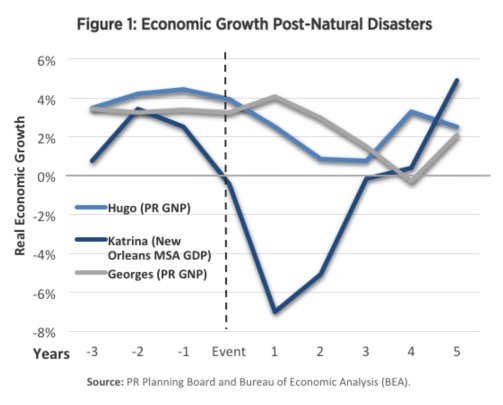

Based on the trends of past hurricanes, it is fair to expect that the GNP of Puerto Rico could experience a dip followed by a boost in growth once the federal funds are distributed and economic productive activities are stabilized. Using the recovery time of past hurricane experiences, we expect a recovery time of 4 years (see Figure 1). However, given the weak economic fundamentals of the Puerto Rican economy prior to the hurricane, this may mean a return to continued economic contraction once disaster aid funds are expended. Furthermore, the injection of capital into the economy via federal funds could be approximately 1.2 times the damages of the natural disaster, when using the damages to aid ratio of past storms (see Table 1). The following section offers some more insights on what to expect in terms of the extent of hurricane relief aid and the pace by which the funds will be received.

Inflow of Funds, Outflow of People.

In the aftermath of the 2017 hurricane season, a significant amount of financial assistance is flowing into the Island to fund the response, recovery, and reconstruction process, positively impacting investment and growth. The injection of cash to the economy will arrive from the federal government, insurers, local and nonlocal nonprofit organizations, private charities, and other sources. Unfortunately, the local economy does not get to keep many of the jobs and incomes created during the disaster recovery process. Many of the contractors and firms that are hired for cleanup, reconstruction and other large-scale projects are not local. Furthermore, the materials and supplies needed are largely imported, with few, if any, local linkages. The formal declaration of a major disaster by the President of the United States, upon the request of the governor of the state or territory, as per the Robert T. Stafford Disaster Relief and Emergency Assistance Act, prompts the mobilization of federal resources for both emergency and permanent work. On September 10, 2017 a major disaster declaration was declared for Puerto Rico following Hurricane Irma, as well as on September 20, 2017 following Hurricane María. Post-disaster federal assistance normally requires a cost-sharing agreement, where the federal government pays for 75% of the costs while state and local governments commit to covering the remaining 25% of the costs. Under certain circumstances, the ratio may be changed to 90% federal and 10% state and local. Given Puerto Rico’s precarious financial situation this federal matching requirement was waived, at least temporarily.

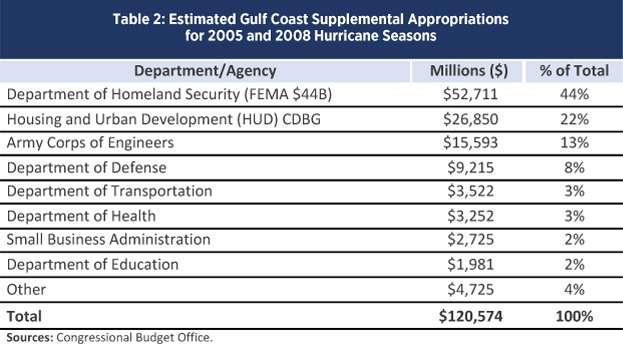

Over 65% of federal funds are estimated to arrive from FEMA and HUD.

To get a sense through which federal entities, programs and activities the federal financial assistance to Puerto Rico will be received, information on the aid provided to U.S. Gulf Coast States following the 2005 (Hurricanes Katrina, Rita, and Wilma) and 2008 (Hurricanes Gustav and Ike) hurricane seasons are presented.

As per a Congressional Research Service Report (CRS Report No. R43139) the impacted Gulf states received $120.5 billion in hurricane relief through 10 supplemental appropriations statutes, distributed among 11 federal departments, 3 independent agencies, among other entities. Most of the funds (66%) were allocated to the Department of Homeland Security, mostly to FEMA, and the Department of Housing and Urban Development, mostly through the Community Development Block Grant (CDBG) Program (see Table 2). It should be noted that the SBA approved roughly 177,000 applications for home, business, and economic injury disaster loans, for a total loan value of $11.8 billion.

