The economic uncertainty that Puerto Rico has experienced in recent years has had a negative effect on the market value of banks that have their main operations located in the Island. However, the solid performance of local banks in terms of profitability and capital adequacy has translated into important increases in market capitalization, eliminating or significantly reducing their market risk premium.

The economic uncertainty that Puerto Rico has experienced in recent years has had a negative effect on the market value of banks that have their main operations located in the Island. However, the solid performance of local banks in terms of profitability and capital adequacy has translated into important increases in market capitalization, eliminating or significantly reducing their market risk premium.Once the acquisitions of Santander PR and Scotiabank PR are completed during 2020, there will only be three banking entities with the full suite of retail and commercial financial services operating in Puerto Rico. These entities, Oriental Bank, FirstBank and Banco Popular, have been the survivors of a quite long consolidation period in Puerto Rico. They have shown tremendous resilience during an economic difficult period and have achieved a solid financial performance for at least the past two years.

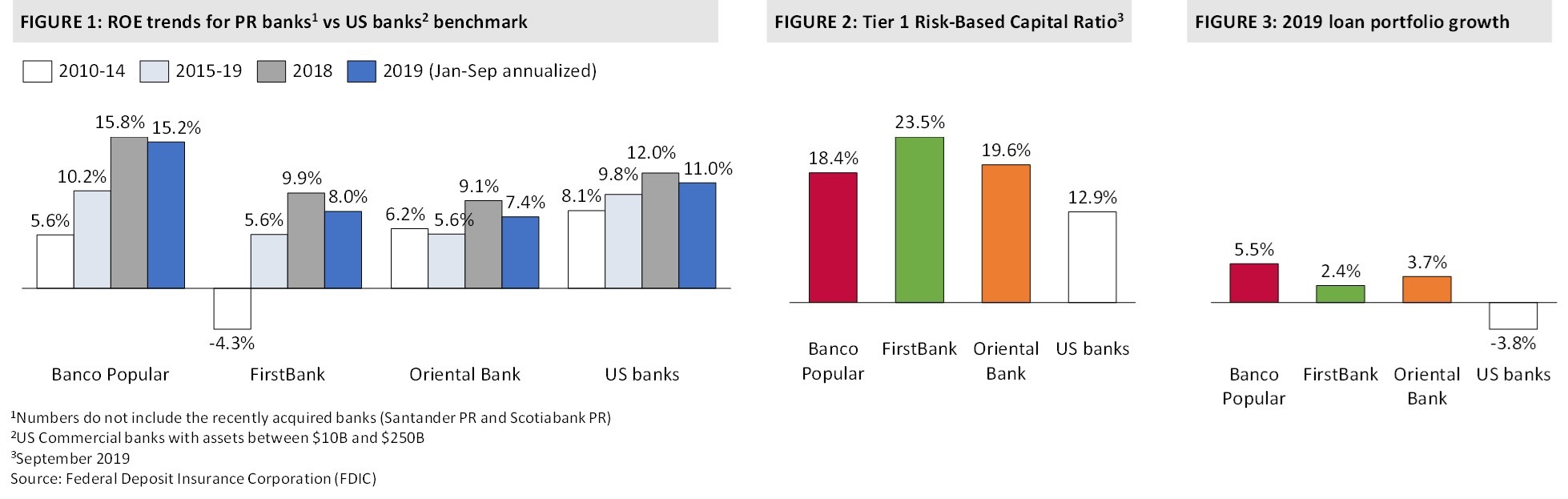

As can be observed in Figure 1, Banco Popular has increased its return on equity from 5.6% in the 2010-14 period to 15.8 in 2018 and 15.2% in 2019, surpassing the profitability reached by the US banking sector benchmark1 as a whole. Likewise, FirstBank has achieved a remarkable improvement in terms of profitability and Oriental Bank, despite showing more stable results in the past decade, has also experienced an improvement.

