On August 1st, Banco Popular announced the acquisition of Reliable, the Wells Fargo auto finance business in Puerto Rico. The agreement involves the purchase of ~$1.6B in retail auto loans and ~$360M in primarily auto related commercial loans. With this acquisition Popular becomes the leader of the Auto financing sector with a 49% auto loan market share and a 69% share in auto leasing.

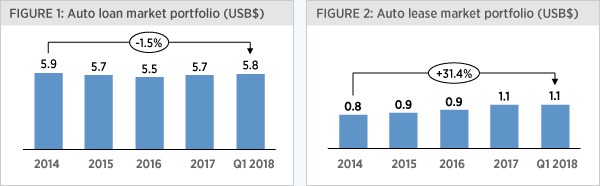

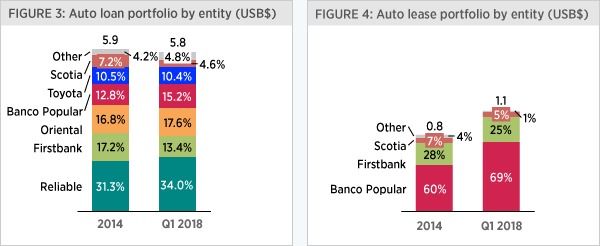

The auto loan market has remained quite stable in terms of size in recent years. It suffered a declined in 2015 and 2016 that was almost offset by an increase in 2017 and the first 3 months of 2018 (see Figure 1). This is a decent performance in an economy that has seen the loan portfolio of banks decrease by 19% in the 2014-Q1 2018 period (see our PR Banking Indicators Portal here). The auto lease market showed an even better performance during this period increasing by 31% (see Figure 2).

But which players have benefitted the most from the relatively prosperous auto financing industry? Based on data published by the Office of the Commissioner of Financial Institutions (OCFI), we can identify two main winners, precisely Banco Popular and Reliable. Banco Popular increased its share in the loan market from 13% in 2014 to 15% in Q1 2018, and from 60% to 69% in the lease market (see Figures 3 and 4). And Reliable consolidated its dominant position in the loan market increasing its share from 31% to 34% in the same period. So, not only did Banco Popular acquire the market leader but also one of the few players gaining market share.

On the opposite side, Firstbank and Scotiabank suffered market share declines. Their share decreased from 17% to 13% and from 7% to 5% in the loan market between 2014 and Q1 2018, respectively.

The new and large dominant position of Banco Popular poses a lot of questions for the future of the auto financing industry. For example, how are other players going to fight against it? How is Banco Popular going to integrate the, probably, most aggressive sales force in the market? Which sales «style» will predominate? Is Banco Popular going to exert some type of price setting leadership in the market? How will that affect auto loan customers? Will the bank sacrifice growth for profitability or otherwise?

Certainly the auto financing industry has shown positive profitability consistently during the past difficult economic times. This is reflected in the data provided by the OCFI for the auto financing non-depository institutions which include Popular Auto (the auto financing subsidiary of Banco Popular) and Reliable. Based on this data, the auto financing non-depository institutions have shown, on aggregate, positive net income in each of the past ten years (2009 to 2018). During the same period, the banking sector as a whole suffered important losses in various years, particularly in 2009, 2010 and 2013.

Given the recent performance and profitability of the auto financing business, and Banco Popular»s need to find opportunities to deploy its excess capital, this acquisition seems to be the right move for the bank. As the integration unfolds and we see the new dynamics of the industry we will be able to confirm or deny this statement.

Sources

Federal Deposit Insurance Corporation (FDIC) «Call Reports», OCFI quarterly reports «Informe Auto Loans No Depo.» and «Schedule of Loans and Leases», Popular Inc. press releases, analysis by «Financial Institutions Practice» V2A.

Disclaimer

Accuracy and Currency of Information: Information throughout this «Insight» is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.