A $36.5 billion emergency aid bill was enacted late October 2017 to address the onslaught of catastrophic events impacting the United States and its territories. FEMA’s Disaster Relief Fund will receive $18.7 billion, and $16 billion was allocated to the National Flood Insurance Program, including a $4.9 billion low-interest loan for Puerto Rico. More recently, the Governor of Puerto Rico has requested $94.4 billion in aid from the federal government, $46 billion (49%) for housing through the CDBG program, $30 billion (32%) for infrastructure through FEMA, and $17.9 billion (19%) for long-term recovery. It is worthy of note the large role political considerations, i.e. presidential and congressional influences, have in the allocation of federal aid. Researchers have found that “disaster expenditures are higher in states having congressional representation on FEMA oversight committees” and “nearly half of all disaster relief is motivated politically rather than by need.”(15) The fact that Puerto Rico is subject to the Territorial Clause of the United States Constitution and only has one non-voting member of Congress may adversely impact the amount of federal aid received. The governor has also requested that products manufactured in Puerto Rico be treated as domestic products, excluding it from the proposed 20% excise tax on the importation of foreign products, a proposal that has raised concern on the Island.

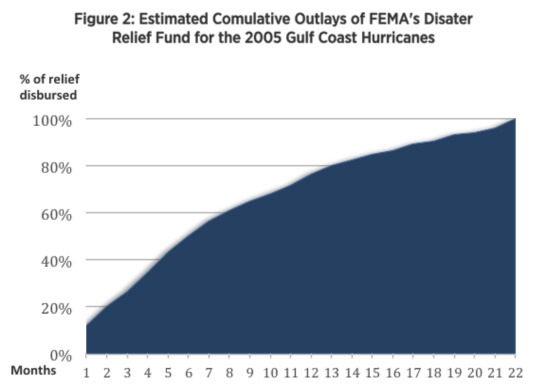

The timing of the inflow of funds is another important aspect of the aid. Figure 2 provides the U.S. Congressional Budget Office’s (CBO) estimate of the pace of FEMA’s outlays from the Disaster Relief Fund (DRF).(16)

Hurricane Katrina made landfall in the U.S. Gulf Coast region on August 29, 2005 and by February 2006, 6 months after impact, FEMA had expended 50% of the $30 billion allocated through the DRF, and by month 12, 75%. Of this $30 billion, 39% was used for housing, 22% for public infrastructure, 16% for administrative expenses, and 12% for mission assignments to other federal agencies.

Nonfederal sources of post-disaster aid, including insurers, private firms and NGOS, could represent 40% of total aid received.

In addition to federal funds, Puerto Rico is expected to receive funds and investments from private insurers, business firms and nongovernmental organizations like the Red Cross.

An important source of private capital inflow after a natural disaster is insurance disbursements. According to the Planning Board, close to 30% of the aid received after Hurricane Georges, $1.8 billion, came from insurance claims. RMS, a catastrophe risk modeling company, estimated that insured losses due to Maria could reach from $15 to $30 billion, while AIR Worldwide estimated losses from $40 to $85 billion.(17) It should be noted that approximately 50% of housing units in Puerto Rico have wind insurance policies while less than 1% of homes are covered by the U.S. National Flood Insurance Program.(18) Business interruption insurance claims are becoming a concern for insurers and reinsurers given the still widespread power outage (50%) two months after Hurricane María.

Private investments from cutting-edge technology companies like Tesla and Google have helped address critical needs of the Island. Tesla has already made a significant investment in solar infrastructure at a children’s hospital in San Juan, while the Google Project Loon balloon-powered internet scheme has delivered internet connectivity to more than 100,000 on the Island. Expect some of these high-profile companies to continue participating in the reconstruction phase, introducing game-changing innovations and practices.

Population displacement and employment loss are expected to increase significantly after Hurricane María, reverting us to a much smaller economy.

Disaster-induced population displacement in the wake of a severe catastrophic natural event can potentially reshape the demographics of a region, shrink the taxpayer base and place a drag on future growth. Puerto Rico, prior to the natural events, was already experiencing a fall in its population. According to U.S. Census data, total population decreased by close to 10%, from 3.8 million in 2000 to 3.4 million in 2016. This wave of migration is estimated to continue, and the fiscal oversight and management board has estimated the population loss post-Hurricane Maria to be 500,000 residents. This estimated population loss would revert Puerto Rico back to 1976 when the total population was around 2.9 million people. The Center for Puerto Rican Studies estimated that from 2017 to 2019 Puerto Rico could lose 470,335 people, representing 14% of the population, with Florida being the main recipient of this migratory flow.(19)

In terms of the impact on the labor market, UBS forecasted employment to fall by 250k over the first two months after the storm, and will likely remain depressed for some time.20 Preliminary estimates anticipate about 125k permanent job losses, with most displaced workers relocating to the mainland. The October 2017 nonfarm employment data is available, decreasing by 3.6% or 31,600 jobs with respect to September. All the jobs lost were in the private sector.