Banks have managed to increase their profitability while maintaining very high capitalization levels (see Figure 2). Their Tier 1 Risk-Based Capital ratio fluctuates between 18% and 25% depending on the bank, significantly above the US benchmark2. This ratio averaged 11.2% in the 2001-05 period (before the start of the financial crisis) for the PR banking sector as a whole. Despite the challenging economic conditions in the Island, the three banks increased their loan portfolio in 2019, even before factoring in their most recent bank acquisitions (see Figure 3).

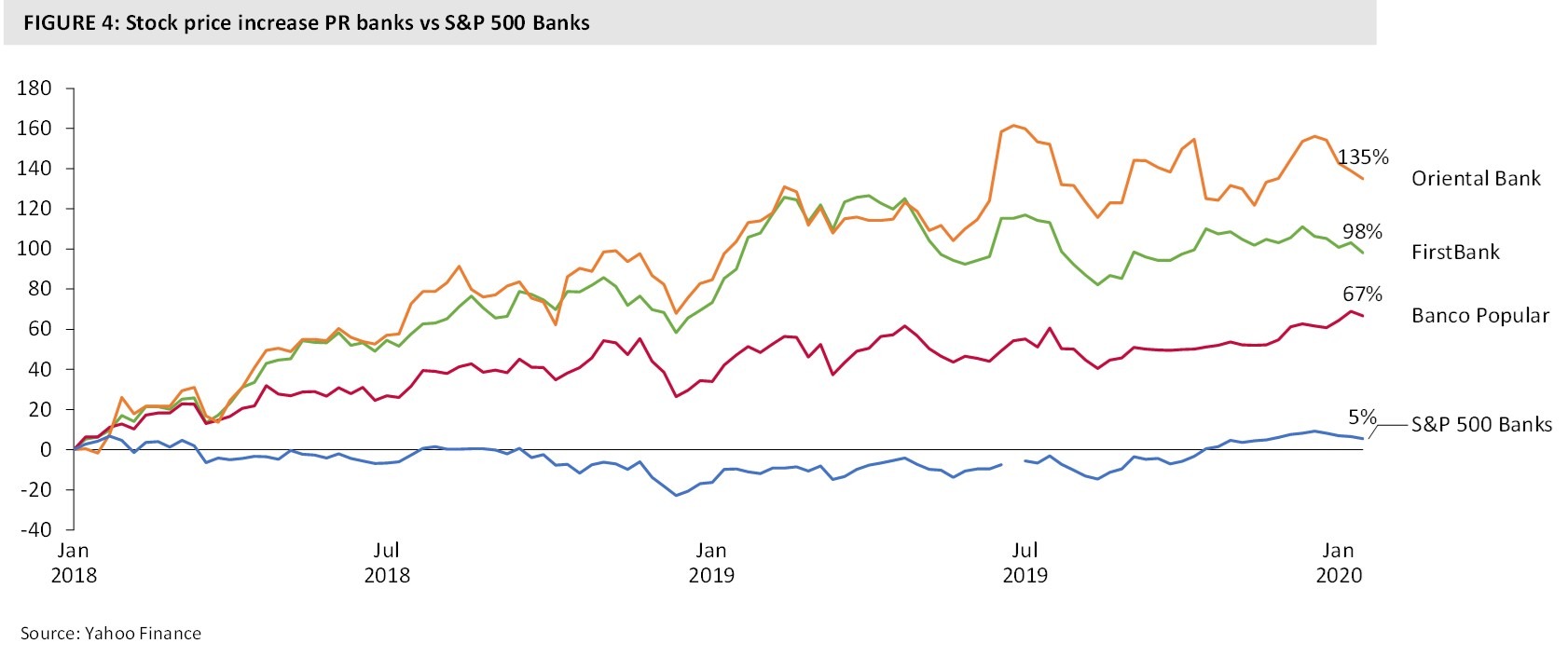

The performance of local banks has translated into significant stock price increases in the past two years. As can be observed in Figure 4, while the «S&P 500 Banks" composite has remained quite stable, the Banco Popular, FirstBank and Oriental Bank stock prices have increased by ~67%, ~98% and ~135%, respectively, since January of 2018.