Economic Impact by Sector

Hurricanes Irma and María will fundamentally change the economic model of Puerto Rico creating opportunities in sectors that previously were contracting and vice-versa.

This section aims to identify the sectors that will likely grow these upcoming years, as well as the sectors that will contract due to the natural events.

CONSTRUCTION

Construction is one of the economic sectors that has been hardest hit since the onset of the economic downturn in 2006. According to the Planning Board, fixed investment in construction reached $6 billion in FY2006, representing 10% of GNP, and has decreased by $3.3 billion or 53% in a decade, reaching $2.8 billion or 4% of GNP in FY2016. Reconstruction efforts funded mainly through federal assistance and private insurance disbursements, in both the public and private sectors, will provide a much-needed boost to this sector. Furthermore, construction employment will likely experience a significant increase after more than 10 years of incessant shrinkage. According to the U.S. Bureau of Labor Statistics, in 2006 employment in this sector (including mining and logging which are negligible) reached 66,000, dropping down to 20,000 as of October 2017. To maximize the sustainability and resilience of these investments, Puerto Rico should adopt and implement post-disaster best practices.(21) In sum, the construction sector will play a critical role in this post-disaster environment, providing the necessary materials, human resources, logistics capabilities and rebuilding know-how for the recovery and reconstruction process.

TOURISM

One of the few sectors that was thriving prior to the 2017 hurricanes was the tourism sector. Puerto Rico welcomed more than 5 million visitors in fiscal year 2016, who spent roughly $4 billion, providing employment to more than 80,000 people. Cruise ship passenger traffic reached 1.4 million in fiscal year 2017, a 10.6% increase with respect to the previous year. The devastating impact of the 2017 hurricanes has severely hampered this important sector. Employment in leisure and hospitality decreased by 15,800 or 19%, from 81,600 in September 2017 to 65,800 in October 2017. This represents 50% of the jobs lost after Maria. According to Puerto Rico Tourism Company, as of Nov. 4, 69% of hotels and 61% of casinos are operational. The negative perceptions of potential visitors given the media coverage of the widespread destruction and humanitarian crisis, the extensive damage to the flora, warnings of bathing in bodies of water due to potential raw sewage contamination, and the lack of water and electricity in many places, represent significant challenges for the sector going forward. Despite these challenges, Lonely Planet recognized San Juan as one of the World’s Top 10 Best Cities for Travel in 2018, highlighting its resiliency.

MANUFACTURING

The industrial sector, prior to the 2017 hurricanes, was already experiencing serious challenges. While the sector’s contribution to Puerto Rico’s gross domestic product (GDP) has remained robust, adding close to $50 billion or 47% of GDP in FY 2016, employment has been gradually decreasing, reaching 69,600 in October 2017, or 8.3% of total nonfarm employment. A number of factors have adversely impacted manufacturing as a source of growth and job creation on the Island including loss of competitiveness in the global economy (i.e. energy and labor costs), mergers and downsizings, automation and robotics, the end of Section 936 of the Internal Revenue Code, patent expirations in Pharma, among other factors.

A prolonged decrease in manufacturing activity due to hurricane-related utility interruptions and logistics issues can prove devastating. While a small but important sector of the larger manufacturers have their own alternative sources of energy to keep production going, the majority that relies on the electric power authority will likely suffer significant losses. The pharmaceutical and medical device industries, which represent nearly three-quarters of all Puerto Rican exports, $15 billion in GDP, and generate $500 million in payroll, are at risk of being permanently affected, as some manufacturers have already temporarily moved production elsewhere. The risk of drug and medical devices shortages prompted immediate action from the U.S. Food and Drug Administration to maintain supply chain integrity.(22) To avert permanent damage of this important sector, the speedy reestablishment and stabilization of the Island’s infrastructure systems is vital.

SMALL BUSINESSES

In terms of the retail, consumer, food/beverage, and other small business sectors of the Puerto Rican economy, the businesses that can survive the short-term challenges of powering their locations with generators will then be faced with the more existential threat of long-term population loss. It is estimated that at least 5,000 of an estimated 50,000 small businesses in Puerto Rico have closed, at least temporarily, because of the hurricane. The situation for small retailers is further complicated by limited access of funds from the Nutritional Assistance Program (food stamps) to beneficiaries, who make up 38% of the Island’s consumers.

BANKING

During the last decade the banking sector has experienced several waves of consolidation. The local banks that have survived have been able to effectively maneuver through a challenging operating market, but are now faced with the Island’s post-superstorm reality. The slow restoration of electrical power will stall the banking sector’s operations and overall business activity and those of their customers. The sector’s financial viability will also be negatively affected by a decrease in new loan originations, waived fees during the immediate aftermath of the storm, and elevated operating expenses due to increased security costs, costs for electrical generators, storm damage repair, etc. In the long-term, profitability will be affected by prolonged population loss, especially of the most productive-aged workers.

Final Thoughts

Puerto Rico, already encumbered by an economy that had been contracting for more than a decade, a debt burden exceeding 100% if its annual economic output, and the exigencies of a federally appointed fiscal board, is now faced with the aftermath of a hyperactive 2017 hurricane season. The magnitude and devastation on the Island caused by Hurricanes Irma and Maria are historic and demand an extraordinary response to get Puerto Rico back on its feet. Celerity and a strategic vision is of the essence in post-disaster scenarios and all pertinent stakeholders must effectively work together to rebuild Puerto Rico better and stronger than ever.

The “Puerto Rico Post-2017 Hurricane Season: Initial Insights & Outlook” is the first of a series of special V2A publications given the extraordinary exogenous shock impacting Puerto Rico’s economy. V2A’s quarterly publication, the “PUERTO RICO BANKING INDUSTRY REPORT”, is available here.

V2A contributors to this special V2A publication:

Olivier Perrinjaquet, John Bozek and Hector Rivera

Download the PDF version of this article.

Disclaimer

Accuracy and Currency of Information: Information throughout this report is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.

Endnotes and References

(1) Hsiang, S. & Houser, T. (2017, September 29). Don’t let Puerto Rico Fall into an Economic Abyss. The New York Times.

(2) Puerto Rico Planning Board, Statistical Appendix 2007, 2016.

(3) U.S. Labor Statistics, Puerto Rico Economy at a Glance.

(4) For a comprehensive study of the Puerto Rican economy see Collins, S. M., Bosworth, B. P., & Soto-Class, M. A. (Eds.). (2007). The economy of Puerto Rico: Restoring growth. Washington D.C.: Brookings Institution Press.

(5) Puerto Rico Fiscal Agency and Financial Advisory Authority (2017, October 31) Liquidity Update to the Financial Oversight and Management Board for Puerto Rico.

(6) Scatena, F. N., & Larsen, M. C. (1991). Physical aspects of Hurricane Hugo in Puerto Rico. Biotropica, 317-323.

(7) Strom Thurmond Institute of Government and Public Affairs. (1990). Hurricane Hugo: Lessons Learned in Energy Emergency Preparedness.

(8) Federal Emergency Management Agency (1999) FEMA 339 Building Performance Assessment Team (BPAT) Report – Hurricane Georges in Puerto Rico.

(9) Federal Emergency Management Agency (1999). The President’s Long-Term Recovery Action Plan for Puerto Rico.

(10) The $5.7 billion figure is in 2016 dollars, as calculated by Estudios Técnicos, Inc. adjusting for inflation.

(11) Bennett, S.P. & Mojica, R. (1998) Hurricane Georges Preliminary Storm Report: From the Tropical Atlantic to the United States Virgin Islands and Puerto Rico.

(12) Estudios Técnicos, Inc. (2017). Preliminary Estimate: Cost of Damages by Hurricane María in Puerto Rico.

(13) Lindsay, B.R. & Nagel, J.C. (2013) Federal Disaster Assistance after Hurricanes Katrina, Rita, Wilma, Gustav, and Ike (CRS Report No. R43139).

(14) Advantage Business Consulting (2017) Post-Hurricane Economic Outlook. Presentation, Puerto Rico.

(15) Garrett, T. A., & Sobel, R. S. (2003). The political economy of FEMA disaster payments. Economic Inquiry, 41(3), 496-509.

(16) U.S. Congressional Budget Office (2007). The Federal Governments Spending and Tax Actions in Response to the 2005 Gulf Coast Hurricanes.

(17) Hussain, N.Z. & Barlyn. S. (2017, October 1). Puerto Rico Power Outage to Mean More Business Interruption Claims. Insurance Journal.

(18) Scism, L & Friedman, N. (2017, September 20). Hurricane María Exposes a Common Problem for Puerto Rico Homeowners: No Insurance. The Wall Street Journal.

(19) Meléndez, E. & Hinojosa, J. (2017) Estimates of Post-Hurricane María Exodus from Puerto Rico. Center for Puerto Rican Studies.

(20) UBS (2017, October 6). U.S. Economic Perspectives. U.S. Outlook: No signal from the employment report; it’s the hurricanes.

(21) UNISDR (United Nations International Strategy for Disaster Reduction). (2015). Sendai framework for disaster risk reduction 20152030.

(22) U.S. Food and Drug Administration. (2017, September 25). Statement from FDA Commissioner Scott Gottlieb, M.D., on FDA actions to bring relief to citizens of Puerto Rico [Press release].