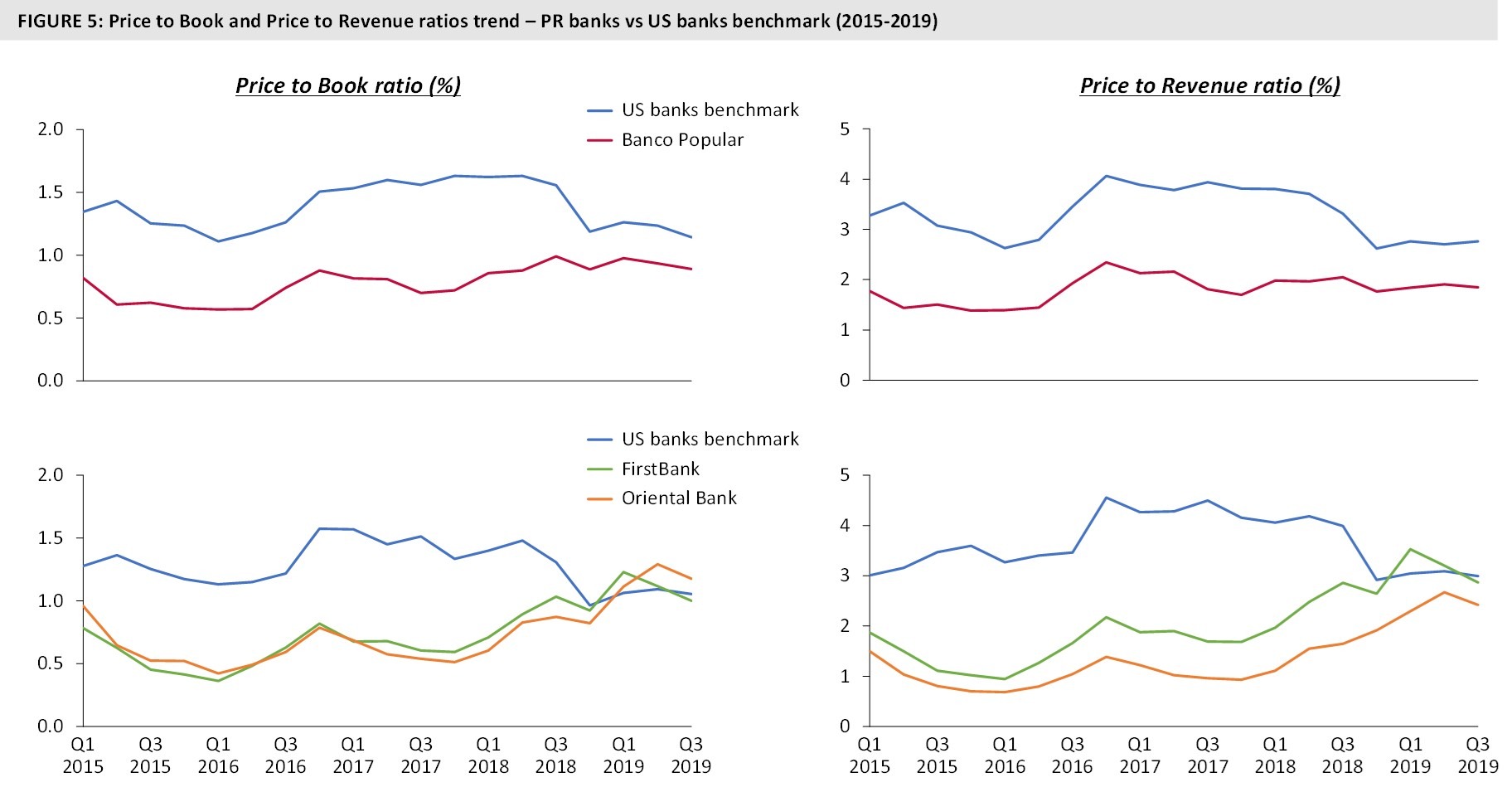

Contrary to the two acquired banks (Santander PR and Scotiabank PR), the operations of the bank holding companies remaining in Puerto Rico, are mostly concentrated in the Island. This limited geographic market diversification and, particularly, the fact that Puerto Rico has been immerse in a deep and long economic crisis, could translate into their stock prices being penalized by market investors. In fact, this so-called «market risk premium" applies to all local businesses operating in Puerto Rico. Banco Popular, FirstBank and Oriental Bank are publicly traded companies and, consequently, we can use publicly available information to understand whether that is happening or not.

The Price to Book (P/B) and Price to Revenue (P/R) ratios are excellent valuation multiples to understand whether local publicly traded companies carry a «geographic risk premium". The P/B ratio is used to compare the firm’ market value to the firm’ carrying value on the balance sheet. The P/R ratio is used to understand how the market participants value a firm vis-à-vis its revenue generation capacity. In theory, companies of the same sector, with similar sizes and operating in similar geographic markets should show similar ratios. We have selected 10 US Banks with similar asset size as Banco Popular, and offering, like Banco Popular, the full suite of financial services (personal and credit card loans, auto loans, commercial lending, retail and commercial deposits, etc.). We have calculated their P/B and P/R ratios on a consolidated basis and have compared them to Banco Popular’. We have done the same for Oriental Bank and FirstBank which, after their respective acquisitions, have similar total assets.

As can be observed in Figure 5, Banco Popular has consistently shown lower P/B and P/R ratios compared to the US benchmark, suggesting that there is a market risk premium the bank has to accept for operating in Puerto Rico in terms of company value. The lower valuation does not seem to be related to profitability given its ROE performance mentioned above. Its potentially higher credit risk related to higher non-performing loans levels vis-à-vis the US counterparts should already be factored in the higher capital ratios, some of which are already risk based adjusted. There could be other factors being considered by market investors, but the Puerto Rico market factor is definitely a plausible one. We are not suggesting that the risk premium is not reasonable; in other words, the Puerto Rico market may truly carry higher volatility — Banco Popular’ profitability has been quite consistent in the past years.

When we look at Oriental Bank and FirstBank, we do observe lower P/B and P/R ratios compared to their US counterparts during the 2015-2018 period. However, starting in Q4 2018, the gap seems to have narrowed or disappeared, suggesting a market valuation more in line with the US counterparts.

Overall, we see a very solid banking sector in Puerto Rico after a long period of market restructuring. Banks are in great shape to take advantage of an economy that will recover sooner or later. In fact, they may be an important player contributing to the economy taking off as they continue to facilitate funding for local enterprises. The global proliferation of non-banking and online financial solutions should also offset the competitive pressure lost from the reduction of classic banking institutions in Puerto Rico. As investors realize that Puerto Rico is again on a path of economic stability, any potential risk premium related to the banks’ operations being heavily concentrated in Puerto Rico, should also disappear.

Notes

1 The benchmark used is the category «US Commercial Banks with Total Assets between $10B and $250B" as per the FDIC categorization

2 The high capitalization level is confirmed by the fact that Banco Popular completed a $250 million accelerated share repurchase agreement and increased its quarterly dividend per share from $0.25 to $0.30 in 2019. Its planned capital actions for 2020 include a $500 million common stock repurchase and an increase in its quarterly dividend to $0.40 per share

Sources

V2A Banking Indicators Portal (http://prbankindicators.v2aconsulting.com/)

Federal Deposit Insurance Corporation (FDIC) Comparison Reports (https://www5.fdic.gov/sdi/main.asp?formname=compare)

Yahoo Finance (https://finance.yahoo.com)

Disclaimer

Accuracy and Currency of Information: Information throughout this «Insight» is obtained from sources which we believe are reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. While the information is considered to be true and correct at the date of publication, changes in circumstances after the time of publication may impact the accuracy of the information. The information may change without notice and V2A is not in any way liable for the accuracy of any information printed and stored, or in any way interpreted and used by a user.